Let’s get to what is most important for investors. Are your stocks safe? The quick answer is stocks are never safe. If safety is the priority, you should probably consider something else, writes John Mauldin.

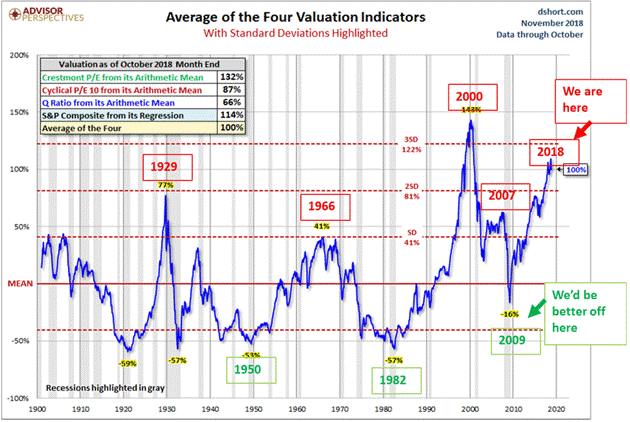

Stocks are a “risk” asset. The real question is whether the gains adequately pay you for the risk you are taking. The higher the valuation, the less you are being paid. That makes this next chart disturbing if you’re long stocks.

Source: CMG Capital Management

We see here four popular valuation measures, the average of which crunch to the second-highest stock valuations since 1900.

The highest was in 2000. We are much higher now than in 2007, which led to a 55% peak-to-trough decline.

That kind of decline won’t necessarily happen next year, but it’s all but certain within ten years.

So, this may not be a “sell” signal, but it sure looks like a “don’t buy” signal. And even with the recent drop, I would not bring a “buy the dip” mentality to my investment selection today.

Note the bottom section of the chart where it says, “We’d be better off here.”

That’s what a buying opportunity looks like. Buying opportunities happen at the bottom of the cycle when everybody is scared.

That’s true for stocks, high yields, real estate, and everything else.

When people say they’re worried about holding cash, I remind them cash is an option on the future.

It’s not earning very much right now but could potentially earn a lot more when you buy at the bottom. I’m not looking at this and panicking at all. I’m rubbing my hands at the coming chance to buy solid assets cheap.

It’s time to hit the send button. My best to you and your families and friends, and here’s wishing you the best of the holiday season. The best gift I get is the time you graciously spend reading Thoughts from the Frontline. Thank you so very, very much.