Geopolitical concerns involving Brexit plan vote and Chinese debt will continue to put pressure on risk assets notes Bob Savage.

China faces growth issues as the People’s Bank of China’s (PBOC) easing is not enough to support the economy and the government’s fiscal plans aren’t enough to help either. Though the rally back in risk today extends Beijing the courtesy of a bounce but with plenty of confusing signals.

ECB Draghi faces the grim reality that negative rates and rolling over the bonds bought is insufficient to support the flagging economy and fight disinflation from lower oil prices. German GDP for 2018 was sharply lower than the previous five years even with better trade and a weaker euro to support it. If the problems in Europe’s strongest economy continue in 2019 its going to be harder for ECB action given the Draghi exit and plans for normalization.

The pound GBP/USD seems stuck in a bigger 1.26-1.31 range for the short-term and that maybe the foreshadowing for equities as the bounce up over the last two weeks seems not enough to break out for a larger rally.

Is the China effort to spur growth sufficient?

Beijing intends to improve credit availability for smaller companies, accelerate infrastructure investment and cut taxes. Under the plan, Beijing will cut value-added tax rates for some companies, including in manufacturing, and hand tax rebates to others. China also plans to step up fiscal expenditure this year, in what looks like a Keynesian push to help companies. Xu Hongcai, Assistant Minister of Finance, told reporters in Beijing that the government was determined to ease the burden on small enterprises and the manufacturing industry, adding: “The focus is on enhancement and efficiency.”

China’s central bank has promised to make monetary policy more forward-looking, flexible and targeted.

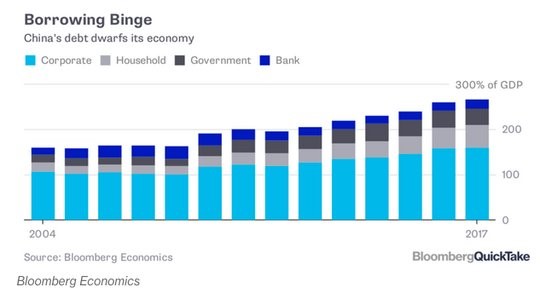

The issue for China is not about stimulus but about debt (see chart below). It is true that China’s external debt, public and private, is still very low by world standards, reaching only 13% of GDP. But debt issued overseas has grown significantly since the slowdown of China’s credit boom. As central authorities have attempted to regulate credit, enterprises have borrowed abroad. The movement in debt in China has been led by companies that can sell the assets to cover loans but only when the markets are bid. This is the key for financial stability and for confidence to hold. There is a socialization of debt in Asia that isn’t well understood in the West where failure isn’t a cause for family shame but an incentive for better ideas. The risk/reward for 2019 rests on the believability of the China stimulus.