“IVZ has rallied more than 15% since its Christmas Eve closing low of $15.71, … [and] now finds itself staring up at a formidable layer of trendline resistance,” writes Elizabeth Harrow.

Investment management stock Invesco (IVZ) has been underperforming technically for quite a while. The shares have given up 52.5% of their value over the past 52 weeks, seriously lagging the broader S&P 500 Index (SPX) — which is off 6.4% for this time frame. And while IVZ has rallied more than 15% since its Christmas Eve closing low of $15.71, which was its lowest daily finish since the fourth quarter of 2011, the stock now finds itself staring up at a formidable layer of trendline resistance.

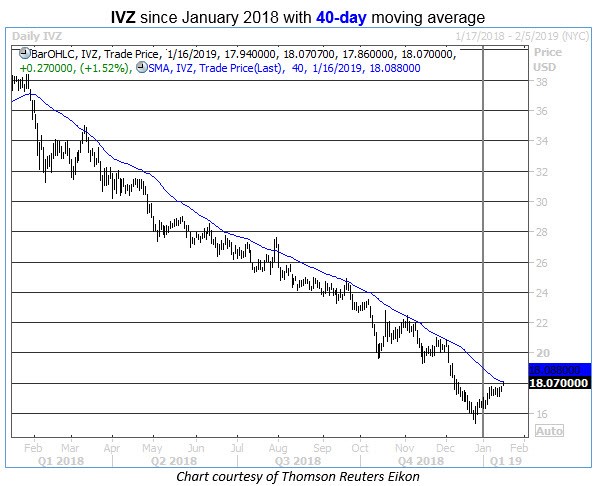

Specifically, IVZ has now run headlong into its 40-day moving average (see chart below). This trendline has guided the stock steadily lower over the past year, and stubbornly rejected a number of rally attempts along the way. Looking at the past seven times IVZ has tested resistance at its 40-day, Schaeffer's Senior Quantitative Analyst Rocky White found that Invesco's average 21-day return was -6.86%, with only one of those occurrence producing a positive return.

With the company set to report fourth-quarter earnings before the market opens on Jan. 30, there's some additional event risk baked into IVZ's short-term outlook. Over the past eight quarters, Trade-Alert data shows that IVZ has closed lower five times the day after earnings— and the average negative post-earnings move has been 3.06%, more than doubling the average positive post-earnings price change of 1.5%.

In the one-month stretch from mid-November to mid-December, short sellers were eager to take profits on IVZ. Over this four-week period, the number of shares sold short collapsed by 32% from the Nov. 15 peak of 19.43 million— but in the most recent reporting period, short interest ticked higher once again, rising by 1.5% to account for 3.3% of the stock's float. As short sellers re-assert their presence on this beaten-down stock, the resulting selling pressure should push IVZ even lower.

There's ample room for downgrades to accelerate IVZ's bearish momentum. Among the 13 analysts tracking the stock, not one calls it a "sell," and four maintain "strong buy" ratings. Any negative notes from this group could spark fresh downside.

Meanwhile, despite the upcoming earnings event, short-term options on IVZ aren't too unreasonably priced. The equity's 30-day at-the-money implied volatility checks in at 34.6%, which registers in the 82nd annual percentile. This reading is still far removed from the Dec. 24 52-week high of 55.7%, as near-term volatility expectations have cooled over the past few weeks. In fact, February-dated options are priced right near the middle of their annual range, for those looking to bet on IVZ's latest 40-day sell signal via the purchase of short-term puts.