“The warnings from economists on the pain from the U.S. government shutdown are rising,” says Robert Savage. He is speaking at TradersExpo New York.

The more you turn the faster you have to move. This is the lesson for driving or flying and the physics maybe the best way to understand the risks for markets today as the European Central Bank (ECB) and the Eurozone economy nears stall speed.

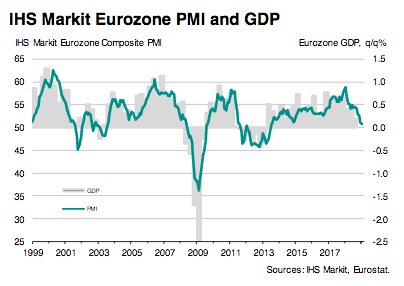

The flash PMI reports were worse than expected for services and that matters given its not just about U.S.-China trade fears anymore but domestic political problems and protests. The power of fear over greed remains in play even as equities float on hopes of a kind ECB President Mario Draghi — as he balances sounding positive on the soft-patch being temporary and yet promises to use more easy money if he is wrong— is promoting.

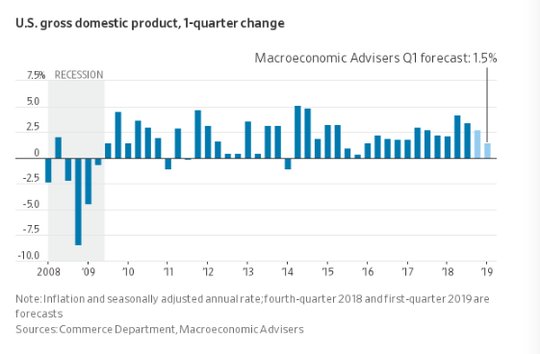

The risk mood is mixed to positive and disregards the economics. The warnings of White House economist Kevin Hasset on the U.S. economy potentially having zero GDP growth in Q1 spooked the markets, but didn’t hold much lasting power. The delay to Trump’s State of the Union address due to the government shutdown maybe more important as politics power economic sentiment. The news flows from overnight were negative: Australia flash PMI lower, Japanese PMI lower and European PMI lower. Markets mostly ignored this and the gloomier outlooks from the Bank of Korea. The Norges Bank didn’t flinch either as it still plans a March hike. The risk for a bigger turnabout of mood seems clearly linked to what Draghi says today – and how the markets digest it. The euro (EUR/USD) is still stuck in a 1.13-1.15 prison but the euroyen EUR/JPY maybe more obvious, with 125 capping rallies and risk for a retesting of the flash crash lows from earlier is in play.

Is the US or Europe worse off for Q1?

The stall speed for the European economy seems to be more in play on the flash PMI reports, but the warnings from economists on the pain from the U.S. government shutdown are rising. This is the balancing act, and it’s captured in two charts (below) with the Q1 U.S. GDO forecasts at 1.5% year-over-year, while Europe is forecasted down 0.5% year-over-year. Both are trouble for the rest of the world.