There is a battle of confidence in play for 2019 as the FOMC pauses and President Trump negotiates a trade deal with China, notes Bob Savage.

While football maybe the focus for the United States today post Super Bowl LIII, most of the world is focused on the New Lunar Year of the Pig. Flying pigskins and flying pigs have similar hopeful outcomes. Given the Patriots sixth Super Bowl win, the statistical arbitrage points to a good equity market ahead.

The long pass for a touchdown and the long game for economic supremacy, both are aimed at winning in a world of relative value full of debt. The world seems prepared like the game for boring defense against a host of leveraged fears. The week ahead brings the focus back to borrowing with the U.S. 3-and 10-year note auctions along with the 30-year bond for a total $84 billion and bills for $134 billion.

There are many things to play for in growth, demographics, productivity, innovation, sustainability and social mobility. The clash of cultures and lack of faith in the institutions of globalization post the great recession are not going to go away just because of a football game or a truce in the US/China trade war. Or even because the FOMC pause may lead to a cut, should the Fed deem the economy needs it.

There is an anxiety to the melt-up in risk that just won’t go away and yet, the forces of FOMO (fear of missing out) and easy money elsewhere leave investors little room or time to wait. Defense is boring but necessary. We are living in a world that wants to believe the most fanciful of all – flying pigs – as the New Year brings an end to the 12-year cycle of Chinese astrology. Wear good clothes and don’t over indulge are the mantras. Unfortunately, the world of debt makes clear that many in the frontier and emerging markets have little room for cheer.

Is the US economic cycle about to turn over?

There is a battle of confidence in play for 2019 as the FOMC pauses and the Trump truce talk on trade lead to a resurgence of risk in January. The playing out of markets for Q1 rests on the balancing of the economic cycle against the power of policy both fiscal and monetary. The view of the world has led to a consensus that 2019, at least in the first half of the year, will bring better than average growth as Q1 slowdowns from weather and the government shutdown shift to a recovery. However, thanks to rate hikes there will be little inflation and so the United States will continue to provide good returns for investors. The problem with this rests on the cost of expansion with the latest jobs report surprising economists even as jobless claims rose. This balancing act will be a key part of the data dependency for the months ahead.

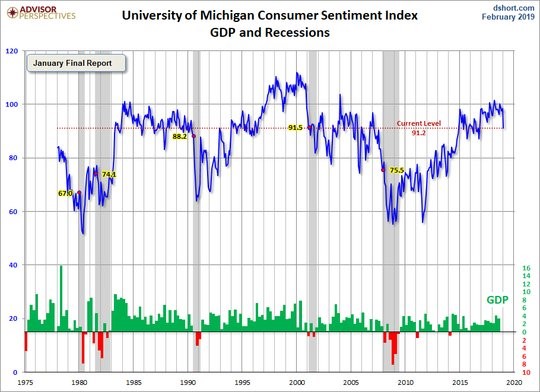

The other worry for markets is one about the consumer. The 7.1 drop in the University of Michigan consumer sentiment survey, more than 2 standard deviations from normal, but still 5.9% above the long-term average of the series. The drop in the Conference Board and NFIB surveys is similar and suggests the FOMC pause last week was prudent.

Market Recap

We started with the U.S. government reopening, followed by mixed China PMI and weaker data in Europe. The FOMC on hold and shifting to a balanced risk bias left plenty of room for the rally in risk to continue but the jobs report confused and leaves many waiting for more confirmation that U.S. growth can sustain without inflation.