Similar technical patterns from the past suggests SWK could drop roughly 10% over the next month, notes Elizabeth Harrow of Schaeffer's Investment Research.

Industrial tool giant Stanley Black & Decker (SWK) has been wildly volatile lately. Its 60-day historical volatility of 49.4% registers in the 96th percentile of its annual range, according to Trade-Alert data, as the stock has zig-zagged all over in recent months. And now, after staging a near-vertical rally from its post-earnings bear gap low of $115.69 back on Jan. 22, SWK is on pace for a collision with a historically bearish trendline.

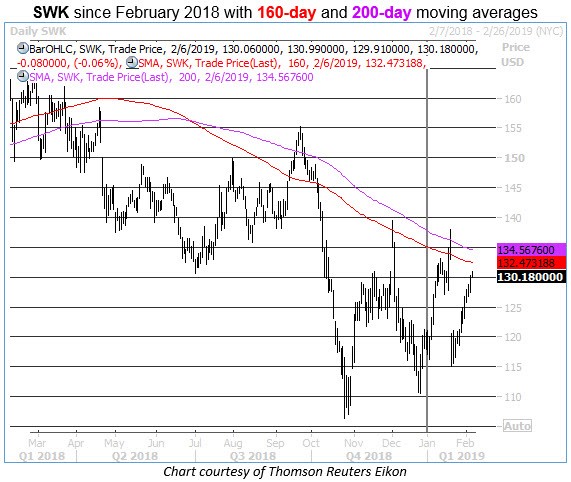

Namely, the stock closed Tuesday within one standard deviation of its 160-day moving average (in red on the above chart). Looking back over the past three years, there have been four previous instances of SWK testing resistance at its 160-day trendline in this manner — the results going forward have been uniformly bleak.

Specifically, going out five days after a test of this trendline, SWK's average return is a loss of 4.48%, with only 25% of the returns positive. And going out 21 days after this signal, the average return is

-9.58%, with 0% positive returns. Based on SWK's Tuesday closing price of $130.26, an average pullback from the 160-day moving average would place the shares around $117.78 one month from now.

Making the forecast for SWK even bleaker is its overhead 200-day moving average, which stands ready to cap any breakout attempts beyond its 160-day, as it did earlier this year.

Despite the stock's year-over-year decline of 18.5%, SWK continues to boast a resoundingly bullish following among brokerage firms. With 12 "strong buys" and one "buy" rating from analysts, compared to just two "holds" and zero "sells," there's plenty of room for downgrades to smack the shares lower in the weeks and months ahead.

A pile-on by the shorts could also create headwinds. Short interest currently accounts for a modest 3.1% of the stock's float, but ramped up by 39.5% in the two most recent reporting periods. If bears continue to target the underperforming stock, the resulting selling pressure should be a catalyst lower for SWK shares.

Meanwhile, short-term options on SWK are reasonably priced, from a volatility perspective. Schaeffer's Volatility Index (SVI) of 27% arrives in the 35th percentile of its annual range, which means front-month, at-the-money options on the tool stock have priced in lower volatility expectations only 35% of the time during the past year. That means speculative players can bet on a quick pullback for a comparatively low upfront cost via SWK put options.