With stocks in an overbought condition, global central banks neutral or in easing mode and the global economy slowing, the market is now a hostage to headlines, writes Joe Duarte.

With stocks in an overbought condition, global central banks neutral or in easing mode and the global economy slowing, the market is now a hostage to headlines regarding the trade talks between China and the U.S. The down side is that there will be some short term pain. The up side is that if things work out, the bull is likely to charge higher, at least a bit longer.

Over the last few weeks I’ve been cautiously making the case that the worst case scenario for stocks might have passed. After all, prior to the recent selling spree, the market had recovered nearly three fourths of the bear market losses from the fourth quarter’s massacre. But things may have changed, and if stocks continue to struggle near the current price range, we may have seen the highs for this rally.

Last week I wrote: “It seems the worst of the market’s blues may have passed,” while cautioning, “We may enter some sort of consolidation period in the next few weeks. After all the market has come a long way in a short period of time.”

Thus, I’m not really surprised at the market’s action over the last few days. What’s most important is to figure out, sooner rather than later, if the selling is something that is temporary or whether we’ve seen the market’s highs for the intermediate term and the selling is going to get worse. Moreover, even though there are numerous external influences to consider, the selling got worse on Thursday after a media report noting that Trump and Xi were unlikely to meet before the March 1 deadline. This was made worse when another report suggested that Trump was going to sign an executive order banning the import of products from the embattled Chinese networking giant Huawei.

Still, it’s worth keeping tabs on the major external influences on the stock market at the moment:

- The Federal Reserve is on hold

- Global central banks are either on hold or easing as is the case for China and now India

- The global economy is slowing and in some cases contracting

- The U.S. economy seems to be in better shape than the global economy, although growth has slowed

- U.S.-China trade talks are nearing a key March deadline and are starting to become perilous

- Emerging markets have been benefitting from the general state of affairs in the world but may be vulnerable to general market trends

- Geopolitical pressures are likely to increase as populist revolts increase and long standing relationships and power structures are under attack

- U.S. politics are increasingly polarized and the 2020 election is about to start making its mark on the news cycle

- We are in year three of the U.S. Presidential election cycle, which is usually a bullish year for stocks

The surprise rate cut by India’s central bank may be a signal of the start of a global easing cycle over the next few months. Certainly the newly minted recession in Italy and the recent crash of German economic data suggest that the weakness is starting to spread in Europe. The issue, however, is how the markets respond to a worsening of economic data and such an easing cycle if it materializes in response.

There May be More Selling Ahead

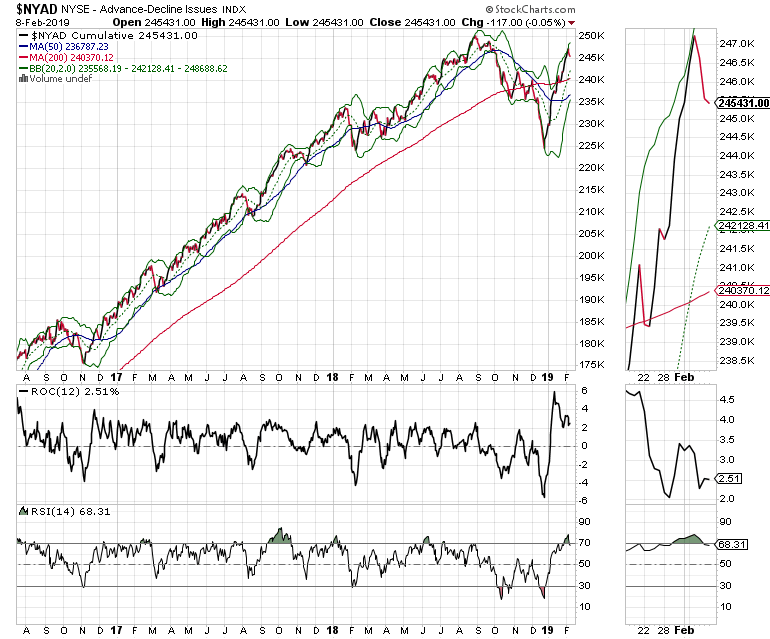

There are still a good number of attractive looking stock charts in this market, but New York Stock Exchange Advance Decline line (NYAD) remains the most accurate indicator of the trend of the stock market since the 2016 presidential election. And its current message is cautionary.

Certainly we are still in an uptrend but in the midst of the pause. First, the overbought Relative Strength Index (RSI) signal coincided with the recent top in NYAD and now the RSI indicator is suggesting that the odds of more selling in the short term are rising. This is confirmed by a rolling over of the rate-of-change (ROC) indicator as well. So if technical tradition holds up, we may see NYAD fall to the 20-day moving average before we see a pause in the selling.

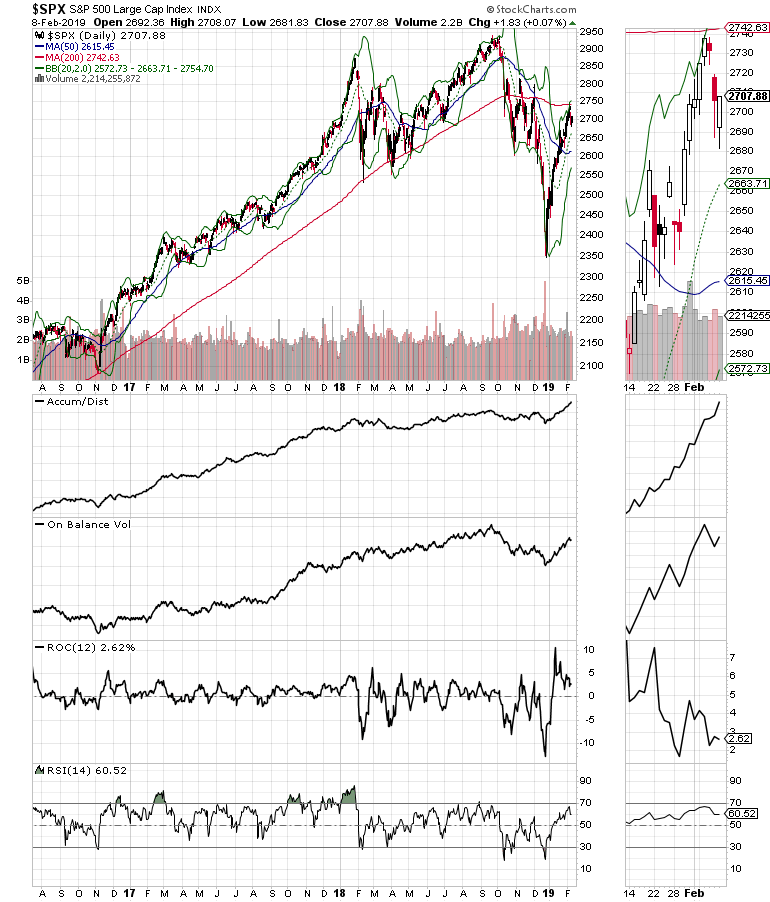

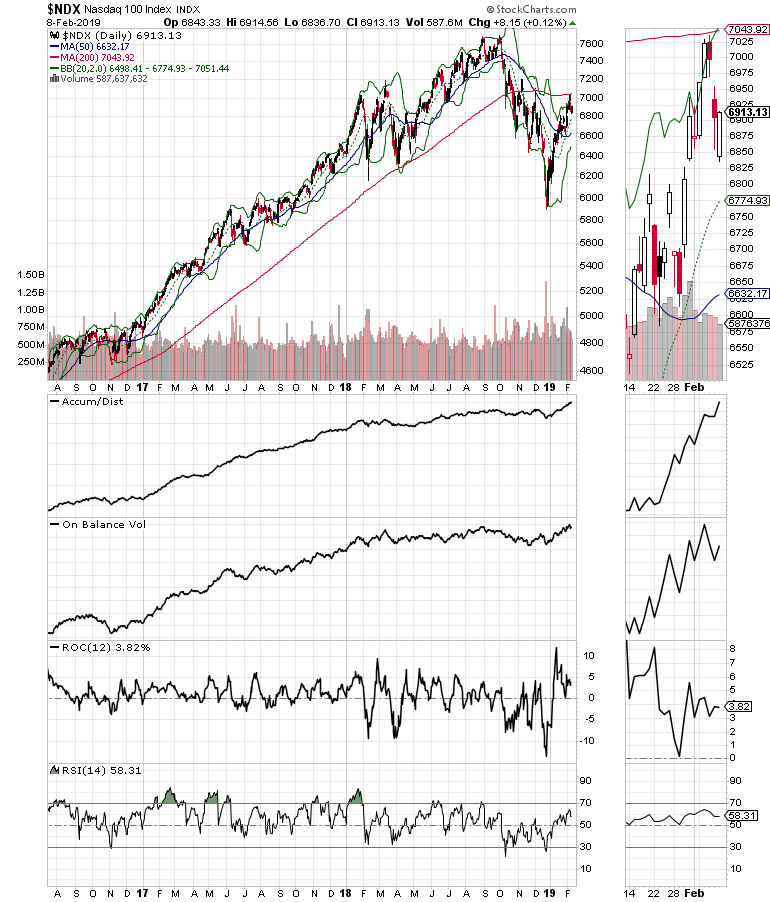

Second, both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes failed to rise above their 200-day moving averages, which mean that technically they are still on the bearish side of the ledger. This may be a temporary phenomenon, and a few days of selling may create enough fear to power these indexes beyond the key resistance level.

Caution and Selectivity Make Sense in this Market

With roughly three weeks before the U.S. and China decide on what to do about trade, the markets are likely to remain bumpy. That means that cautious trading is the best policy. Narrowing your focus and sticking with what’s working and taking some profits makes sense. It’s not a bad time for using options to lower risk. And it’s still o.k. to give winners some room to consolidate. But it’s not a good idea to let the market take away too much from significant gains, and throwing in some hedges makes sense. Moreover, if you’ve put on some trades and they aren’t working, it’s best to take them off the table before they get worse.

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit our website.