The real driver of the mood overnight is more about the fate of the U.S.-China trade talks, writes Bob Savage.

We all know the problem, without a traffic light, rules on who goes first become a game of chicken. There are mixed signals and mixed messages in our markets today. Hope on better trade deals, hope for more easy money meet the reality of deflationary risks. The downdraft in risk in Asia reverses in Europe. There are mixed messages in the data and the headlines. Markets are preparing for more U.S. data as well after the weaker U.S. retail sales left many rethinking the Goldilocks story for markets. Growth steady and inflation tame is not what the tape is providing.

China is a case in point. The largest increase in new bank loans in China on record, and a larger than expected drop in CPI and PPI don’t mix well. Next week the retail sales, industrial production and unemployment will be watched against the large rise in money supply to make clear whether Beijing has done enough. Many are trying to dissect the China seasonal noise of the new-year and the usual front-loading of lending in January against the government efforts to stoke up the economy.

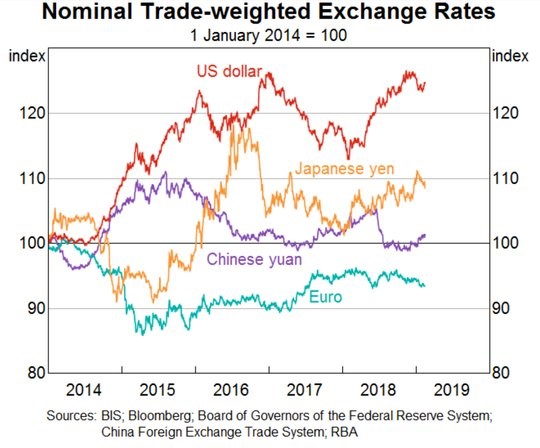

The real driver of the mood overnight is more about the fate of the U.S.-China trade talks – where President Xi stepped in and where Treasury Secretary Steve Mnuchin noted they were “productive,” suggesting that there is still hope for a deal and delay mixture in the month ahead. The other headlines from Asia – weaker Singapore Q4 GDP on the revision, weak Japan industrial production confirmed, and lower New Zealand Purchasing Managers Index PMI – all led to the risk-off swing. The flip in Europe rests on trade talk hopes, better UK retail sales, and a view that even with auto sales weaker, Germany is over the worst of its slowdown. Whether this is true will depend on the data ahead. The mixed market messages make clear that the Japanese yen is the safe-haven to watch today.

Trump speaks at 10 to likely enact emergency measures for the wall.

Does the China money supply offset the PPI?

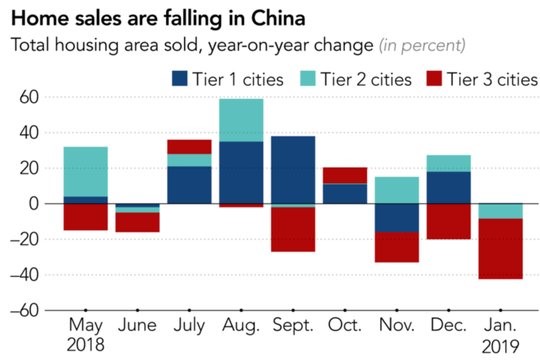

The connection between easy money and asset prices works everywhere but with some lag as confidence from the action into the real economy – i.e. forward guidance – matters as well. The U.S. and EU versions of low rates and QE drove up bonds, equities and home prices from 2009 – with the role of the banks critical. The China version of such easy money and QE hasn’t yet been felt. Perpetual bonds are just starting, while the People’s Bank of China has delivered 4 cuts, rates are still over 2% - making real rates positive still. The leap up in the January total social finance merits watching. The connection of M2 or Chinese yuan bank loans to China home loans isn’t so obvious.

The Nikkei Asian Review reports that 65 million urban residences (21.4% of all housing) is unoccupied, that is up from 18.4% in 2011. Sales volumes in 24 cities tracked by China Real Estate Index System fell by 44% in the first week of 2019 compared with a year earlier, though the four largest cities -- Shanghai, Shenzhen, Guangzhou and Beijing -- still saw a 12% increase. Many analysts now expect China's home sales to contract this year. Perhaps more worrisome, though, is the growing number of Chinese property companies that appear to be struggling under the weight of heavy debt burdens. Moody's Investors Service has assigned junk status to 51 of the 61 Chinese property companies it assesses.

The turnabout in global policy since January outside of China also matters and supports the more traditional push of exports for growth. The Royal Bank of Australia chart on policy outlooks is worth considering on this point as is the chart on real trade weighted FX (see chart). Perhaps the key for better China growth is going to be a mix of more easy money and a weaker Chinese yuan.