While recent equity strength appears to be climbing a wall of worry, Bob Savage argues that it will require additional drivers to sustain momentum.

We maybe tilting at windmills as the relentless rally up in risk in the last week for U.S. equities begets ever more analysis as to why markets react to policy and economic data as bulls beat bears. The cause and effect of why shares are bid in the United States and Europe — less so in Asia and emerging markets — matters. Knowing what caused the rally matters more than the rally itself, as it will be the underpinnings for the next cycle of selling.

The abnormality of the last week stands alone: Stocks up, dollar up, oil up, bonds up and Emerging Markets down. The cracks are in the logical inconsistency of it all; bonds and stocks can’t rally together forever, nor can the U.S. Dollar rally with commodities. Emerging markets depend on growth and easy money and yet the weakness last week seems to suggest more a zero-sum game in play for value. The bulls will list out better Q4 earnings, less fears about U.S.-China trade, less fears about China growth, less U.S. political troubles – no new government shutdown – and further easy money promises from numerous central bankers. Bears continue to point to the growing disappointments of Europe, the troubles in China and doubting of its data, ongoing political issues in Europe from Brexit to Spain to Italy and Germany, along with the usual geopolitical problems from Russia, to India/Pakistan to Mexico and Venezuela.

The following four stories that play out this week will matter significantly to how markets see the windmills of cause and effect – they might be giants, or they may be more grist for the millstone.

1) China: Is this optimism that the U.S.-China trade talks lead to a March 1 deal or an extension in the deadline? According to a Reuters report, China offered to boost its purchases of U.S. semiconductors in exchange for lower U.S. tariffs even as the talks seem inconclusive on intellectual property or state subsidies. The underlying status of talks will become more obvious with President Trump tweets on this next week along with the China auto sales and home price data.

China bank lending exploded last month will it continue?

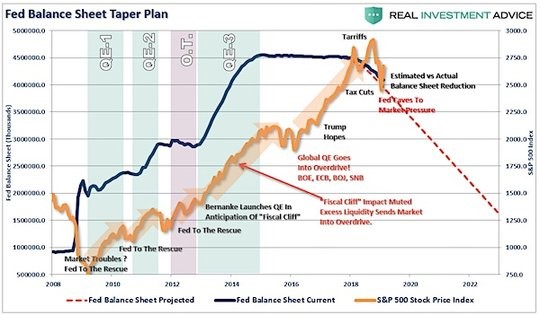

2) Federal Reserve: Is this hope that the FOMC has reversed course driving another risk parity rally with the 1.2% drop in U.S. December retail sales – worst drop since Sep 2009 – along with a higher weekly jobless claims? The FOMC minutes will be critical in assessing the reaction function to the present data.

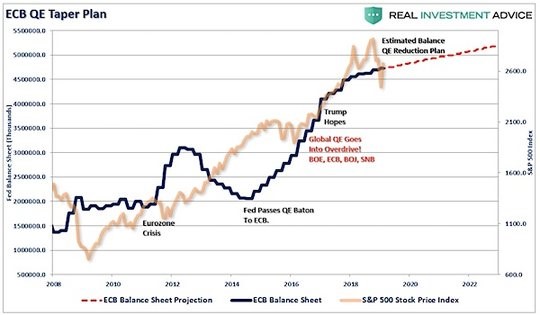

3) ECB: Similarly, is the EUR weakness due to German near recession and Italian confirmed recession or because the ECB is more likely to reverse from its QE end and talk for rate normalization? The numerous ECB speeches from Praet this week along with the ECB meeting account will be seen as critical in judging this point.

4) Brexit: Finally, we see the confusion of Brexit still bleeding over the UK economy and yet the GBP holding stable, perhaps because of the inevitability that without a deal yet acceptable both Europe and the UK will delay any divorce.

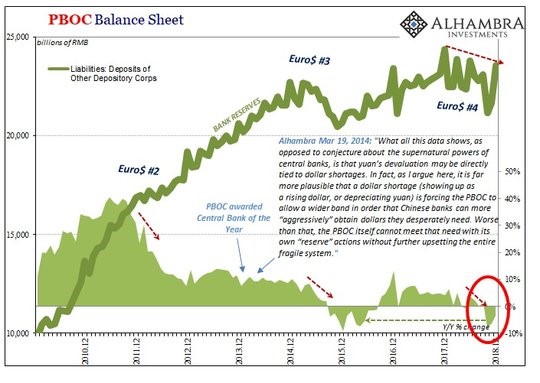

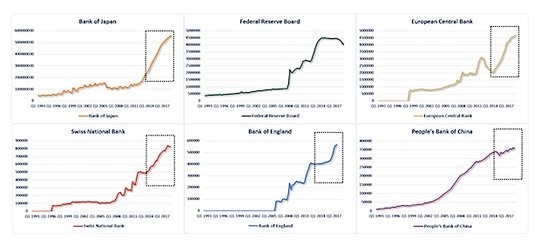

There are many undercurrents to cause and effects in markets, as every cause produces more than one effect. We will find this out in the readings of the FOMC minutes as they compare to those of the ECB. Present policy expectations are like windmills – they might be giants blocking the next advance up in risk as not hiking isn’t the same as easing, nor is freezing the size of your balance sheet the same as continuing to expand it. What matters is what the US, European, Chinese and Japanese central banks and others do with their policy more than one action alone.

Is this more than a short-squeeze for stocks?

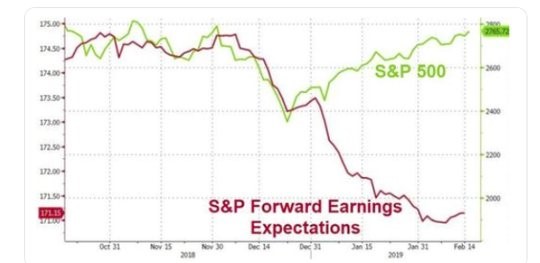

There is a growing view among analysts that the present eight-week rally up in the S&P 500 is more than just a short-squeeze from the Q4 correction. Some argue that the FOMC and other central banks are now going to continue the easy money liquidity, others claim that the efforts for China stimulus and the likely Trump/Xi deal on trade mean 2019 growth will beat present reduced expectations. The flip-flop of bearish to bullish price action in U.S. shares from Dec. 24 to the present has become legendary. The rise in shares despite weaker expectations for Q1 stands out for the S&P 500. Yet, the rally has put U.S. equities near overbought technical conditions.

According to FactSet companies are reporting earnings growth of 13.1% and revenue growth of 7.0% for Q4. For calendar 2018, companies are reporting earnings growth of 20.1% and revenue growth of 8.9%. However, analysts expect a decline in earnings in Q1 2019 and low, single-digit growth in earnings in Q2 2019 and Q3 2019.

- For Q1 2019, analysts are projecting a decline in earnings (-2.2%) and revenue growth of 5.3%.

- For Q2 2019, analysts are projecting earnings growth of 1.0% and revenue growth of 4.7%.

- For Q3 2019, analysts are projecting earnings growth of 2.4% and revenue growth of 4.5%.

- For Q4 2019, analysts are projecting earnings growth of 9.1% and revenue growth of 5.0%.

- For CY 2019, analysts are projecting earnings growth of 4.8% and revenue growth of 4.9%.

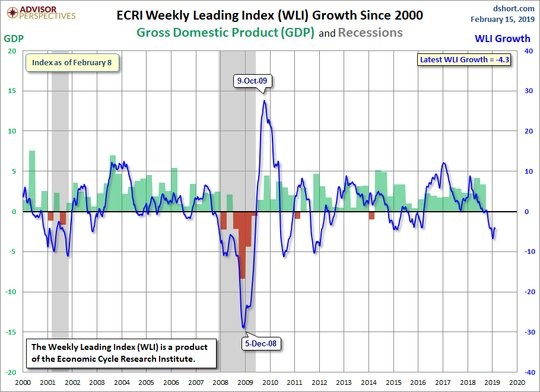

The other issue for the bullish argument about equities is one about the real economy and its risks for Q1 and beyond. The ECRI Is flashing red over U.S. growth. Its track record in capturing recessions is worth studying. There are other worrying signals at play as well. The hits of retail sales and weekly jobless claims also stand out in the last week as they drove the Atlanta GDP now to 1.5% from 2.7% Feb 6.

Bottom Line

In order to argue that U.S. equities have more upside, you will need new drivers. The cause and effect of the rally from Christmas Eve is changing from short-squeeze to something else. Just exactly what this is matters – whether its FOMC dovishness or Trump trade deals or better news from the rest of the world – particularly China – all that matters in how to trade the S&P 500 and other risk markets going forward.