Welcome to March, where markets like the weather, are greeted with the intensity of a fading trend, writers Bob Savage.

Welcome to March, where markets like the weather, are greeted with the intensity of a fading trend be that winter or a bull market in risk or harsh economic data. The better than expected (though declining) U.S. fourth quarter GDP and better Chicago Purchasing Managers Index (PMI) numbers led the selling of bonds yesterday and that supported the U.S. Dollar Index, but it didn’t hurt risk moods.

Overnight the China Caixin PMI was better even as Korea trade data was worse as exports fell sharply again. Japan saw better Q4 Capital Expenditures, worse unemployment and weaker PMI. The focus in Europe was lower core Harmonized Index of Consumer Prices (HICP) at 1% and as expected weak PMI reports.

German jobs were stronger and retail sales robust. This data all matters but seems less of the driver for risk-on everywhere as its still all about U.S.-China trade talks leading to a deal. The fear of a no-deal Brexit is also significantly lower and so that helps markets in Europe and the UK.

Data becomes important when geopolitical fears are lower and that describes the start of March – the lion is more a symbol of strength than of volatility as the first two months of 2019 have been kind to passive investors chasing momentum and looking for carry. Whether this can change in March will rest on the data dependency of central bankers and their reactions.

Markets are set up for another test of 2800 in the S&P 500, which is the upper boundary of many value players. Without better data, the run up in global risk will seem more hope than fact. For those looking for a barometer – watch the AUD/JPY – its back in play with carry, US-China trade hopes, the rise copper prices and the seemingly eternal easy money of the Bank of Japan. The Aussie dollar will be waiting for its central bank statement and GDP next week and some confirmation of the easing expectations priced into the market. Until we break 80.75 the lion of the 2019 recovery may still just be a lamb in the making.

Are we near the growth bottom?

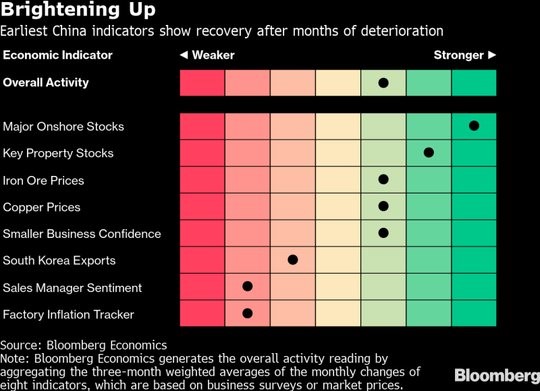

The better Chicago PMI yesterday, the stronger Caixin China PMI today (almost at flat 49.9), better Japan Q4 Capex and hopes for a US-China trade deal mixed with FOMC patience and other central banks easy money – all put many analysts into the “green shoots” camp for global growth. Of course, the markets appear to have already priced this theme (see table below).

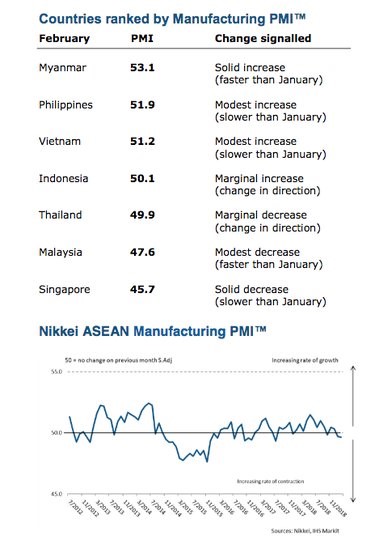

However, there are other reports that conflict with this like the ASEAN February Manufacturing PMI at 49.6 from 49.7 – this is the first back-to-back loss in two-years as new orders continue to drop as foreign sales contract for the seventh month. This isn’t a bottom but a continuation of trouble that holds from Q4. The hope for growth needs facts to prove the point and make it real. Today’s U.S. ISM will be watched accordingly. There is one silver lining in the divergence of the region and in that Indonesia and Vietnam maybe the key places to watch to confirm a bottoming out for the region.