Large options trades can provide clues to make market moves, notes Jay Soloff.

Following the action in the options market can help savvy traders gain insight into what the smart money is focused on. Analyzing large money flows can provide clued to major moves and opportunities to get an edge.

However, following exchange traded funds (ETFs) options can be tricky because there’s often so much action to sift through. In the major ETFs, there’s plenty of systematic option trading which may not be a signal but instead, simply part of a regular routine. For instance, large funds often buy major index ETFs and writes covered calls every month on them.

Still, less heavily traded ETFs or unusual types of options strategies can give plenty of clues. You’d be amazed at the types of trades and strategies you can find on a daily basis if you take the time to do the research.

One type of ETF (or ETN), which typically doesn’t have a lot of regular options volume is the leveraged ETF. ETFs with 2x and 3x leverage are typically too volatile for most commonly used options strategies. (This doesn’t include leveraged volatility ETFs which were quite popular before they mostly vanished after the February 2018 volatility explosion.)

For the most part, leveraged ETFs are the domain of day traders – who quickly get in and out of stock positions throughout the day. This is especially true of 3x leveraged instruments, where you rarely see big options volume hitting the tape.

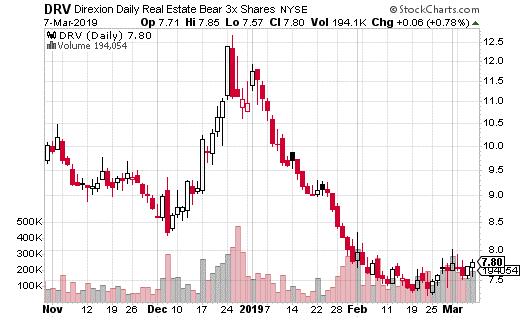

So, it certainly came as a surprise when about 3,000 contracts in Direxion Daily Real Estate Bear 3X ETF (DRV) were recently traded. Now, 3,000 contracts may not seem like a lot, but the daily average for DRV is normally 274. And, the ETF itself only trades about 150,000 shares a day on average. For reference, SPDR S&P 500 ETF (SPY) trades more than 100 million shares a day.

DRV is a triple leveraged inverse ETF. That means it moves three times the benchmark and goes up when the asset or asset class it’s tracking goes down. In this case, DRV is betting against REITs, so it does well in a bearish real estate market.

Taking a closer look at the trades in DRV revealed every contract traded was a call. Most of the larger blocks were done in the $9 May call for 30¢ with the ETF at $7.60.

This trade is interesting for a couple reasons. First, leveraged ETF options mostly trade in the front-month because of the nature of the instrument and risk involved. May is a long way out for a triple leveraged ETF.

Next, the $9 strike seems pretty far out-of-the-money for a $7 stock. However, the options only cost 30¢ each, or $60,000 for 2,000 contracts. Not to mention, the 52-week high in this ETF is almost $15. There clearly is a lot of upside potential with this trade.

So, is the trade a low-cost gamble on a spike in DRV? Or does the strategy go deeper? Is this trader betting on a true pullback in REITs and the overall real estate market? It’s impossible to know for sure, but it certainly is interesting to see this kind of a longer-than-normal options trade in a 3x inverse ETF. It’s also a cheap enough strategy that it would be easier to emulate if you share the same opinion.