Bitcoin has been consolidating and could be preparing for breakout, writes Matt Weller.

With headlines flying around Wednesday’s high-profile Brexit votes, a big dovish shift at the Reserve Bank of New Zealand, and the “race to the bottom” in global bond yields, what topic should an experienced market analyst write about?

Bitcoin of course!

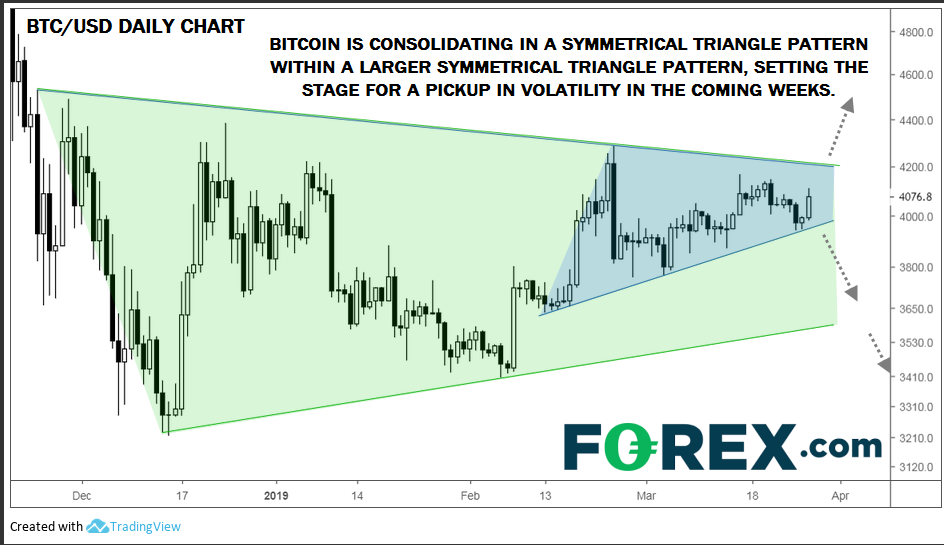

All kidding aside, the granddaddy of cryptocurrencies has been snoozing for the entirety of 2019 so far, with prices trapped in a range between the mid-$3,000s and low-$4,000s. More to the point, Bitcoin has seen a series of lower highs and higher lows over that period, creating a textbook “symmetrical triangle” pattern. This is a classic sign of consolidation and waning interest in an instrument:

Source: TradingView, FOREX.com

While trading in Bitcoin hasn’t been particularly compelling of late, it’s important to remember that volatility is cyclical, meaning that the current low-volatility conditions could set the stage for a potentially explosive move in the coming weeks. At this point, the established trend for Bitcoin (and essentially all cryptocurrencies) is definitively down, favoring to a potential bearish breakdown.

For those with a contrarian bent, sentiment on the space has finally turned dour, as shown in the shift from headlines like the New York Times: “Everyone Is Getting Hilariously Rich and You’re Not” (in the style section no less!) to last week’s downbeat Wall Street Journal report, “Bitcoin Is in the Dumps, Spreading Gloom Over Crypto World.”

A breakout above resistance in the $4,200-$4,500 area could mark the first sign that Bitcoin, and the crypto asset space more broadly, is starting to turn a bullish corner.