Jay Soloff shares a significant options position is a lightly traded issue. Tabb the tote!

It is nearly impossible to overstate how valuable options can be for traders. The benefits to using options for trading are numerous and straightforward. Every trade involves risk, options—used properly—can define each risk to a mathematical equation that can eliminate many of the variables of trading.

Traders will often begin experimenting with options because of the leverage they provide. Having one option equate to control of 100 shares of stocks can certainly lead to greater returns than simply using stocks—if you’re are approaching this from the equity world.

However, options leverage is more than just increasing returns. The leverage component also means traders can trade stock they may not normally be able to afford. Take Amazon (AMZN) for example. It’s nearly an $1,800 stock. With options, you could control 100 shares ($18,000) of AMZN for a few hundred dollars.

Options can also provide access to strategies traders may not normally be comfortable with, such as short selling stock, or trading commodities—though spoiler alert—commodities are much less risky that equities. Using options can make these strategies simpler and safer—if done right—and most importantly, much more precise.

Big investment firms, funds, and trading desks will often use the options market to establish their positions in stocks and ETFs. Traders can often get an idea of what the smart money is doing by following big, block trades in options.

Sometimes, block trades will occur in stocks you’ve never heard of or that rarely trade in big volume. These situations can be particularly useful. Not only are they easier to spot among the noise of everyday trading, but it can often be easy to tell what the goal of the trader is.

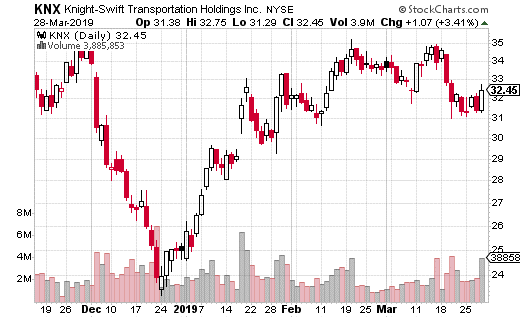

For instance, a large block trade in Knight-Swift Transportation (KNX) was recently established. The trucking and transportation company trades about 2.5 million shares a day on average, but only about

2,000 options. So, when a massive KNX options trade hits the wire, it can be an eye-opener.

A trader bought 20,000 August 35 calls for $2.35 per contract with the stock trading at $32 per share. What this means is that KNX needs to be at $37.35 or above by August expiration for the trade to break even.

The trader is spending $4.7 million for this trade, which is the maximum loss potential. So, this clearly is a very bullish trade and the strategist is risking a lot on the call purchase. We’re talking about a $5+ move higher (more than 15%) in a stock that doesn’t make big moves all that often.

The trade will generate $2 million for every dollar the stock moves higher than the breakeven point. In other words, there is a substantial upside to this strategy. It isn’t likely someone is risking nearly $5 million on calls on a whim.

This is a situation to take note of. KNX options don’t trade that much and a straight up call trade is pretty transparent. Someone thinks this stock is going up in the coming weeks. For about $250 - $300 you could control 100 shares of KNX for about five months.