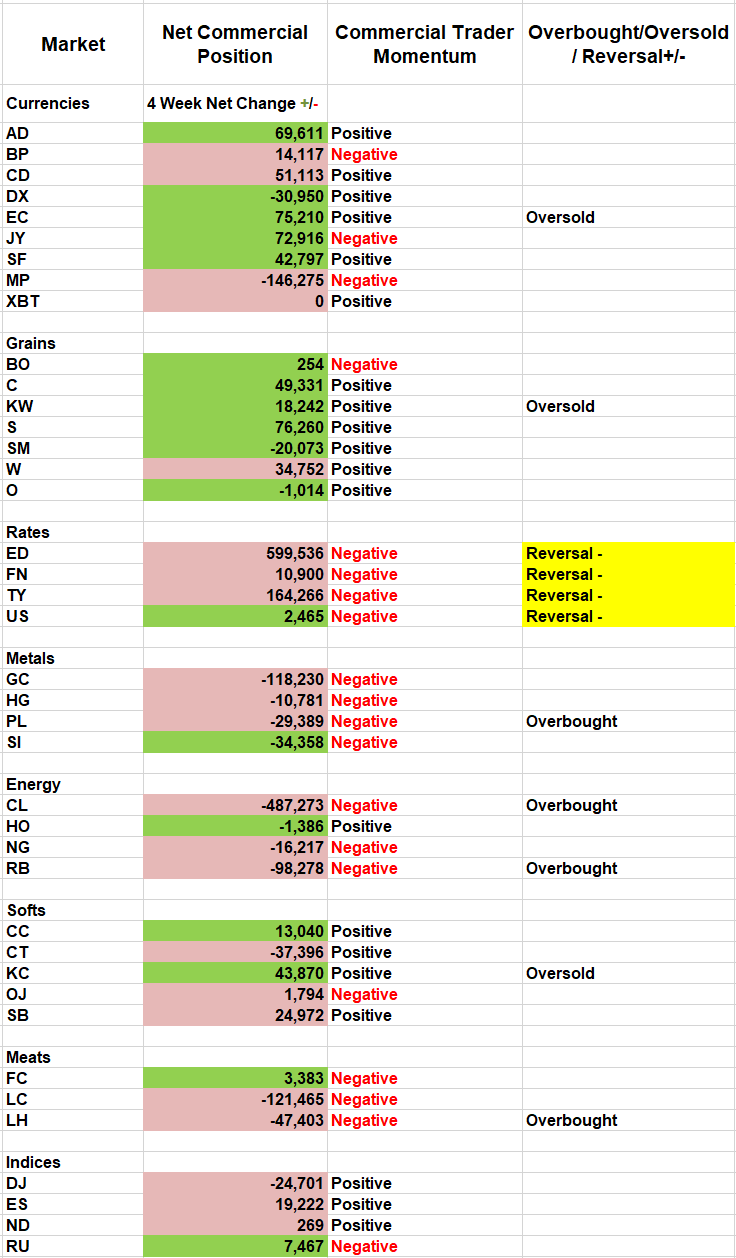

Andy Waldock of Commodity & Derivative Advisors, shows current trends in Commercial Interest from the CFTC Commitments of Traders (COT) report.

While every market sector tends to be correlated—grains, for instance tend to move together—very rarely do all markets within a sector signal a reversal. However, this week, all the markets we cover in the Interest rate complex: Eurodollars, five-year Treasury notes, 10-year Treasury notes and the 30-year Treasury bond, all are indicating a reversal.

This consistency within a sector strengthens the signal. Because of this traders may want consider taking a position in a leveraged exchange traded fund as well as futures.

Here is this week’s report sector by sector.

Interest Rates

We’ve been waving our hands and shouting about the interest rate trade setting up on the weekly charts. Daily COT subscribers got a head start last week. They received a second, add-on trade, as well. Now, the weekly COT sell signal has triggered across the interest rate spectrum. It appears that the market jumped too quickly on recently dovish FOMC comments. No rate hikes for the rest of the year doesn’t mean, no volatility, and it certainly looks like the high has printed for Q2.

We’re looking for long-term inverse positions in the interest rate exchange traded funds. Some of these may include unleveraged inverse products like the iPath US Treasury 10-year Bear ETN (DTYS) or, the ProShares Short 20+ Year Treasury (TBF). More aggressive traders may want to look at the Direxion Daily 20+ Year Treasury Bear 3X Shares (TMV), an inverse fund focused on 20-year rates with 3X leverage.

Coffee

The downward trend in coffee prices has been punishing. Recent activity by the commercial traders has begun to pique my interest. Watch for a daily close in the May contract above 98. This might spark some short covering heading into first notice day for the May contract on the March 22.

Energy

Crude oil drillers had been light, but consistent forward sellers as prices have risen throughout 2019. They’ve been selling for seven straight weeks, but this has intensified as their net short position has increased by more than 50% in the last two weeks. Not coincidentally, crude oil prices are 50% higher than they were at the December low. The crude oil market has just become overbought on the weekly scale. We’ll be watching this market closely for signs of a turn in the coming weeks as we play for a reversal before the summer driving season unleashes new demand.

Open Position Commentary

Softs: The orange juice trade continues to work in our favor as prices decline. Lower the protective stop from 125 to 120. We’ve neared the support near 115 – 116. It’s time to take profits. The commercial traders have nailed this trade, and we’ve followed right along, making 12 points on the way up and, more than 13 so far on the way down. That’s $3,750 in three weeks.

Cotton once again held our protective stop price and nearly reached our profit objective of $.80 per lb. We still think this is a good target as overhead resistance comes into play.

Currencies: The Swiss franc stopped us out at breakeven, and the Peso stopped us out with a profit.

Meats: We were stopped out of the lean hog short position. Daily traders managed a breakeven. The weekly stops are almost always wider due to the nature of time in the markets.

We’re still short live cattle. Prudence gets the better part of valor when trading. Lower the protective buy stop to 122.80. This is just above our entry point making, locking in a scratch if we’re wrong. Quick profits could be taken between 116 and 117.

We offer more specific instructions in our Weekly COT newsletter.

Andy described how traders can exploit the Commitments of Traders report in an interview with Dan Collins at the TradersEXPO New York:

Understanding the COT Report.