Recent strength in benchmark US Treasuries suggests weakness in economy, notes Fawad Razaqzada.

Benchmark 10-year U.S. government note prices have been inching higher and yields lower again, suggesting the recent improvement in U.S. economic data has not made a big impact on interest rate expectations (see chart). If the moves can be sustained, this could potentially derail the U.S. dollar’s rally against some of her major rival after the Dollar Index briefly broke above last year’s high yesterday.

Admittedly, the euro remains a soft spot owing to the economic troubles in the Eurozone and this could keep the dollar’s downside limited. However, other currencies such as the Japanese yen and British pound, and potentially gold, could make a comeback should U.S. bond yields fall further.

Indeed, the longer-term technical directional bias is still bearish on 10-year U.S. Treasury yields given the lower lows and lower highs on the weekly chart, and with the long-term bullish trend also broken.

Source: TradingView and FOREX.com.

Here are a few technical observations to consider following the recent price action:

- A Doji candle on weekly chart after a retracement to prior support could be a major bearish reversal signal

- Expect some downside follow through this week after the above price action last week

- Daily downtrend re-established after a brief break, potentially trapping the bulls

- Liquidity below this year’s low yield at 2.344 is the main downside objective for the bears

- Shorter-term potential support seen at 2.513, an old resistance level

- Key resistance around the 2.588-2.626 area, previously support

- Technical bias would turn bullish in the event of a break above prior high of 2.800

Overall, the technical indications suggest we may see weaker bond yields going forward, which could have major implications for other financial markets.

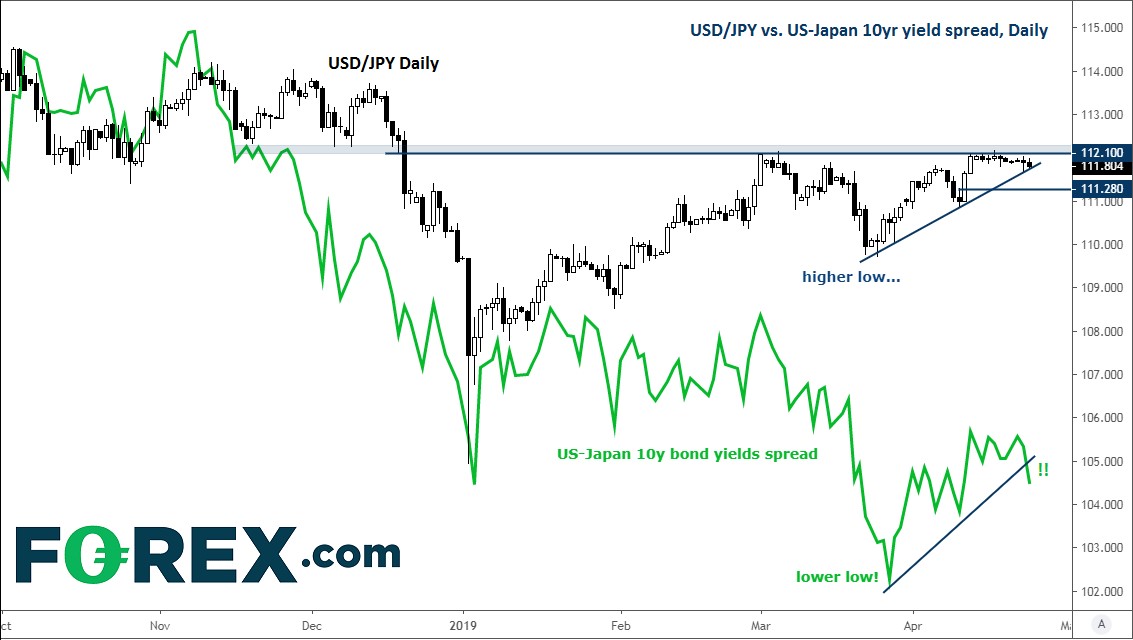

Could USD/JPY break lower?

With inching higher and yields lower again, suggesting the recent improvement in US data has not made a big impact on interest rate expectations. If the move in U.S. 10-year notes highlighted above can be sustained, it could derail the U.S. dollar’s rally against some of her major rivals. One of those rivals is the Japanese yen, which has actually outperformed the dollar over the past several days despite the U.S. Dollar Index breaking above last year’s high yesterday (see chart). The divergence between the DXY and USD/JPY suggests that the USD/JPY could actually break lower if U.S. bond yields continue to fall at a faster clip than Japan’s. The Bank of Japan is unlikely to make a significant impact on the direction of yields at its overnight meeting.

Source: TradingView and FOREX.com.