Multiple reports on Wednesday said President Trump will delay a decision on auto tariffs, reports Ashraf Laidi.

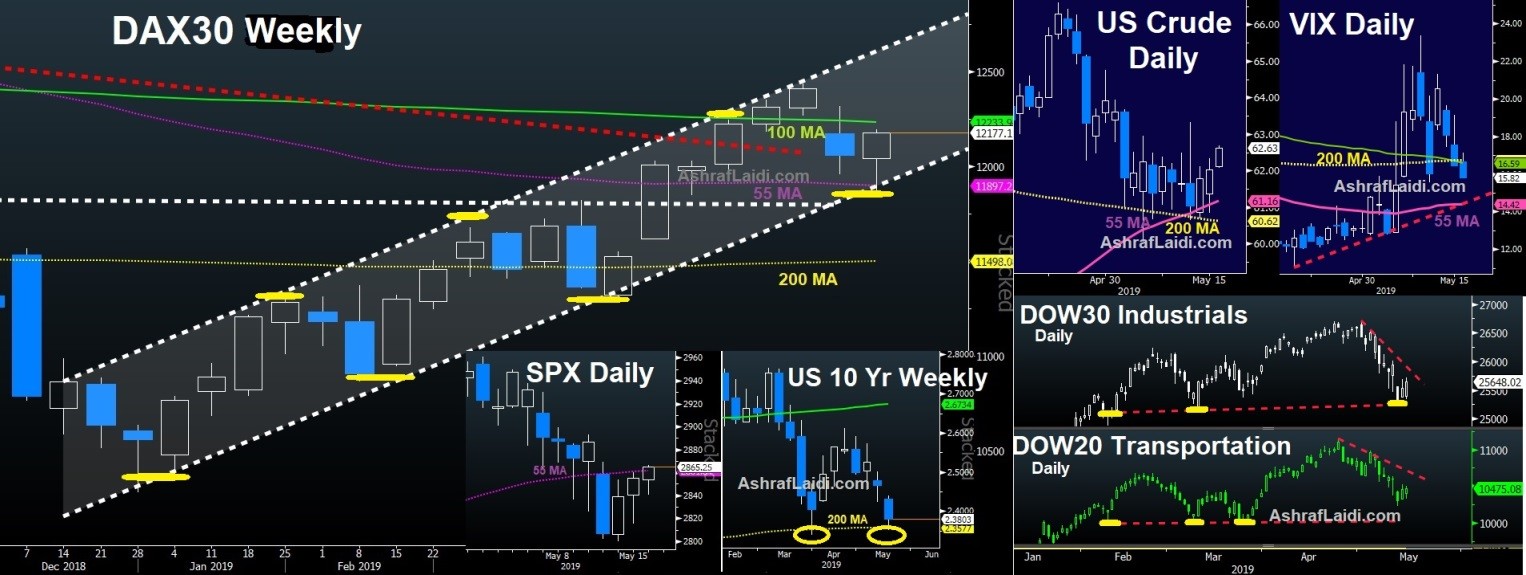

Multiple reports on Wednesday said President Trump will delay a decision on auto tariffs, allowing for a major reprieve in indices throughout Europe and Asia. The move boosted risk assets and the Canadian dollar was (and is today) the top performer while the British pound continues to lag. Watch out for comments from Federal Reserve Governor Lael Brainard on Thursday. U.S. jobless claims, Philly Fed survey and housing starts are due next. The seven charts below highlight the supporting technicals across the intermarket landscape, justifying why we went long indices during the selloff. The index trades are netting +500 point in the green.

Hover To Enlarge

Risk assets reversed positively on reports that Trump won't use national security powers to put tariffs on auto imports. He had been scheduled to deliver a decision by Friday but he has decided to delay it by as much as six months. We have noted previously that the plan was likely to settle with China and then pivot to Europe and Japan on autos. Yet, the recent breakdown in China talks meant President Trump had to reorganize and decided he didn't want to fight two battles at once.

In a sense, that's good news – especially for automakers, Germany and Japan – but it may also be a signal that he's braced for a longer battle with China. The DAX 30 has regained the 12200 level, bouncing off the five-month channel and 55-week moving average.

Along those same lines, the White House also appeared to make moves to end steel and aluminum tariffs against Mexico and Canada. Several reports indicated a deal is close after ministers from the NAFTA countries met Wednesday in Washington. That news helped to lift the loonie.

Looking ahead, comments from the Fed's Brainard at 16:15 GMT (2:15 EDT) will be worth heeding. What we're trying to evaluate now is how stubborn and committed the Fed is to holding rates and remaining patient. Low inflation, tariffs and further disappointing data like Wednesday's retail sales report have made the Fed fund futures market increasingly confident about a rate cut late this year (odds are at 76%). So far policymakers haven't genuinely opened that door but Brainard has floated key signals in the past and is a risk to do that again.

Ashraf Laidi recently talked about the Dollar, gold and the Chinese yuan Triangularity at TradersEXPO New York.

You can see his daily analysis at www.AshrafLaidi.com.