Look at these two healthcare plays and stay risk averse in this difficult market environment, warns Joe Duarte.

Expect more headline-related volatility as the summer trading season thins out volume, the geopolitical situation heats up and the algorithmic traders to keep chasing their own tails. Unfortunately, the bottom line is that the macro situation is increasingly sticky, and it will have consequences.

In fact, stock trading is a tale of two worlds; the high frequency trading (HFT) world of the algos, where big bucks buy access to faster data and the knowledge of what’s going to happen with every trade before it happens, and our world. Of course, our world is one without an HFT rig in our garage and the advantage of being at the exchange waiting for every trade. Moreover, this scenario is not likely to go way, at least for now, which is why it’s important to know how to maneuver around the algo trading traps.

Therefore, for the rest of us, it’s all about stock picking, risk management, grinding out profits, collecting dividends, and using old fashioned eye burning analysis of charts, SEC filings, and conference call transcripts.

Two Healthcare Diamonds in the Rough

The algos may rule the roost, but there are places where being patient may pay off.

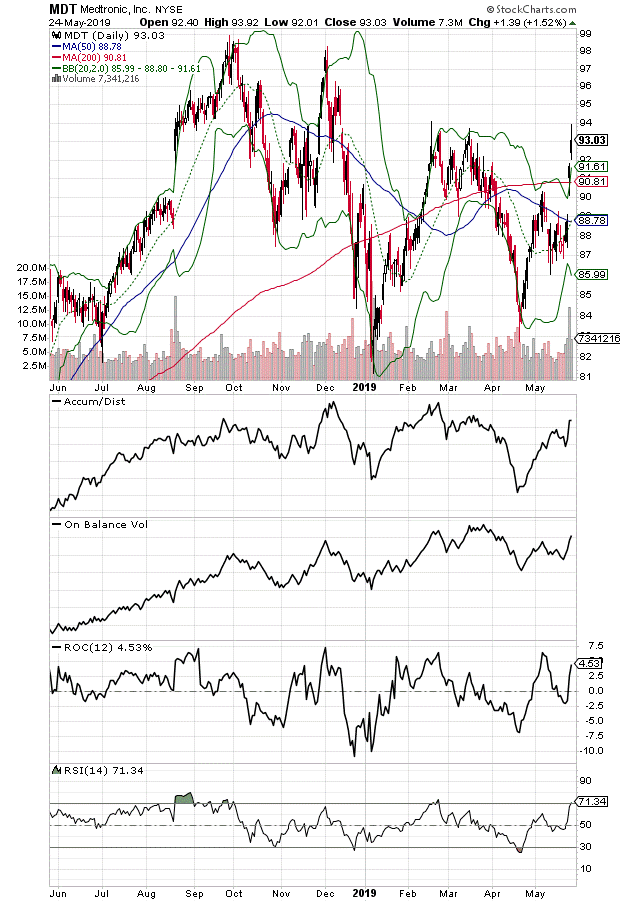

A perfect example of where patience paid off recently is Medtronic (MDT), a highly underrated medical equipment manufacturer, which we have owned for the past few weeks. Medtronic is a geeky medical stock which is best known for its pacemakers and heart valves; you know stuff that saves lives but doesn’t get much buzz. What’s interesting is that very quietly, under the radar, the company has been diversifying its wares into orthopedics and spine surgery while shoring up its pain management division. And last week’s earnings beat shows that the strategy is working as the surgical unit outperformed expectations and delivered a nice pop in the stock (see chart).

Perhaps what is still under appreciated is Medtronic’s pain management surgical product line, which should benefit from the opioid crisis and the likelihood of further reductions in prescription pain medications over the next few years. If I’m right, once the market figures that out, the stock should move higher for some time.

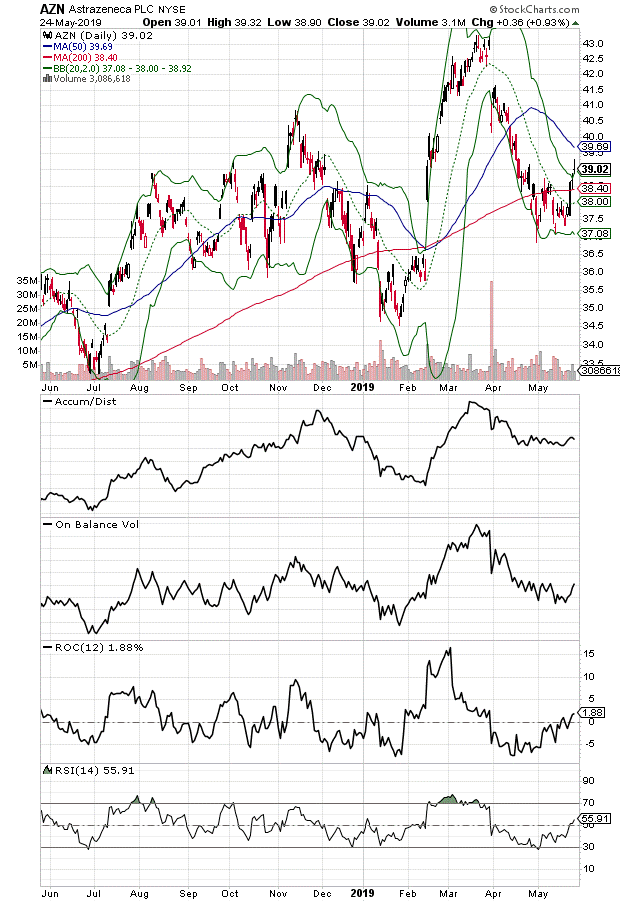

Another under rated company is healthcare giant Astra Zeneca (AZN), an old school, seemingly plodding pharmaceutical stock. I recently recommended AZN to subscribers and I own shares in the company as well. AZN is far from sexy, but it has solid franchises in oncology, diabetic care, and asthma. Furthermore, recent studies suggest that AZN’s cardiac drugs are making a big difference in diabetics with heart disease, a fact that should allow for label expansion on at least one current blockbuster. It’s not 5G but, just for a moment, consider the fact that you have to be alive to watch streaming video on your new cell phone, especially if you’re diabetic and you have heart problems.

Amazingly, likely due to “Medicare for All” jitters and HFT hysteria, the stock has lost 14% since April 1, before bottoming out in mid-May. The stock found support at its 200-day moving average and money is starting to flow back into the shares. Barring an all-out market massacre, if things continue as they are starting to go for AZN, the shares look set to recapture the lost ground, which would put the stock back above $40, perhaps in the next few weeks.

Market Breadth Limps Along

Certainly, we are in a difficult market. And although there are stocks out there that are worth owning, given the status of the market’s breadth this is not a good time to be mortgaging the house to buy stocks or to be overly aggressive.

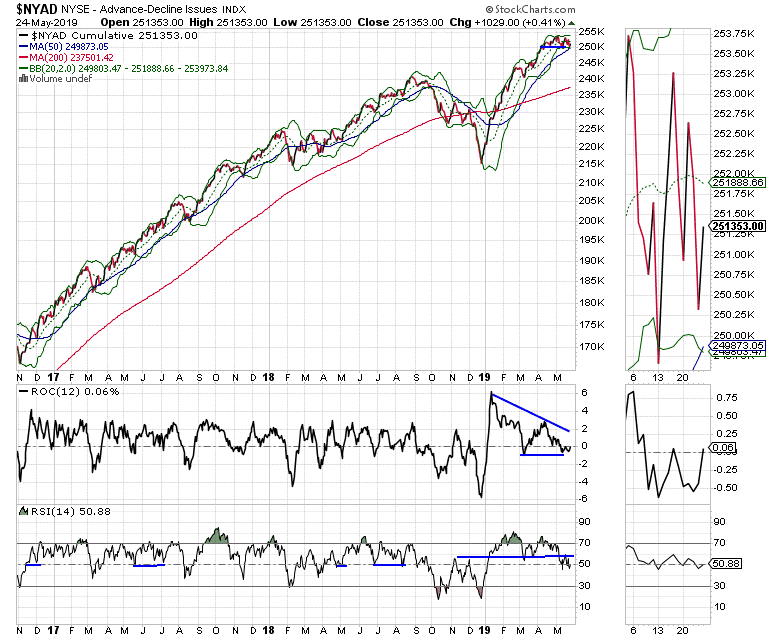

Of course, the NYSE Advance Decline line (NYAD) remains the most accurate indicator of the market’s trend, which is why its current posture is of concern. Specifically, the NYAD is currently range bound but is also clearly not forecasting much beyond a sideways trend. And things could change in a hurry.

Furthermore, given the current time of the year during which trading volume traditionally thins out, we may see a lot of false starts for a while.

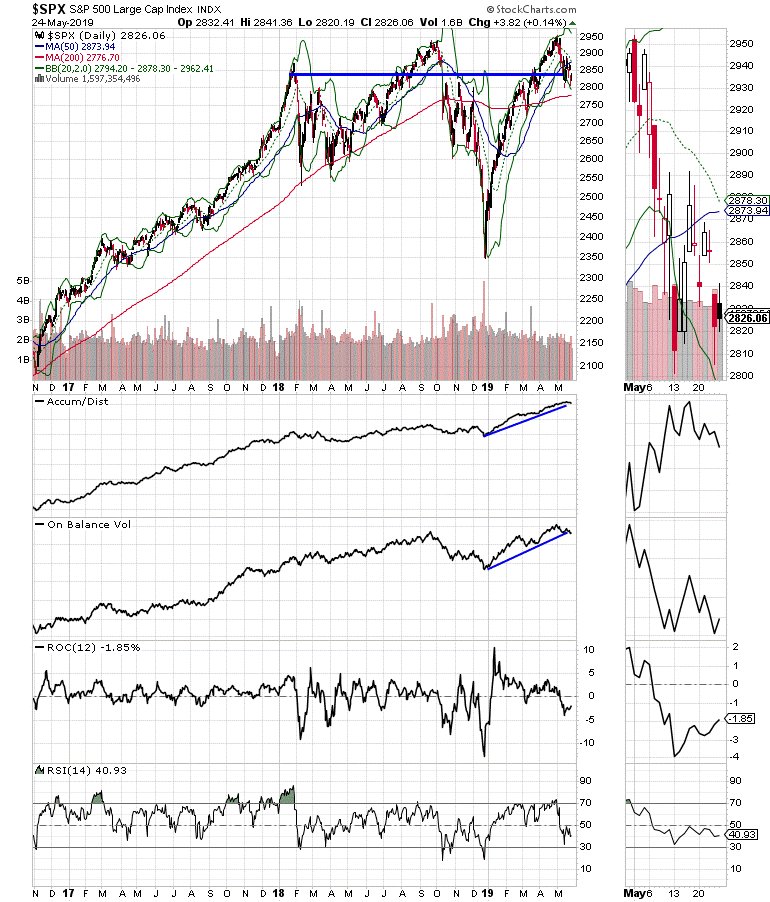

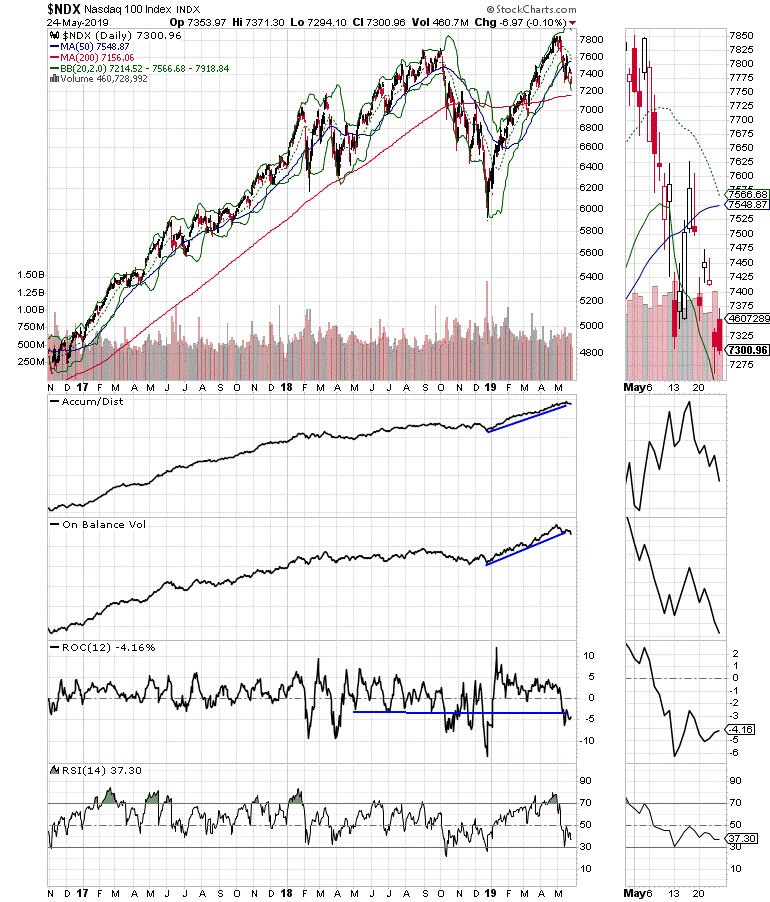

Making matters a bit worse, the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes are not as robust as the NYAD, which is saying something. In fact, both benchmarks closed below their 50-day moving average and just above their 200-day moving average which means that a few more bad days could increase selling pressure and lead to worse losses if the 200-day line does not hold as support. If that happens, the algos would pounce on the situation and the selling could accelerate as it did in the fall of 2018.

Even of more concern, the Accumulation Distribution (ADI) and On Balance Volume (OBV) indicators for both are also rolling over. As a result, the odds are increasing that we will see lower prices in many stocks before all this is over unless something changes.

On a positive note, the relative strength index (RSI) for both indexes is just above 30, which signals that the market is oversold. This could also be a signal that the next down leg may lead to a more credible rally after things stabilize.

Still, this is not a time to be very aggressive while remaining patient and selective.

Risk is Rising

With the major indexes seeming to be in a transition from an uptrend to a downtrend in the intermediate term, it makes sense to be risk averse. Indeed, this is the reason that at the moment, only stocks with very strong characteristics are still holding up and should be areas where smart money concentrates.

This is a great time to stick with what’s working and to consider options for higher risk stocks if you must trade them. It is also a time to start watching the very beaten up sectors of the market, especially technology and energy for possible places to enter the market in the future while currently focusing on solid dividend paying stocks with strong technical and fundamental characteristics.

Meanwhile having a bit of a hedge in place via puts and inverse ETFs is not a bad idea.

I own shares in AZN, and MDT as of this writing. I have used Medtronic medical products in my private practice of medicine but have no insider knowledge of events in the company.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.