Last week we wrote about why the Mexican peso was unusually placid in the face of the tariff threat while other asset classes showed more concern, writes Adam Button.

How long can global equity indices in and out of the United States continue to rally on the hopes of looming Federal Reserve interest rate cuts and on President Trump's decision to call off planned tariffs on Mexico?

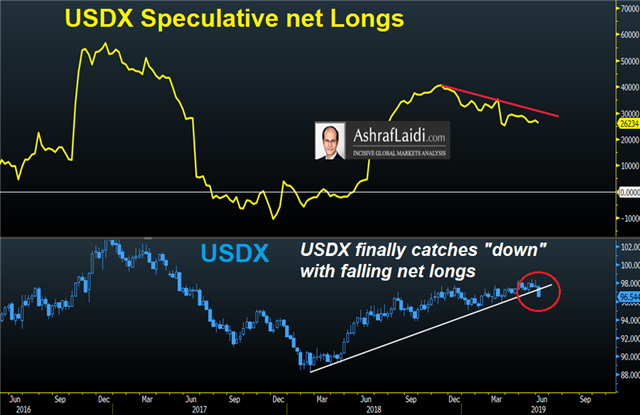

A poor U.S. jobs report helped move three USD trades into the green. The New Zealand dollar was the top performer last week while the U.S. dollar lagged. The Commodity Futures Trading Commission (CFTC) Commitments of Trader (COT) data showed aggressive selling in the British pound, further diverging away from the spot rate. The charts below shows how U.S. Dollar Index has finally converged with falling USD net longs.

Last week we wrote about why the Mexican peso was unusually placid in the face of the tariff threat while other asset classes showed more concern. The details of the deal raise further questions about what's coming next. Importantly, the New York Times reports that the deal announced Friday consisted largely of actions Mexico had already promised over the past several months.

President Trump disputed that in a series of tweets but the entire saga increasingly looks like a political sideshow that the market had largely discounted. If that's the case, then the reasons for the fake brinksmanship are critical. They could be: 1) political theatre aimed at appealing to President Trump's anti-immigration base and to further highlight his aggressiveness on the border, and 2) An effort to normalize tariffs as a tactic and (more importantly) a strategy that wins.

If the first scenario is valid, then the market should easily move on, but it's the second one that's a concern — President Trump said he will make a decision on hitting the final $300 billion in Chinese goods with tariffs after the G20 and that's just two weeks away.

It will be interesting to see how markets react throughout Monday. A sell-the-fact reaction would highlight the worries while a rebound in the U.S. dollar and continued strength in equities would put the focus back on the Fed.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday (Net short denoted by - long by +).

EUR -88K vs -100K prior GBP -48K vs -32K prior JPY -44K vs -55K prior CHF -36K vs -35K prior CAD -42K vs -39K prior AUD -63K vs -66K prior NZD -11K vs -11K prior (for more in-depth COT analysis see Andy Waldock’s weekly COT analysis).

U.S. dollar longs remain a crowded trade despite last week's selling. A US-China trade war and the Fed strongly hinting at a cut at next week's meeting would certainly cause some soul searching.

Adam Button is co-owner and managing director of ForexLive.com and a contributor at AshrafLaidi.com