How options are priced can affect potential returns on stock options, notes Rocky White.

Even though an option contract's value is based off the stock price, a successful stock picker is not certain to be a profitable options trader.

The main difference is that options have expiration dates. An options trader, therefore, not only has to be right on direction, but also must be right about timing. Strike prices and implied volatilities are two more things an options trader must consider that stock traders don't have to deal with. Ultimately, impressive stock returns do not necessarily correlate into great option trades.

This week, I'll give an example where stock and option returns diverged. I'll also give a list of some of the best stocks for trading options over the past year.

The Difference Between Stock & Options Trading

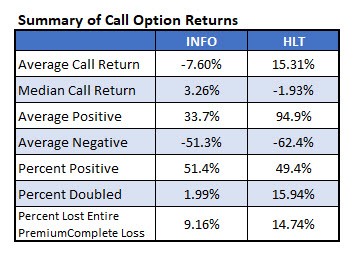

Below is a chart showing stock returns for IHS Markit Ltd (INFO) and Hilton Hotels Corporation (HLT) over the past year. Both stocks have done very well with INFO (+22%) outgaining HLT (+12.5%). But have these stocks been kind to options players? That's what options traders like us want to know.

Let's consider a short-term options trader who typically holds a position for one month. What would the performance look like? To evaluate this, I assumed every day there was an option available on the stock that was exactly 5% in-the-money and expired in 21 trading days (one trading month). To find the prices of these hypothetical options, you need an implied volatility. To get these, I looked at current implied volatilities for options on the stocks that expire in July. Furthermore, I assumed the trader held the call options the entire month and closed them out at intrinsic value when they expired.

So how would a trader have done with these two stocks had they purchased one of these hypothetical calls every single day over the past year, assuming their options were priced as they are now? The table below summarizes the results, and many will find them surprising. Notice that even though INFO easily outpaced HLT during the time frame, buying calls on INFO would have resulted in a loss of more than 7% per trade, while HLT call options trades would have gained about 15% per trade.

While the options for both stocks were positive right around half the time, HLT options doubled almost eight times more often. The average positive return for HLT options was, therefore, significantly higher than the average positive return for the INFO options. This is what drove the outperformance of those HLT options.

How did this happen given the superior stock returns for INFO? It's because HLT options are much cheaper than INFO options. Since options traders expect more volatility in INFO's stock price, its options have a much higher implied volatility, leading to more expensive options. Therefore, it takes a much smaller move in HLT's stock price to generate profitable options trades (it has a higher delta). To sum it up, while stock traders were better off with INFO, options traders were much better off using HLT options.

The Best Stocks for Option Trading

The analysis above might provide a fruitful list of stocks that have underpriced options. Essentially, it looks at how options are priced and shows what kind of returns you would expect if the stock moves similarly to the past year. It's up to the trader to decide how relevant each stock's return over the past year is to how you expect it to perform going forward. For example, the analysis is irrelevant for stocks with a known event coming up or ones that had news break over the past year that has changed its risk profile. For other stocks, however, it might be a decent assumption.

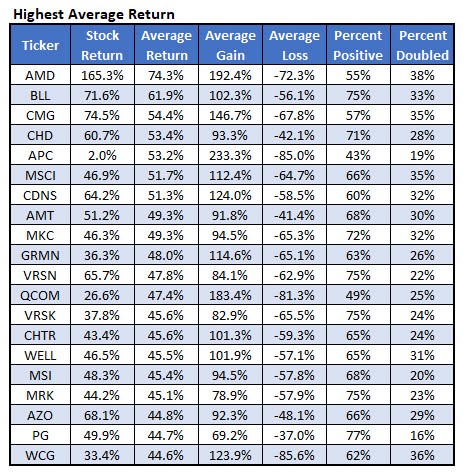

Here is the list of S&P 500 Index (SPX) stocks whose options had the highest average return. Note that the stock returns are as of last week when I ran the numbers, and it's the return over the past 13 months. That's because the study looks at one year's worth of one-month option returns, so that first option return includes the stock return of the prior month.

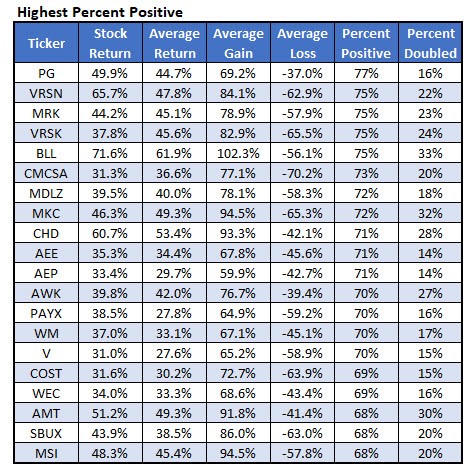

This next list of stocks shows the options that had the highest percent positive. Based on the last year of stock returns, options on these stocks would have the highest probability of yielding a positive return.

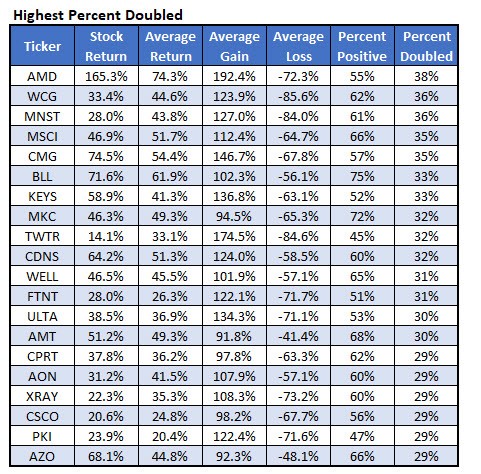

Finally, if you're looking for big hits, this could be a helpful list. Based on the analysis, these stocks were most likely to produce 100% option returns.