After recent extremes, expect crude oil to slide into a more stable trading range, says Al Brooks.

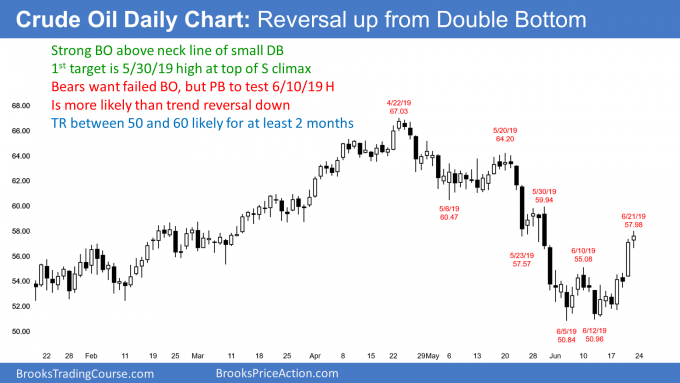

The crude oil futures market broke above the neckline of a small double bottom last week (see chart). It will probably test $60 and then enter a trading range between $50 and &60 for a couple months.

Crude oil futures rallied strongly last week. For the past three weeks, I have been saying that either the low of the next couple months was in or there would be one more brief push down and then a reversal up.

Furthermore, the first target is the top of the most recent sell climax. That is the May 30 high just below $60. Also, the daily chart might enter a two-month trading range.

Finally, I have been saying since November that crude oil had a Big Up, Big Down pattern and that creates big confusion. I therefore said it will probably be in a trading range for the rest of the year.

This week broke above the June 10 high around $55. That is the neckline of the June 6/June 12 double bottom. A measured move up would be around $60.

After a breakout, there is often a pullback. Consequently, the daily chart might sell down the June 10 high within a week or two. Even if it does, the odds still favor a test of $60 within a few weeks.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.