Another weekly close above a key technical level is giving hope to euro bulls, notes Al Brooks.

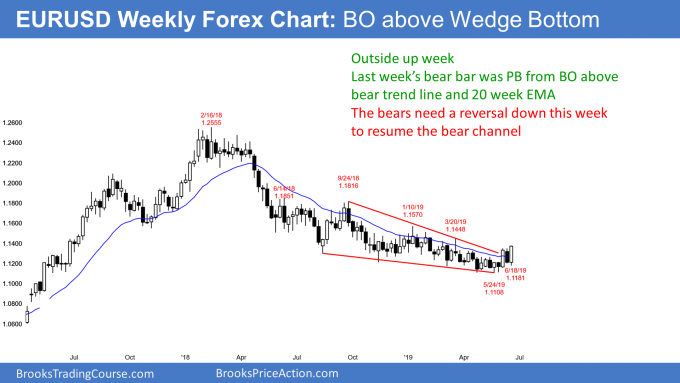

The EURUSD weekly chart broke above the yearlong bear trend line two weeks ago when it closed above the 20-week exponential moving average (EMA) for the first time in nine months. After a brief dip, it closed above the 20-week EMA again. Therefore, the price action is becoming more bullish (see chart).

Despite the bear reversal bar two weeks ago, last week traded below the low and above the high of that bar. This week is therefore an outside up bar and a buy signal bar for next week. The odds favor higher prices.

Price action is transitioning out of bear mode

The bulls have a 50% chance of ending the bear trend over the next few weeks. If they get consecutive bull trend bars closing near their highs and above the EMA, the odds will favor a test of the March 20 high and possibly the Jan. 10 major lower highs. At that point, traders will conclude that the bear trend is over.

The end of a bear trend can mean either the start of a bull trend or an evolution into a trading range. There is often a trading range lasting many bars before there is a clear bull trend. However, the bulls are becoming increasing willing to hold onto their longs.

For the past year, every leg up and down reversed within about three weeks. Traders did not believe that any leg would last very long. If they begin to see two to three consecutive bull bars, many will hold onto their longs, and others will buy as the rally continues.

This is unlike every rally over the past year. The bulls took profits and the bears sold every time there was a two- to three-week rally. Traders will watch carefully to see if the price action is becoming bullish.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.