Forex markets are waiting to see what come out of the Trump-Xi meeting at the G20.

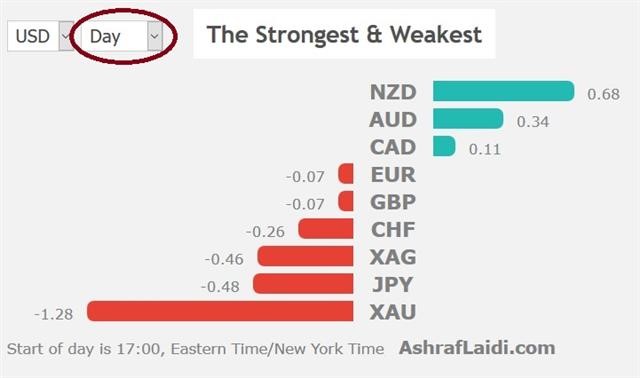

On a day filled with economic data and Fed speakers it was St Louis Fed President James Bullard who stole the market's attention with a hint that a rate-cutting cycle isn't coming. Instead of a series of rate cuts, Bullard implied there would be one or two. The New Zealand and Aussie dollars are the top performers, while silver and yen are the underperformers as equity indices push higher as seen in the chart below. Bitcoin pushed to $12,970. US durable goods orders are due up next. The big event remains the two-day meeting between President Trump and President Xi - starting tomorrow at the G20 summit.

The U.S. economy showed fresh worrisome signs on Monday as home sales and consumer confidence sank. Sales fell 7.8% to a five-month low in a sign that low rates aren't spurring activity.

Consumer confidence also dove to 121.5 from 131.0 as the expectations survey cratered. Those numbers added to the pessimism in the U.S. dollar early and lifted gold for the sixth day.

That move quickly unwound on a pair of comments from Fed super-dove James Bullard. First he said July wasn't the time for a 50 basis point rate cut. Prior to the comment the market was pricing in a 40% chance of a 50 basis point move. Thus, if a dove like Bullard doesn't think it's appropriate then there is little hope that the bulk of the FOMC does. More importantly, Bullard characterized a move in July as an insurance cut. That suggests only one or two cuts, not the 3-4 the market is pricing in over the year ahead.

Powell also spoke Tuesday in comments that left both sides of the Fed debate off balance. He continued to emphasize that U.S. fundamentals are good but highlighted that many on the FOMC see a stronger case to cut and that things have changed significantly since early May. He also warned that the undershoot in inflation looks to be more persistent.

All of it pointed to a high certainty of a July cut but little beyond that.

The U.S. dollar rallied 30-50 pips on Bullard and held the gains until fresh talk about the G20 sent the dollar lower. U.S. officials have tried to downplay the chance of any kind of a deal. At best, the market is hoping for a promise to negotiate for a set period without any fresh tariffs. The Trump-Xi meeting is set for Saturday.

Today, the focus returns to the U.S. economy with the durable goods report due. Manufacturing numbers have been very soft this month and that points to a weak reading. Tariffs could also be weighing on the industrial sector. The expected hit to the global economy could be as high as $1.2 trillion according to Bloomberg's economics team, a level matching that of the global financial crisis of 2008/9.

At the moment, there is a fairly straightforward trade on US economic data in that soft numbers hurt it and good numbers help it. Expect that to continue indefinitely.

Adam Button is co-owner and managing director of ForexLive.com and a contributor at AshrafLaidi.com. You can see Ashraf’s daily analysis at www.AshrafLaidi.com and sign up for the Premium Insights.