While the equity markets have rallied on the expectation of imminent cuts in the Fed Funds rate, there has been a buy the rumor sell the fact reaction to recent easing cycles, suggests Joon Choi.

The stock market is in the midst of a sharp rebound this month, following a lackluster performance in May. In fact, the S&P 500 Index (SPX) is on a pace to record its best June performance in 80 years, which led to President Trump rejoicing on Twitter. There are two major reasons for this recent rally. First, investors are pricing in the chance of progress in alleviating the trade war ahead of the G-20 meeting in Japan. Second and more importantly, investors are betting that the Federal Reserve will cut interest rates in July which is construed as beneficial for the stock market as it should provide more liquidity into the capital market. In fact, Fed fund futures indicate 100% chance of an interest rate cut in July (the Fed is under no obligations, this is just the expectation of where rates will be based on those trading Fed Fund futures). I want to bring to attention that reducing the Fed fund rate may not be positive for stocks; at least after a prolonged rate hike.

Recent history of initiating an interest rate cut

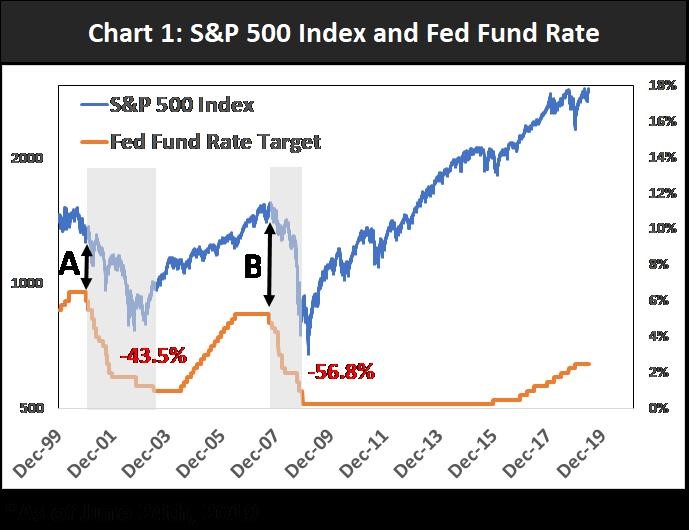

As stocks soared in the late 1990s, the Fed raised rates to 5% in June 1999 in order to curtail excessive risk taking in capital markets. Five additional hikes followed in the succeeding 11 months. However, the Fed reversed its course on Jan. 3, 2001 (see chart below) and reduced rates to 6% to spur the weakening economy, followed by 12 more cuts. The news of the Fed’s rate cut led to a 5% rise in the S&P 500 Index on the day of the announcement. However, the index was only able to muster an additional 1.9% rally before embarking on a 43.5% decline in the ensuing 20 months.

The Fed started to normalize short-term interest rates in 2004 with a 0.25% rate hike, followed by 16 more, one after every Fed meeting for the following two years. However, the Fed reversed its course with a rate cut Sept. 18, 2007 after dismal home sales data. The reduction in the rate was met with cheers on Wall Street as the SPX rallied 3% after the news but the index managed to rise only 3% further before embarking on a 56.8% decline in the ensuing 17 months.

Conclusion

As of this writing, the S&P 500 Index fell nearly 1% when Federal Reserve Chairman Jerome Powell said the central bank was still in a wait-and-see mode and monitoring further signs of economic weakness before a rate cut. This selloff exemplifies that investors are looking forward to a reduction in interest rates. However, if the past two monetary tightening cycles serve as a guide, market participants should be careful what they wish for because they just might get it, which may be a sign that a recession is around the corner. I sense that the Fed will be very careful with the rate cut to avoid sending the wrong signal to investors.

Joon Choi is Senior Portfolio Manager, Research Analyst, Signalert Asset Management LLC. He contributes to Dr. Marvin Appel’s Systems and Forecasts newsletter.