Crude oil has had two major moves in the spring and may be settling into a tradeable rage, writes Al Brooks.

The month-long rally in crude oil futures is testing resistance. It will probably stall over the coming week.

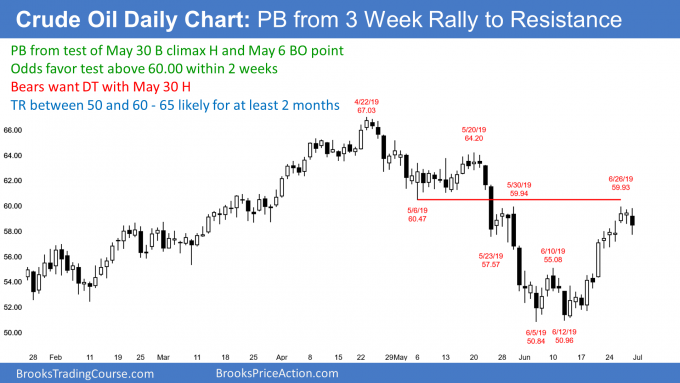

Crude has rallied for several weeks. It is now testing the May 30 high, which is the top of the final sell climax on the daily chart. That is the first target when there is a reversal up. It is also testing the May 6 low, which is the neckline of the April/May double top (see chart).

Because the rally is now testing resistance, the rally has slowed over the past six trading days. The bodies and ranges are becoming smaller and the tails are getting bigger. This is two-sided price action and it will probably lead to a tight trading range next week.

I have been writing for the past month that this rally will probably evolve into a trading range between $50 and $60 over the next month. It should remain in a trading range for the rest of the year.

The top of the range could be around the May 20 high of $64.20 because that is the top of the sell climax on the weekly chart. Even if it continues up to the May high at around $67, the several big legs up and down over the past year are a sign of a trading range price action.

There is nothing to indicate that this is about to change. Traders will continue to sell rallies to resistance, buy selloffs to support, and take profits every two to three weeks.

There has been no better market to trade a wide range as crude oil over the past five years.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.co-m trading room. We offer a two-day free trial.