With a near-term top in hand, the E-mini S&P should test recent support before continuing higher, notes Ricky Wen.

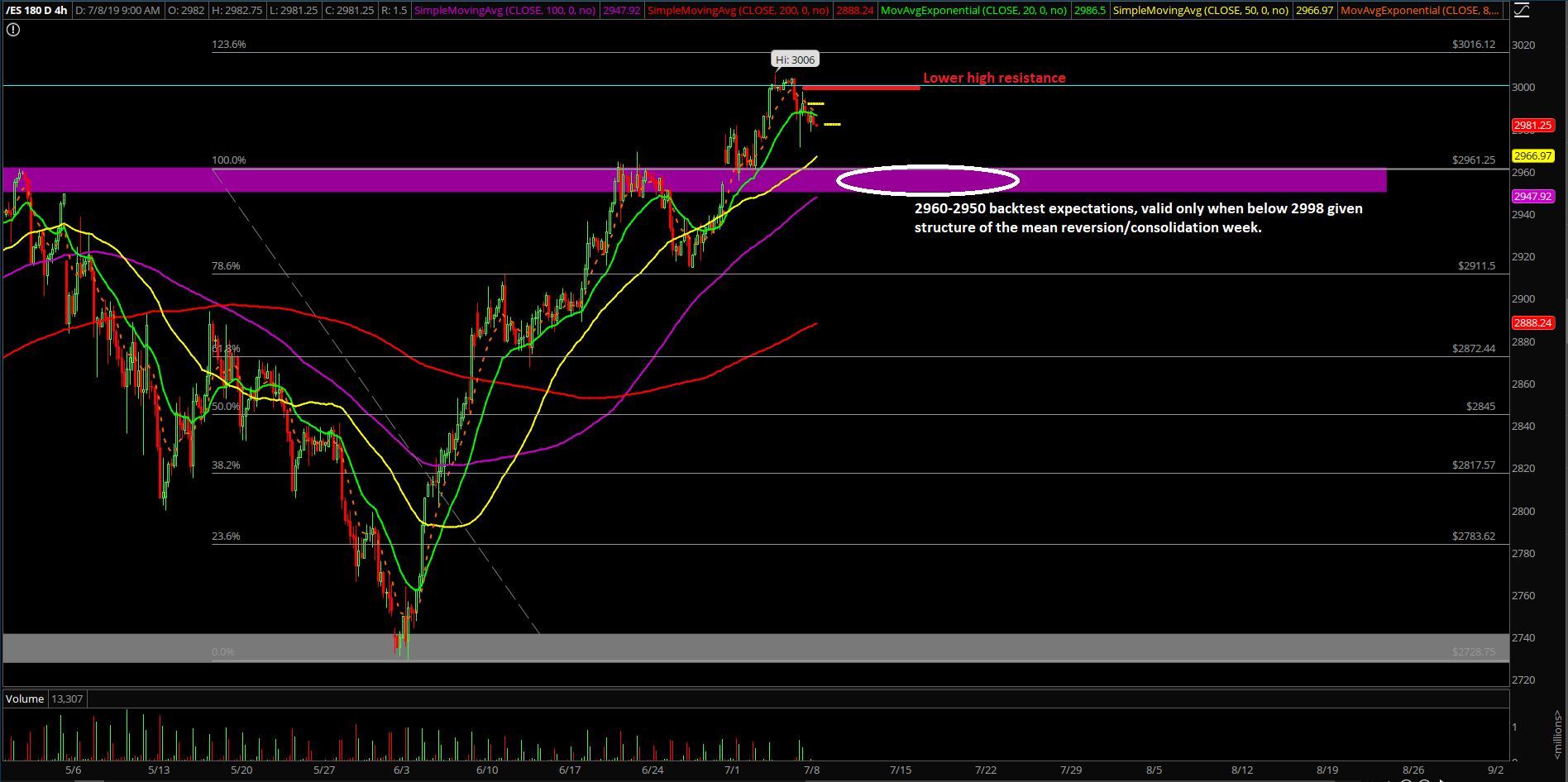

The first week of July went according to our plan and expectations as the E-mini S&P 500 fulfilled both the 2975 and 3000 targets. Then, later in the week, the market price hit a high of 3006 with a micro double top and made a temporary top, which is resistance going forward. Price action is likely doing some sort of mean reversion/consolidation setup going forward, until the train can ramp up again.

The main takeaway from the first week is that we have some sort of resistance/temporary top to trade against this week so traders can finally trade both directions instead of the on-trend longs for the past few weeks due to the odds. This is very significant as it’s been some time since the short side got any traction on some type of resistance and follow through. This is healthy because of the 10% rise within five weeks, so a pullback/consolidation for a week or two would be ideal if the levels hold.

For now, this week has a high probability to eventually grind towards the 2950-2960 support area as long as the E-mini S&P is below 2998 (see chart below). Assuming the support area holds, it is likely to be a buying opportunity as the 20-day exponential moving average keeps grinding up to catch up with price action. There is additional of support underneath this key support level.

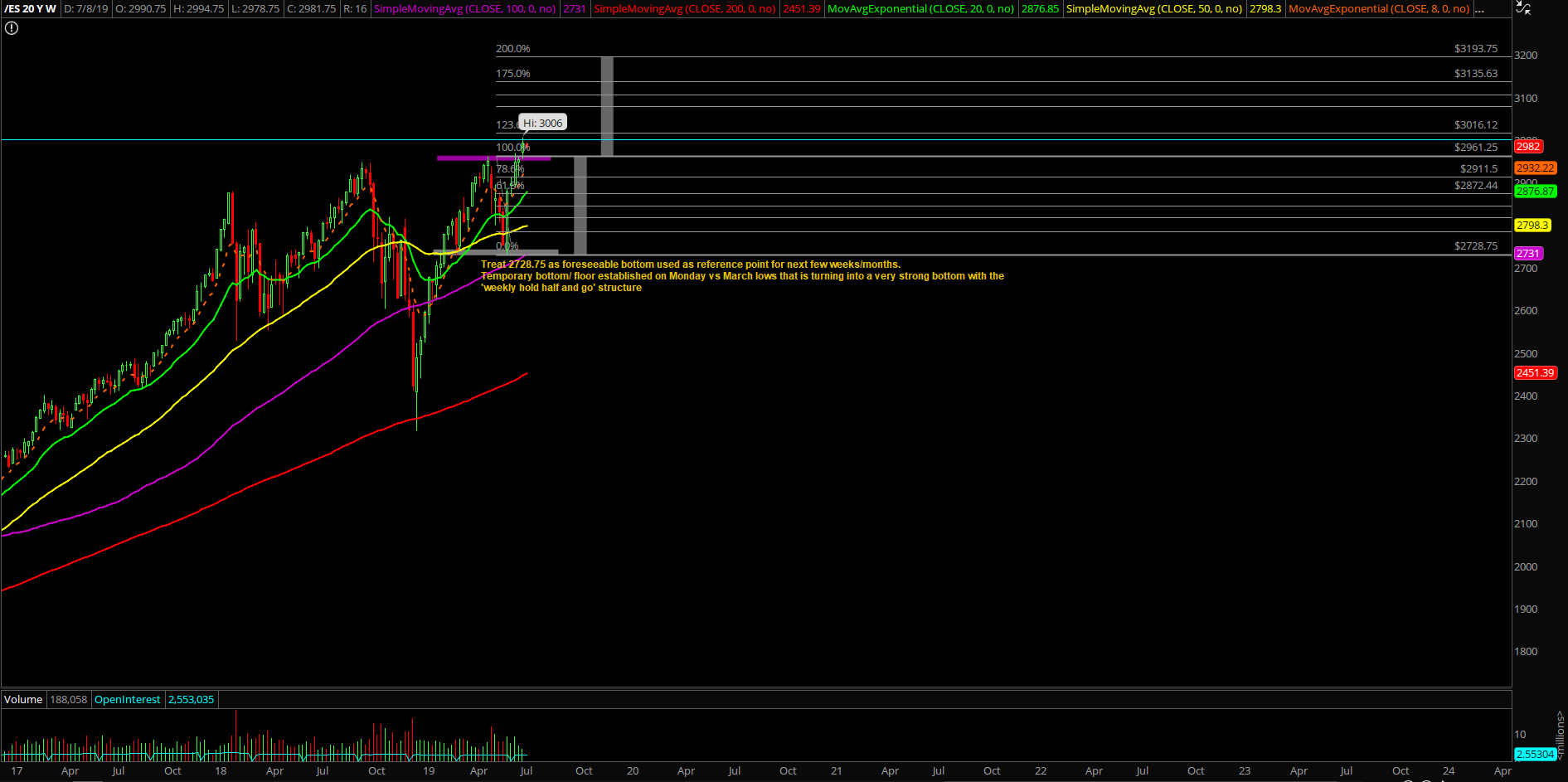

Keep in mind that the month of June retraced all the losses made in May, so we have about a month’s worth of trapped bears’ inventory and a bunch of price chasers into new highs. Given the ongoing structure of the bullish weekly and month charts, the month of July should be predictable because we’re still treating one side as the winner (see chart below). There are only two high probability outcomes and they will be either our standard ‘hold half and go’ upside continuation setup on the monthly charts or an immediate continuation to the upside without looking back in the rearview mirror.

The key point is that any dip is an opportunity to reload longs and adjust average cost and keep milking this bull train until the music stops. When one side is dead and remains in "hopium" mode, then we’re just going to keep taking advantage of the winning side.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.