The main takeaway from the fourth week of July is that the bulls are trying to close the month on market highs, writes Ricky Wen.

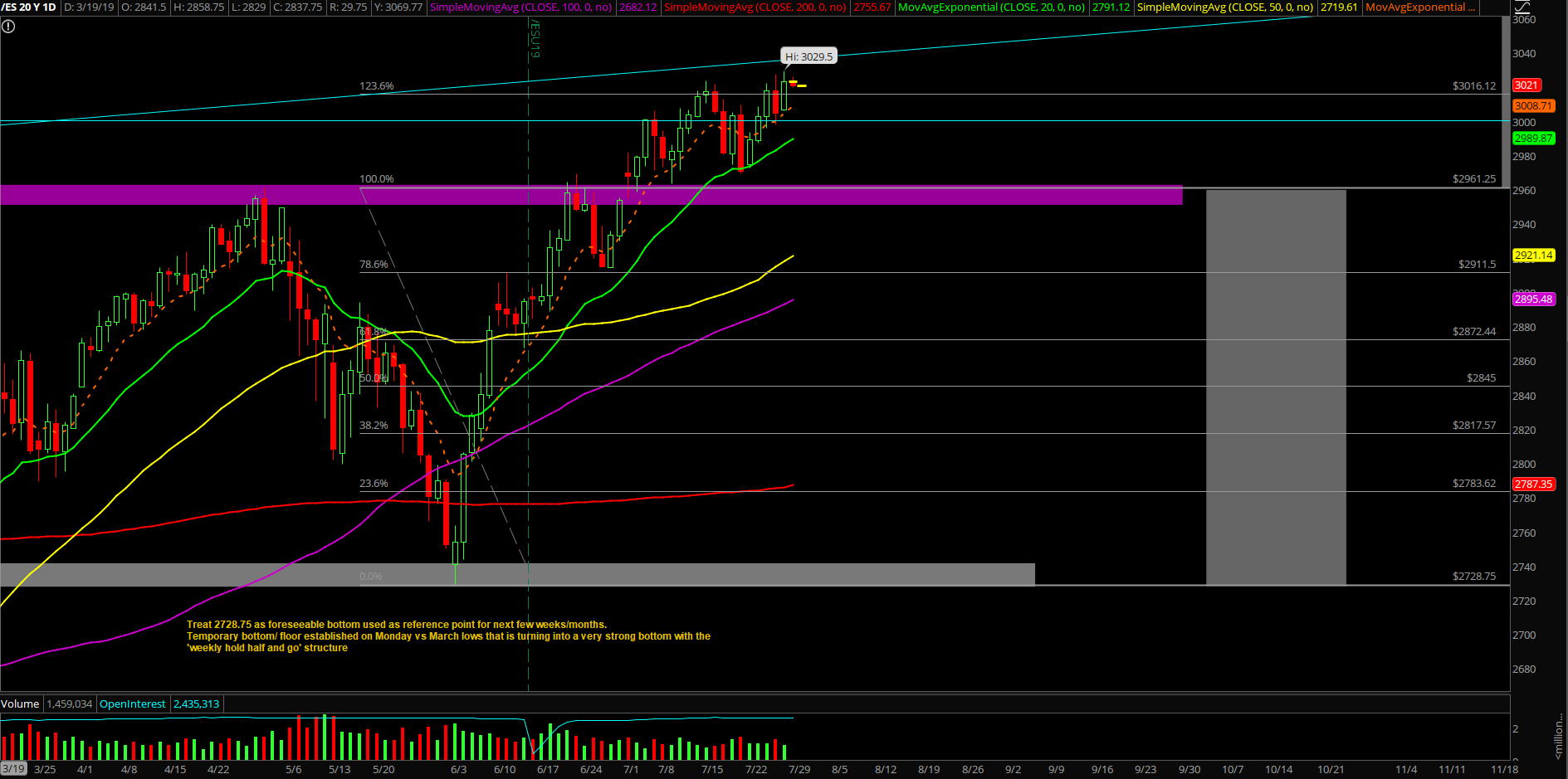

The fourth week of July showcased the markets usual stick save at the 20-day exponential moving average (EMA). This gave traders the textbook setup for the bull train to grind higher into all-time highs by week's end.

Last week started off with the bears failing after Monday’s session and the bulls remaining in control with the ongoing trend. Overall, it was a fairly easy week as we highlighted how the market has been handing out free money on Fridays for the majority of 2019. It’s been an impressive 75% + win rate for bulls year-to-date in terms of positive closes on Fridays.

What’s next?

The main takeaway from the fourth week of July is that the bulls are obviously attempting to wrap up the month on its highs as we head into the FOMC meeting on Wednesday, July 31. The market is offering little to no surprises these days, so we must stay focused and keep watching the ongoing fundamentals.

The E-mini S&P 500 (ES) closed at 3023 on Friday, a new all-time high close. Judging by the daily and weekly candles, it’s clear that the bulls are still in control and it’s either going to be a "hold half and go" setup or a straight up continuation trend week as long as supports hold.

Current parameters/bias:

- Feedback loop squeeze setup is in place as price held the backtest of 2996 on Thursday, July 25 with the 2998 stick-save low.

- We continue to buy every dip when price is above Friday’s low of 3006, at least until it stops printing us money. Adapt when below.

- On the monthly chart, it’s been an easy trend-up month and the bulls are trying to wrap this month at the dead highs again as we head into Wednesday FOMC and beyond

- Major support is at 2955. This is the first warning sign of a larger bearish move

- We must be prepared because we’re seeing a lot of complacency among traders and managers. We cannot get complacent just because the bull train has been easy to milk this year.

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.