Now that the market’s have corrected, what are the time windows telling us, asks Jeff Greenblatt.

Time windows have played out exactly how they were supposed to. Our time zone at the end of July was from July 22-25, the peak came in on the July 26, which was 987 days from the Dow Jones Index low in 2015. My view that a rate cut wouldn’t help the market also came true.

There are too many macro geopolitical events that are more important than rate cuts. Let’s put it this way, the situation in China including Hong Kong is more important than any rate cut. As we’ve seen, Asian markets were crushed on Sunday night on fears conditions might escalate. On Monday, at one point the Dow was down nearly a thousand points.

What is really going on?

Putting aside all the chaos in the world which I’ve been warning about for a long time. Now that markets have validated this time window, they no longer have the wind at their back, especially with the end of the bullish portion of the Presidential cycle. What that means is the complacency we’ve seen for months where the markets were able to ignore any number of geopolitical or domestic disturbances will longer be the case.

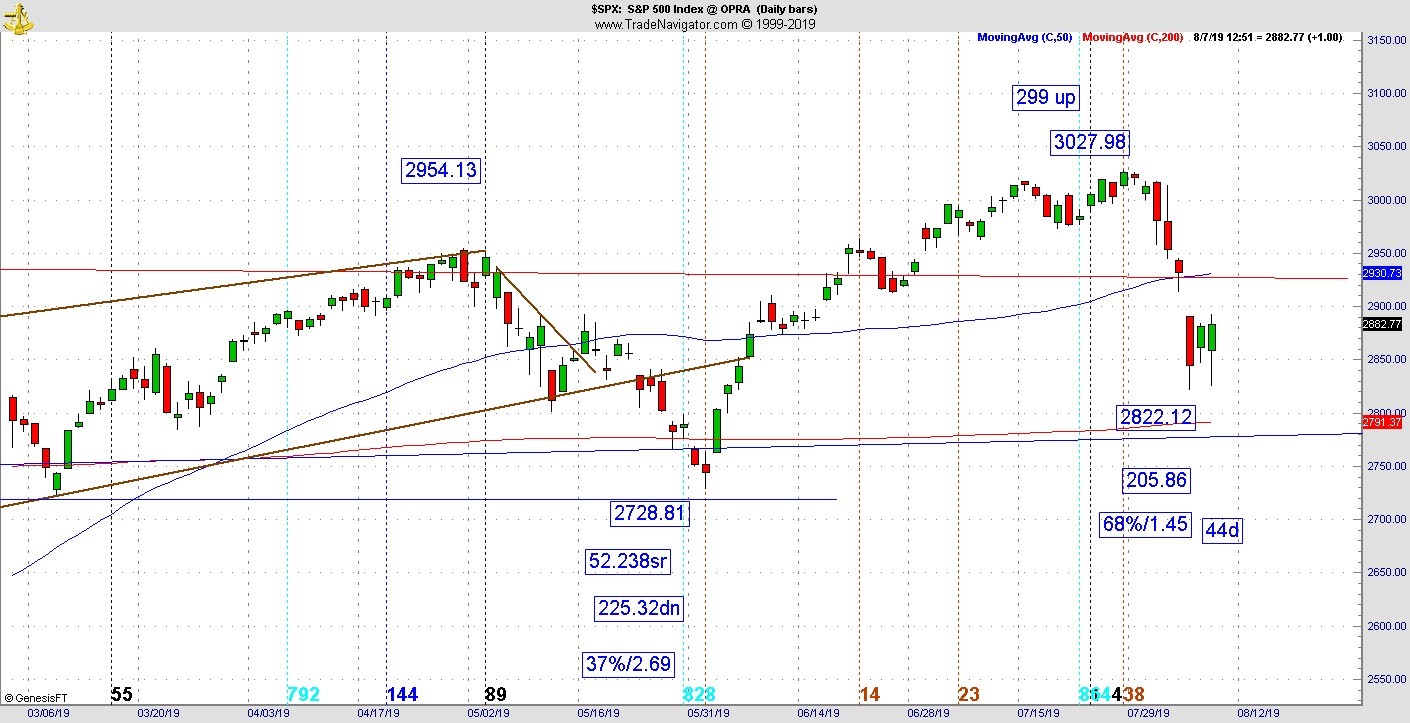

Now markets are trying to find a low. Just when it looked like conditions could spiral out of control, there appears to be just enough fear that came in to allow for a change of direction. My readings kicked in on Tuesday night, so none of Wednesday’s action was a surprise. On just one chart, the SPX, we have a vibration that allows for another thrust to the upside. The SPX was up 299 points from the early June low and now roughly 206 points down (see chart below). The ratio is 1.45 and is roughly 44 days. That’s good enough for an attempt. On Wednesday morning they retested the low and came within three points of taking it out. The Dow made a fresh low while tech held. No doubt the low is shaky. But we’ll go with the SPX for the moment. It held the reading.

Now we have a situation where Aug 16 is exactly 618 weeks from the October 11-12, 2007 top of the financial crash leg. Thursday Aug. 15 is also the 161-day window off the bottom from December while Monday is the 161-day window in the E-mini and the discrepancy is due to holiday trading sessions. If a futures market is open for a few hours on a holiday as we know they are, it counts as a trading day. Here we are, a couple of days away from the next window and it looks like we could be rallying into it as opposed to finding the low from the move over the past week or two.

Hypothetically, markets could still peak in this time window as early as Friday and even find another low in a week from now. Then it could rally for three weeks into Labor Day when it will be 618 weeks off the tech high from 2007, which came three weeks behind the Dow/SPX.

How is this going to play out?

That is unknown. News events are perilous these days and financial markets can be just as perilous. By the time Google (GOOG) earnings sent the stock through the roof, it finally felt like the charts were going up and never coming back down. That was the top right on the back end of the 987-day window. If this window plays out the same way, Wednesday’s reversal will persist through the end of next week and stay up until the very last minute when the last person gives up on the idea it could drop. How would that happen? We just saw the market get crushed. Because of the geopolitical news and the domestic events, America is scared. The market is a strange mechanism, it doesn’t care where the fear comes from. The front page of the New York Post on Sunday read, “America is scared.”

We have a right to be concerned. But since we know markets are a mechanism of mass crowd psychology, there is enough fear to turn the market around for now. It’s vitally important to understand how headline events can impact financial markets.

If we get to a situation where the market rallies after a serious shake like we just had, people may really conclude they’ve recovered and it will never drop again. It’s hard to say if and when that could happen. But it could happen. That’s usually when bounces or rallies come to their termination points.

Obviously, we are speculating but there is a strong possibility one of these scenarios will play out. It’s important to understand how the cycles work so you don’t get caught on the wrong side.

If you want more information, go to: https://www.lucaswaveinternational.com/ and sign up for the free newsletter.