Low volumes indicate that recent the recent stock rally may not have staying power, notes Kerry Given.

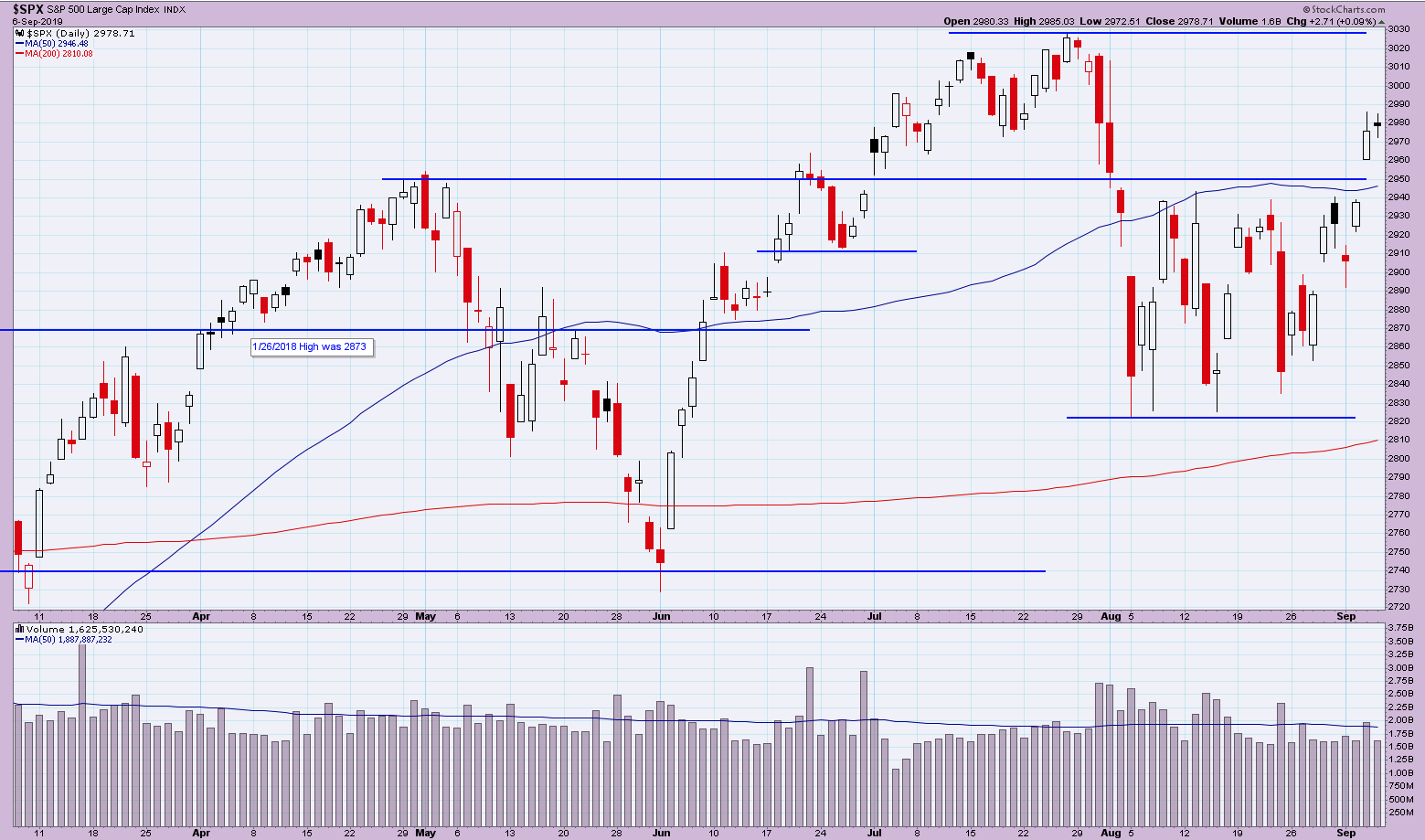

Last was a shortened week due to the Labor Day holiday, but the bulls came out in strength. The S&P 500 Index opened Tuesday at 2909, and closed Friday at 2979, an increase of 70 points or +2.4% in a single week. SPX had been caught in a trading range from 2822 to 2940 since Aug. 8, but the market gapped open Thursday morning and broke through the 50-day moving average at 2944.

Standard and Poor’s 500 Index (SPX)

Chart courtesy of StockCharts.com

Lest we get ahead of ourselves, trading volume remains weak. Volume remained below the 50-day moving average until Thursday, but only touched the average then and dropped back lower on Friday. As the bulls drive this market higher, they do so carefully. They are not all in.

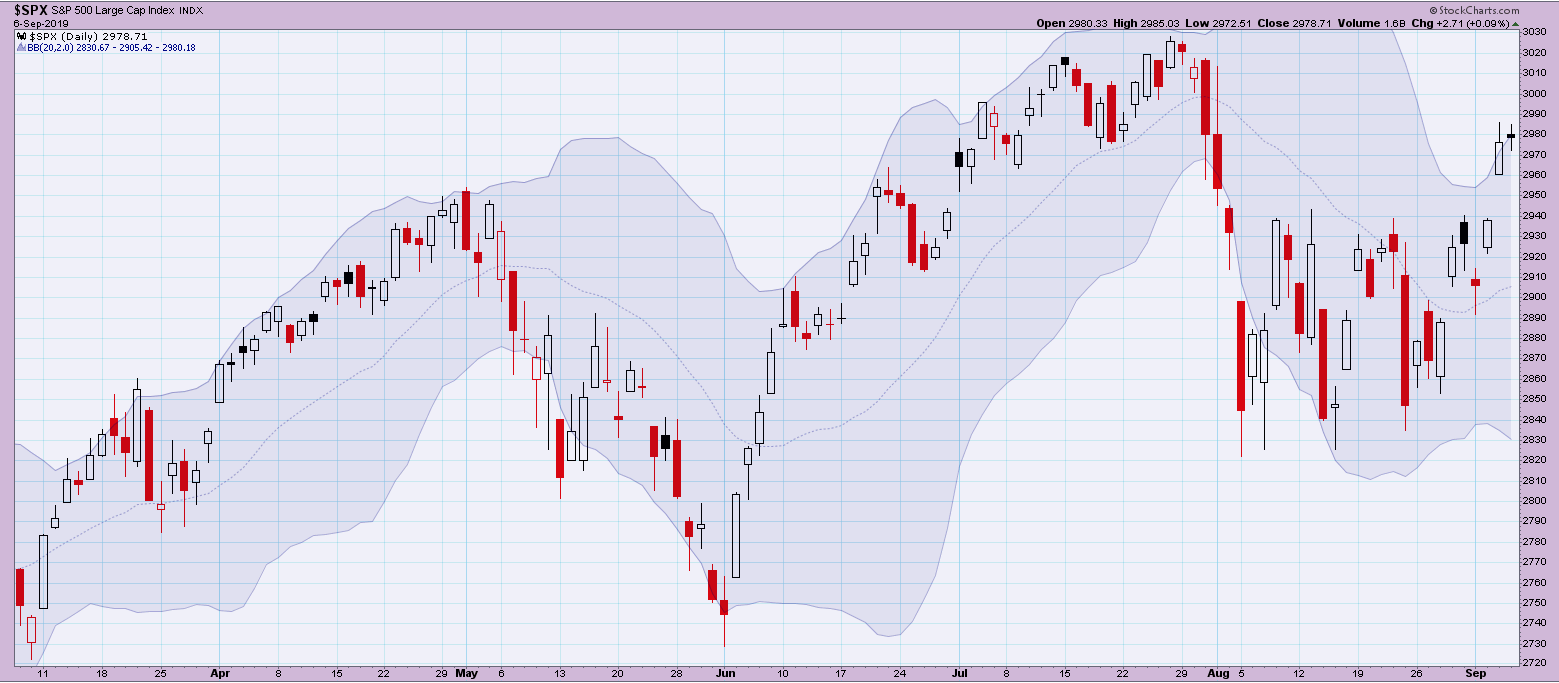

When we plot the Bollinger bands on the SPX chart with two standard deviations above and below the 20-day moving average, it makes the significance of this move more apparent. SPX started the week near the center of the bands, but Thursday’s price spurt closed outside the upper edge of the Bollinger bands, a relatively rare event. And SPX maintained just enough bullish price action Friday to close right on the upper edge of those bands. From a statistical, random walk point of view, it will be hard for next week’s market to match this week’s strong climb higher.

SPX with Bollinger Bands

Chart courtesy of StockCharts.com

The Cboe Volatility Index (VIX) opened the week at 21 and closed at 15. I regard a 15 VIX as a line in the sand. VIX levels below 15 are relatively benign, but I start to raise the caution flag above that level.

CBOE SPX Volatility Index (VIX)

Chart courtesy of StockCharts.com

It is old news to observe that the Russell 2000 Index (RUT) continues to trade far weaker than its big brother indices. Whereas SPX gained 2.4% last week, Russell’s close at 1505 was only an increase of 0.7% for the week. RUT is bouncing off resistance at its 200-day moving average. That is weak. Russell would have to gain 7.3% just to return to its May highs. And those May highs are far from the all-time high set in August of last year at 1741, almost 16% above today’s close. These small to mid-cap stocks are the risk on stocks – a sobering thought, given their weakness.

Russell 2000 Index (RUT)

Chart courtesy of StockCharts.com

The NASDAQ Composite index ran parallel to the S&P 500 last week, opening at 7906 and closing today at 8103, up 197 points or +2.4%. NASDAQ gapped open on Thursday and broke out above the 50-day moving average, but it gave back about 14 points of those gains on Friday.

NASDAQ Composite Index

Chart courtesy of StockCharts.com

NASDAQ’s trading volume ran below the 50-day moving average all week, and was especially low on Friday. The same thing occurred the previous week and I attributed it to the holiday weekend. This isn’t the beginning of another holiday weekend. The bulls may be buying, but they are playing safe.

The China trade negotiations continue to be the principal worry for traders. We are caught in a particularly dangerous market. It will spike higher or lower in seconds on the basis of a tweet or even a rumor. But this market recovers quickly from each rumor or tweet inspired panic, demonstrating a fundamentally bullish posture. Traders exit the market in volume on the least provocation. It remains twitchy, and therefore dangerous.

In my trading group, we play moderately conservative trades. The riskiest trades we enter are plays on a stock’s earnings announcement. These trades are riskier than our usual trades simply because they are binary trades – you are either right or wrong. There is no time to hedge or adjust the trade. It is over in 24 to 48 hours.

Earnings trades may be thought of as relatively safe in this volatile market. Getting in and out quickly has a certain appeal. The overall market’s twitches are less relevant to these trades. Hence, we only entered three trades last week: two earnings trades on Palo Alto Networks Inc. (PANW) and one earnings play on Lululemon Athletica Inc. (LULU). I closed one PANW position the next day for a 61% gain. The other PANW trade and the LULU trade expired worthless this weekend for gains of 18% and 14%, respectively.

This is analogous to the day trader. We commonly think of day trading as very risky, but at the end of the trading session, the day trader is safely out of the market. When we are in a volatile and unpredictable market, entering and exiting quickly has strong appeal.

Limit your trading to stocks that are demonstrating steady strength in the midst of this volatile market. I believe the following stocks meet those criteria: Chipotle Mexican Grill (CMG), Cintas Corp (CTAS), Hershey Co. (HSY), Intercontinental Exchange (ICE) and Starbucks (SBUX).

My advice remains the same. Position your stops conservatively and don’t hesitate to trip those stops. Don’t wait and hope in this market.

Learn more about The No Hype Zone Newsletter

Kerry W. Given, Ph.D.

Parkwood Capital, LLC