High yield bond funds may be the best play as stocks rebound against defensive plays, notes Marvin Appel.

As expected, the Federal Reserve cut the Fed Funds Rate by a quarter last week, bringing the target below 2% for the first time in a year. Despite the lower rate target the Fed temporarily lost control of short-term interest rates as an unexpected shortage of cash caused overnight borrowing rates to jump to 6% earlier this week before the Fed directly infused more than $100 billion in cash into the banking system to bring rates back down to its target range. This hasn’t happened since August 2007.

Back then the problem was that cash lenders became unwilling to accept mortgage-backed securities as short-term collateral, which turned out to be prescient at that time. Fortunately, that does not seem to be the issue now. It is reassuring that the Fed can still exert tight control over short-term rates with its interventions.

Overall, the markets are evidencing greater optimism about the economy. In the last issue of Systems and Forecasts I noted that continued firmness in corporate high yield bond funds was a bullish sign, notwithstanding the historically worrisome inversion in the yield curve. High yield bond funds are mostly at new highs, so this continues to bode well for the economy. Corporate floating rate bond funds have not done as well this year as high yields, in part because the drop in the Fed Funds rate means that their yields will decrease. However, this area of the bond market is also economically sensitive, and it too is holding its ground.

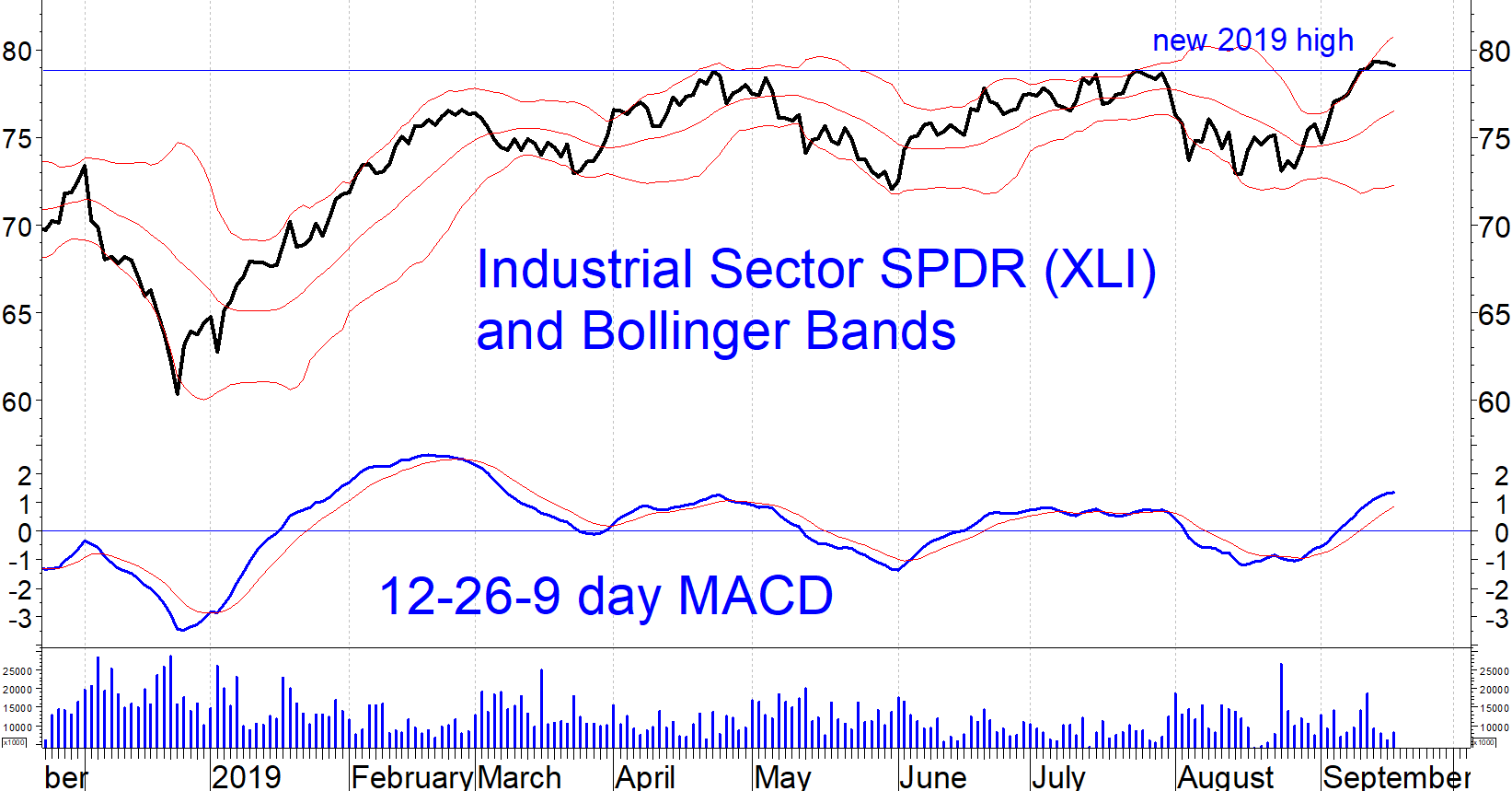

We have seen some stock market sector rotation this month that is also economically bullish. For example, the Industrial Sector SPDR (XLI) made a new high for the year this month, confirmed by its MACD (see chart below).

Moreover, all the defensive sectors that were outperforming the S&P 500 through the end of August (utilities, consumer staples, REITs, low-volatility stocks) are lagging this month.

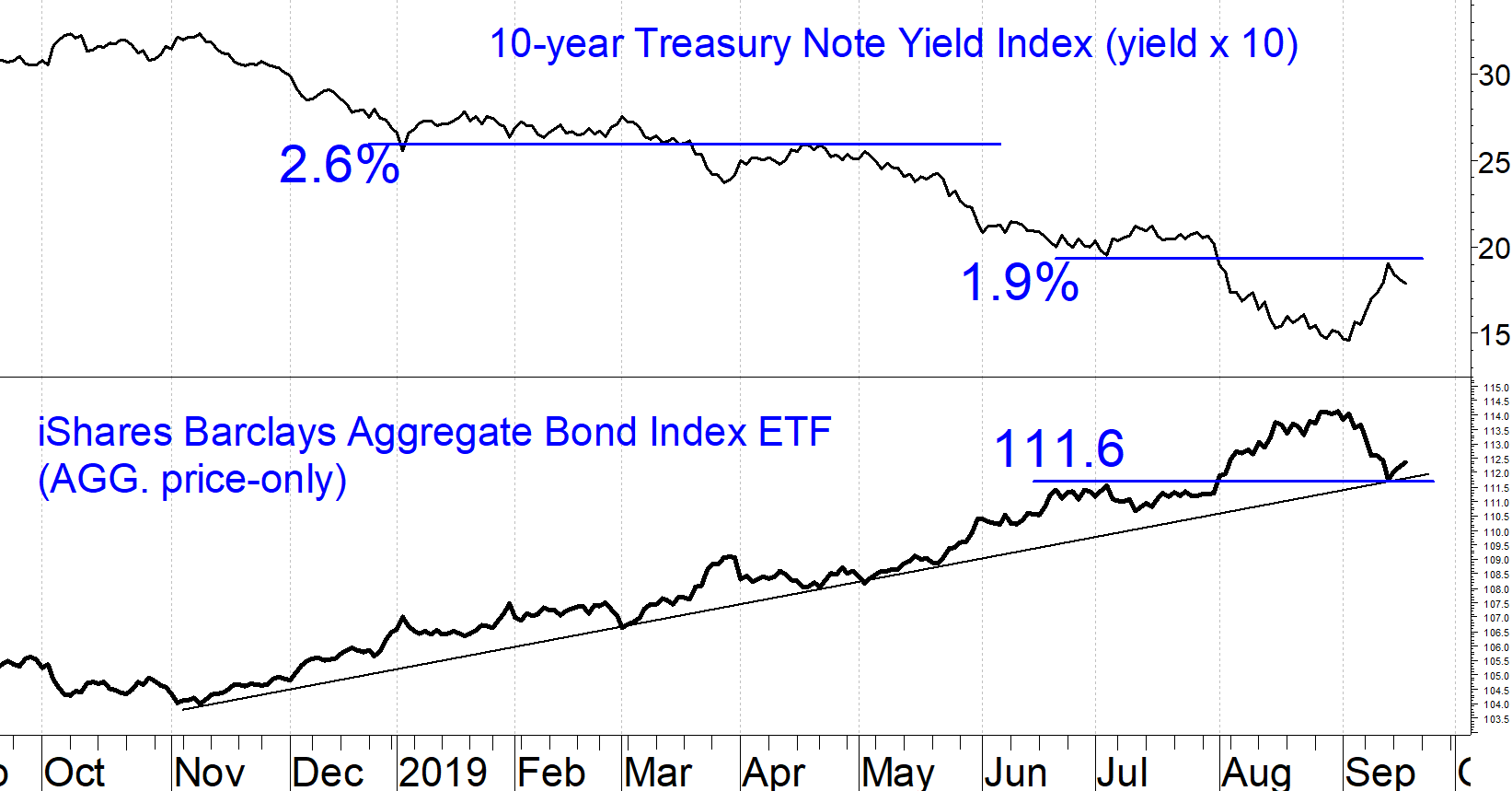

The improvement in industrials and relative weakness in defensive sectors has been confirmed by a recovery in long term interest rates (10-year Treasury note yield), now up from 1.46% on Sept. 4 to 1.78% late last week. The level of inflation that the Treasury market is predicting over the next 10 years has ticked up as well, from 1.51% on Sept. 4 to 1.59% now. One month does not make a trend, but it is nice to see that the markets are not responding just to bearish news.

Implications

One of our secondary U.S. equity timing models went on a buy signal on Sept. 16, and as a result we added some equity positions to our clients’ accounts and to the newsletter growth and income portfolio. The presence of this buy signal suggests that risk could be well contained in the weeks ahead. It is also reassuring that stocks barely blinked even as an attack disabled half of Saudi oil output (a reduction of about 5% of global production).

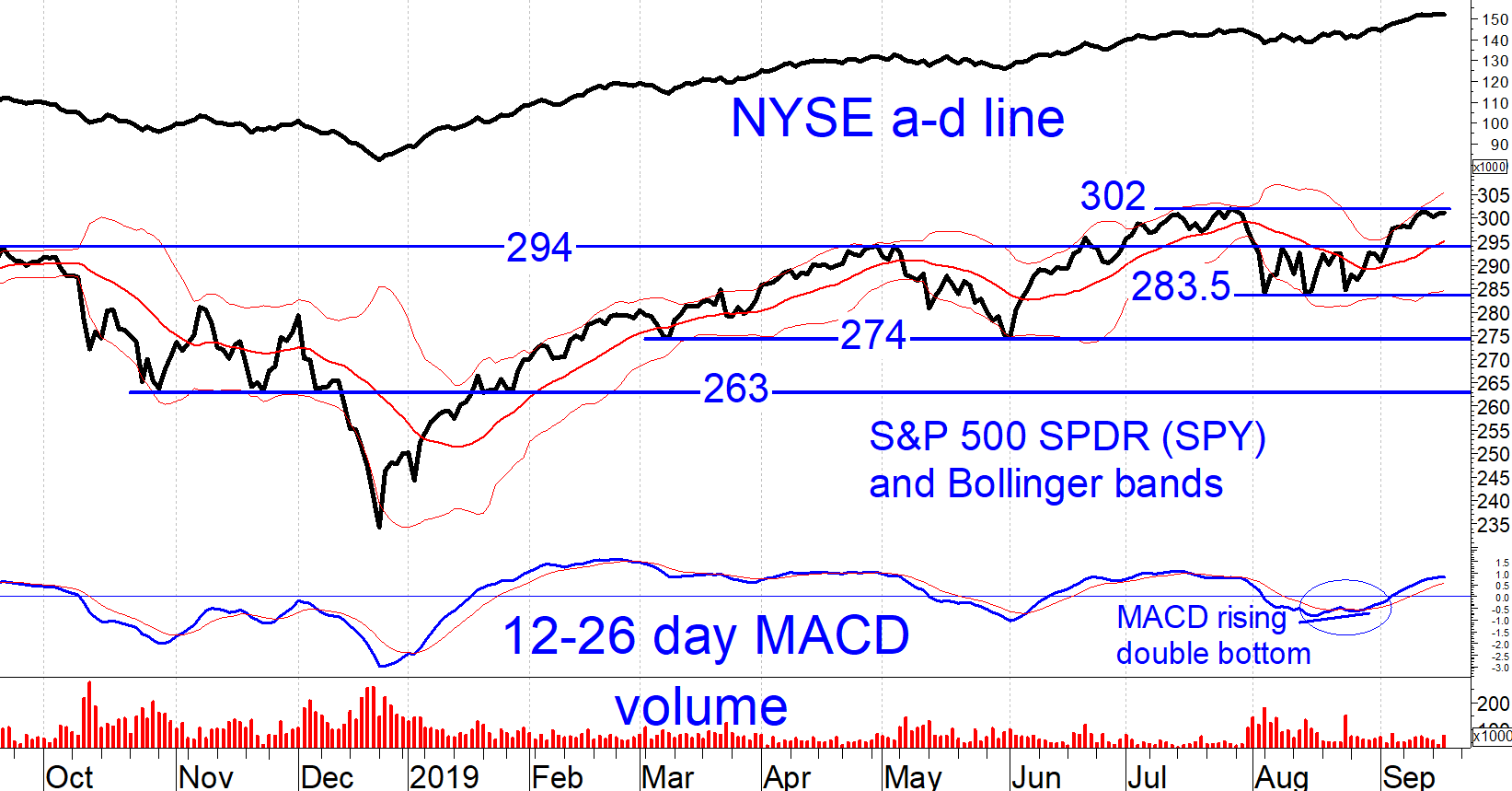

Nonetheless, I continue to project an overall sideways market in the near term as the S&P 500 SPDR (SPY) is experiencing resistance near its July high of 302, confirmed by investment-grade bonds as represented by the iShares Core U.S. Aggregate Bond ETF (AGG) bouncing off of a support area of 111.6 for AGG and 1.9% for the 10-year Treasury note yield (see charts below). Investment-grade bonds, particularly long-term Treasury debt, have generally moved in the opposite direction of stocks during short and intermediate term stock trends for most of the time since 2003.

The best area on a risk-adjusted basis is corporate high yield bond funds, which should perform well in an overall sideways market. Notwithstanding last week’s rally in small-caps, I do not recommend making concentrated style or sector bets because the market has shown itself capable of turning on a dime from one trend to another.

Stay with the S&P 500 SPDR for your equity exposure, and with corporate high yield bonds for your income exposure. We are also keeping some dry powder (cash position) in reserve for our clients while we wait for a more favorable stock market climate.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.