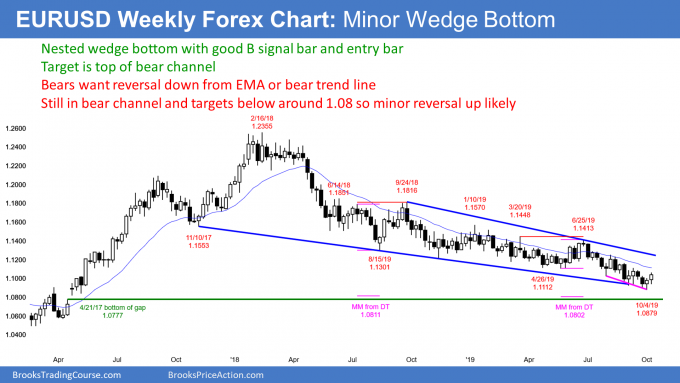

The euro has been in a downward channel for two years and is heading inexorably to 1.08, notes Al Brooks.

The EURUSD Forex pair weekly chart is reversing up from the bottom of nested wedge bear channel (see chart). This should continue for several more weeks, but the rally will probably lead to another lower high.

Two weeks ago, included a bull bar closing near its high, making it a buy signal bar. It was a reversal up from the bottom of the wedge bear channels.

Last week triggered the buy signal by trading above the previous week’s high. Last week was the entry bar and it had a bull body.

The bear rally should reach the 20-week exponential moving average and possibly the top of the bear channel over the next few weeks.

Reversal up in tight bear channel

Even if a strong reversal up develops over the next few weeks, it will probably be minor. There are several reasons for this. First, the two-year bear channel is tight. Traders expect that the first breakout above a tight bear channel will be minor. That means it would form a bear flag or lead to a small trading range, and not a bull trend.

Next, look to the left. All of the many prior reversals over the past two years formed lower highs and led to new lows.

Finally, there are two measured move targets near 1.08. Also, there is a gap there as well. That makes 1.08 a magnet below.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E[-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.