The conservative’s victory in UK is driving the British pound higher, reports Adam Button.

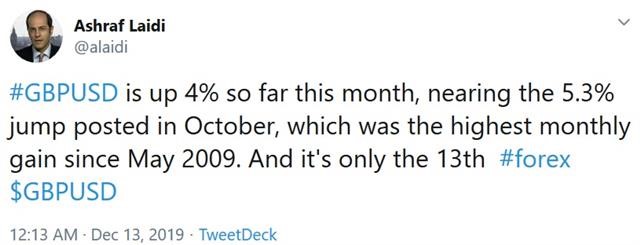

UK Conservatives won a resounding electoral majority to ensure a Brexit deal. The British pound (GBP) soared by more than 4¢ to 1.3514--the highest in 19 months straight after exit polls showed Conservatives had the biggest parliamentary majority since 1987.

U.S. November retail sales disappointed with a 0.1% rise (control group) vs. expectations of 0.3%. Days like Thursday remind us why we love the FX market. The news and market moves were non-stop in a sea of opportunity.

What's a Friday without a Trump Trade Tweet

Less than 20 hours after President Trump lifted markets with his trademark tweet on reaching a deal on tariffs with China, doubts are resurfacing— again. U.S. stock indices are off 0.8% after Trump disputed a Wall Street Journal article stating that he agreed to roll back existing tariffs. The details are still murky but we have yet to hear from China's state council information office at its press conference due shortly. It will undoubtedly ratchet down tensions and promises a period of stability. Like the UK vote, traders were also reluctant to price in a deal because of Trump's unpredictability.

The deal is good news for global growth in the first half of 2020 and underscores that the global easing cycle is over, at least for now. There are many breakouts but a standout is AUD/USD. We highlighted the break of the major downtrend yesterday. This was followed by breaks of the 200-day moving average and the October high on Thursday. A weekly close above those levels would be a further positive signal.

The UK election was the crescendo. The market has been leaning towards a solid Conservative majority since the vote was called but no one could forget the failure of pollsters in the Brexit and 2017 UK votes. So even though the result was expected, we had a massive market move. Part of that also speaks to the strength of the Conservative majority. It looks to be at the extreme limit of what polls were indicating.

UK Conservatives crushed expectations with 364 seat-victory, fueling the sterling's rally based on a strong, stable, business-friendly government in the UK. Something it hasn't had in a decade. With the rise above 1.35 the pound broke the March 2019 high. In the bigger picture it's only back to where it was on the night of the Brexit vote. In the days ahead real-money and structural shorts will be unwound and further upside could come from any less-austere hints from Johnson.

Adam Button is co-owner and managing director of ForexLive.com and a contributor at AshrafLaidi.com. You can see Ashraf’s daily analysis at www.AshrafLaidi.com and sign up for the Premium Insights. Ashraf's Tweet on indices here.