Emerging markets may be preparing for a breakout, but traders should be patient, recommends Marvin Appel.

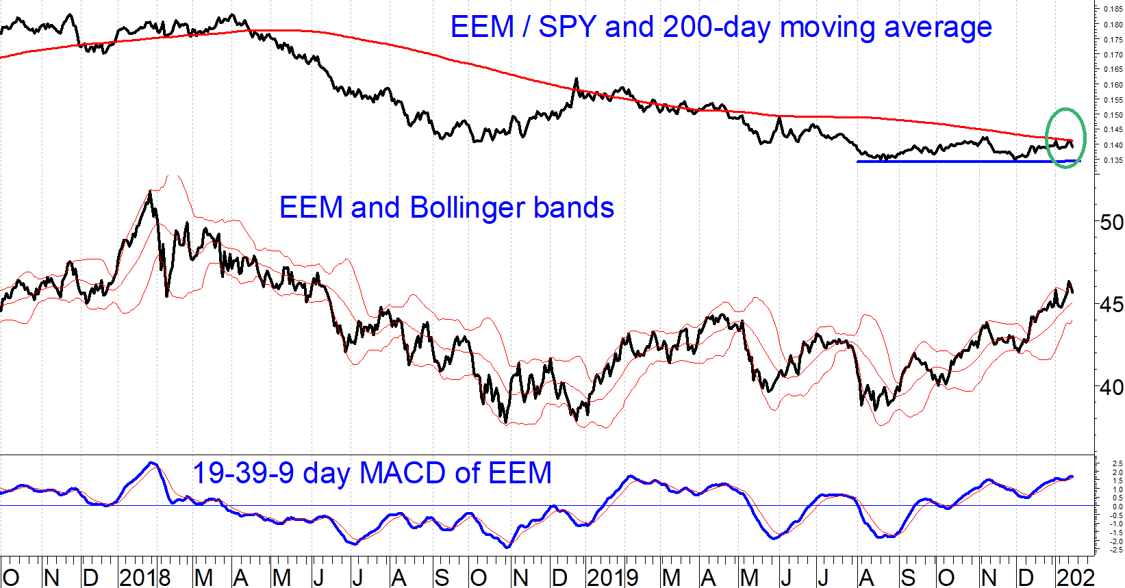

Emerging markets have been breaking investors’ hearts for almost 10 years of lagging the S&P 500 Index. Could things finally be different this time? The chart below shows that the ratio of iShares MSCI Emerging Markets ETF (EEM)/SPDR S&P 500 ETF Trust (SPY) is close to its 200-day moving average. Historically, when the EEM/SPY ratio has broken above its 10-month average, that has been a good signal to switch equity exposure from SPY to EEM.

The 10-month and 200-day moving averages cover similar timeframes but the monthly moving average has generated fewer whipsaws. All we would need for the monthly signal to switch to EEM from SPY would be for EEM to outperform SPY by about 2% in the space of a month. We came close earlier this year, but as of this writing SPY and EEM are neck and neck year-to-date, which is not enough to generate a switch.

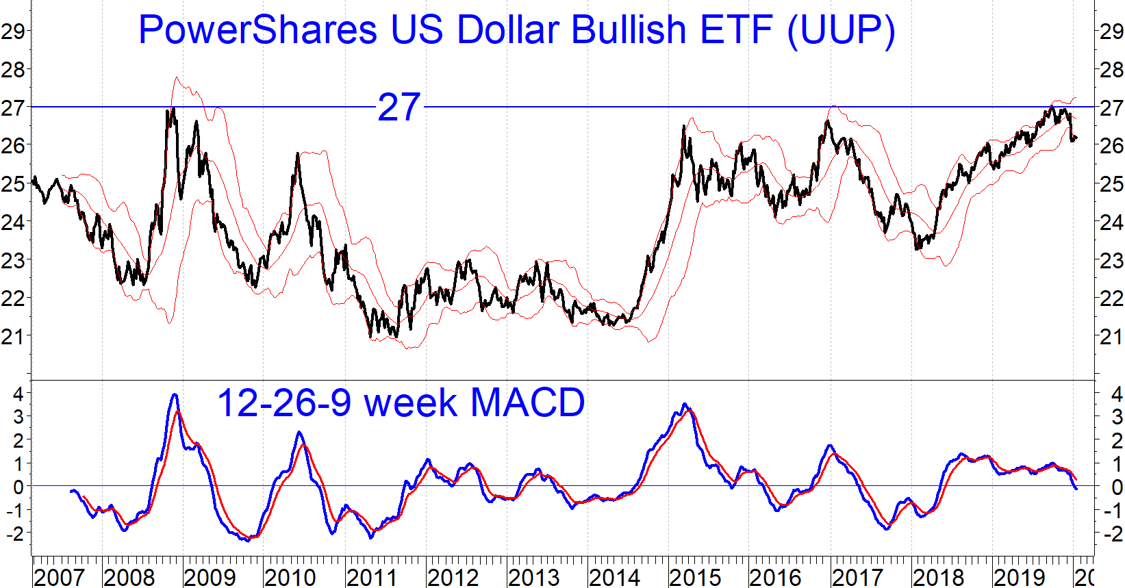

The history makes the monthly EEM/SPY ratio a signal worth following with at least some of your equity exposure. The fundamental backdrop also appears favorable for emerging markets. For one thing, trade tensions are lower as the result of the Phase One US-China trade truce. Second, emerging markets valuations are attractive relative to developed-country stocks. Third, the U.S. dollar has reached the upper end of its long-term trading range (see chart below).

Emerging markets stocks tend to move in the opposite direction from the dollar, so downside potential in the Invesco DB US Dollar Index Bullish Fund (UUP) implies a tailwind to EEM, all else being equal. Not only has UUP failed to break above the long term 27 resistance level, but its MACD is on a sell signal. The 12-26 week MACD has been a reasonably successful tool in identifying major trends in UUP.

Putting this all together leads me to recommend following the next shift in momentum (monthly EEM/SPY ratio) to favor EEM. I would of course not recommend moving all your U.S. large-cap equity exposure from SPY to EEM on the next signal. However, I would recommend switching 20% of your SPY exposure to EEM when the EEM/SPY indicator favors EEM. We will update our readers when such a signal materializes. Until then, stay with SPY.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.