While the bull market appears as strong as ever, overbought indicators suggest a retracement could be near, reports Marvin Appel.

The S&P 500 continues its steady ascent to new highs. The latest boost seems to be the Phase One trade deal between the United States and China. My reading is that the United States got a better result than expected. Apparently, China did agree to address the issue of forcing American companies to transfer technology in order to access the Chinese market and to implement some additional protections for intellectual property.

We will have to see if the facts on the ground actually improve, but I don’t fault the market for interpreting this as a bullish development. In fact, the New York Times ran an op-ed last week titled “China Wins in Trump’s Trade Deal.” The gist of the argument is that opening itself up to more foreign competition will energize Chinese businesses and that this will redound to China’s longer term benefit than to ours.

One criticism is that the Phase One agreement does not address Chinese government subsidies to state-owned or state-favored businesses. I don’t view these as damning indictments. If that is the worst indictment of the deal, then I would say it was a good outcome. Trade issues are unlikely to resurface before the election, so that is one less thing for the markets to worry about in 2020.

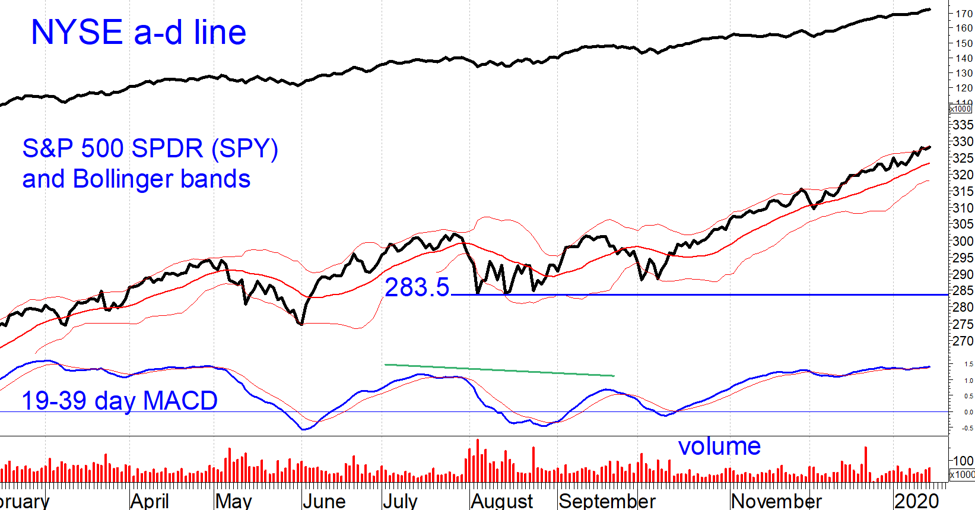

The S&P 500 SPDR (SPY) has been on a practically uninterrupted rally since early October. The new highs in stock prices are confirmed by market breadth as illustrated by the New York Stock Exchange advance-decline line and by the Moving Average Convergence Divergence (MACD) Indicator (see chart below).

The only warning sign is that when MACD has gotten as overbought as it is now, a several percent retracement has often followed as with May last year. The slow (19-39 day) MACD of SPY has been overbought for about six weeks, so I project that we are vulnerable to a retracement by the end of February.

In view of this outlook, I recommend caution in chasing rallies. If there is a pullback to the lower Bollinger band, now at 320, then I would recommend bottom fishing by opening covered call positions on SPY. Write at-the-money covered calls expiring in three months.

Based on current options prices such a position would have a maximum potential total return of 2.8% but if you open a covered call position after a retracement, option premiums would likely be higher, which would lead to a higher potential return.

Sign up here for a free three-month subscription to Dr. Marvin Appel’s Systems and Forecasts newsletter, published every other week with hotline access to the most current commentary. No further obligation.