Why cash-secured put selling is preferable to covered call in bear markets, according to Alan Ellman.

Covered call writing and selling cash-secured puts are both outstanding low-risk strategies that can outperform the overall market on a consistent basis. I favor covered call writing in normal to bull markets and include put-selling in bear markets.

In normal to bull markets, covered call writing gives us the flexibility to use out-of-the-money (OTM) calls, which provides the opportunity for two income streams with the same trade; one from call premium and the other from share appreciation from current market value up to the OTM strike.

In bear markets, selling OTM puts generates similar premium returns as calls and, in many scenarios, allows us to purchase the stock at a slightly lower cost-basis than had we sold a covered call should the put get exercised. It’s a close call but I give a slight edge to put-selling in bear markets.

Bear Market Strategy

Here is a real-life example with ZTO Express Inc. (ZTO). With ZTO trading at $23.29, we will look at selling the $22 in-the-money call and the $22 out-of-the-money put. We are assuming a bear or volatile market environment where we are willing to accept an initial modest time-value return in return for greater downside protection.

ZTO call-put option-chain for five-week returns

ZTO Call and Put Option-Chain

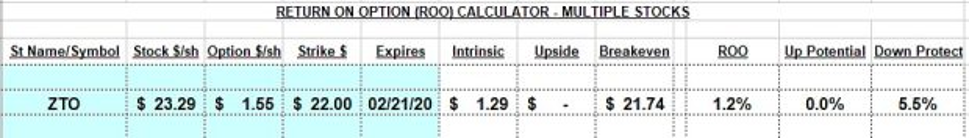

ZTO call calculations with the Ellman Calculator

ZTO Call Calculations Using the Multiple Tab of the Ellman Calculator

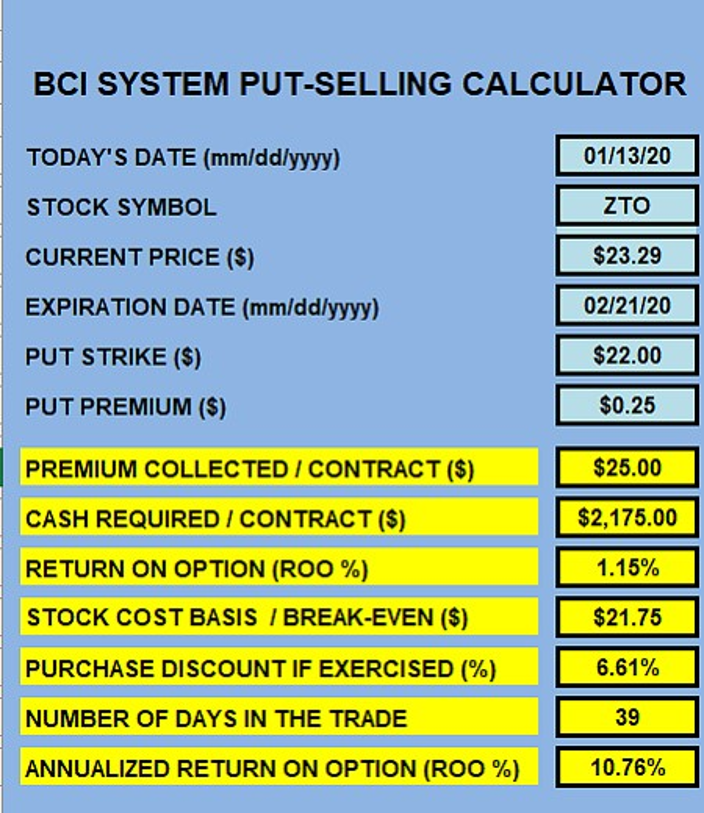

ZTO put calculations with the BCI Put Calculator

ZTO Put Calculations

Analyzing calculation results

The initial time-value returns are similar (1.2% for calls and 1.15% for puts). The intrinsic-value of the call option ($1.29) buys down our cost-basis from $23.29 to $22. If the put is exercised, the 6.61% discount results in a cost-basis of $21.75 ($22.00 – $0.25), slightly lower than that of the covered call (a 1.4% advantage).

Discussion

In normal to bull market environments, covered call writing offers the benefit of potentially two income streams per trade when using OTM call strikes. In bear markets, OTM puts will generate similar initial time-value returns but frequently allow us to own the underlying security at a slightly lower cost-basis if and when the put is exercised.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.