S&P 500 is rebounding and in a consolidation phase, notes Ricky Wen.

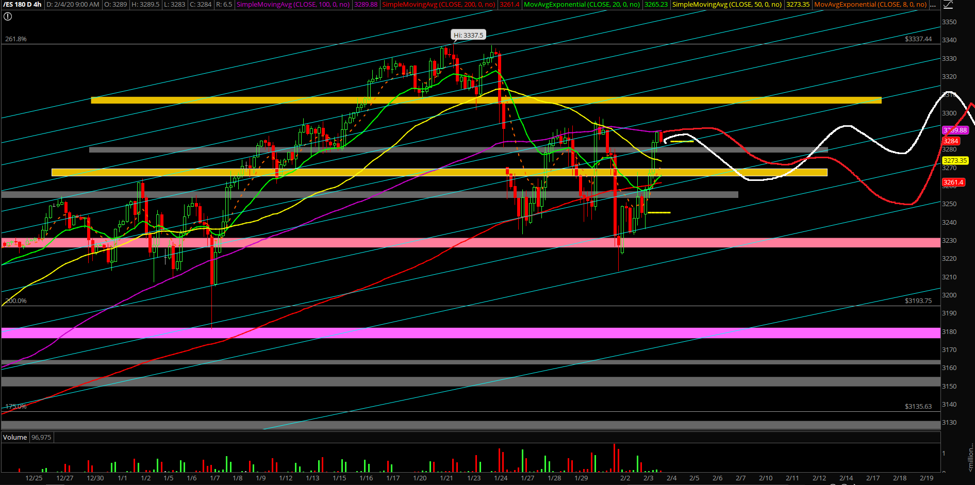

Equity price action on Monday found a temporary bottom and then proceeded to bounce back into the 50% to 61.8% Fibonacci retracement region before rolling back into the expected 3250-3240 support area in the E-mini S&P 500 (ES).

The main takeaway is that short-term momentum has changed somewhat since the October 2019 breakout. This means that February will likely be some sort of inside month until price action expands the range either above 3337.5 or below 3181. In other words, it’s a "shake-and-bake" horizontal structure (consolidation) in a pre-defined range, so traders can look to capture bi-directional setups. If thinking more intermediate-term, catching anything that is an extreme, like 3181 or 3200, could potentially turn into a double bottom/higher lows setup that one could ride. This is very preliminary still, but it’s something to consider for February and the rest of Q1 if the structure actually develops that way.

What’s next?

Monday closed at 3245 on the ES as an inside day, and the overnight structure has enhanced the odds that this week’s low is in already and that we take advantage of the momentum for the rest of the week. Bears lost the setup fight, so it’s time for the bulls to take them to the slaughterhouse and finish the job. Just be aware that it’s still technically an inside day (and inside week and month) given last Friday's massive range of 3212.75-3297.5 and January's range of 3212-3337.50, so make sure you know what timeframes or what the heck you are trying to trade for. Shake and bakes/consolidation ranges do not take prisoners, so utilizing key levels is pretty much a must when compared a full blown trending week where it’s the same structure every day.

Our game plan:

- There are key timeframes to understand fully for this week since it’s technically still an inside day, inside week, inside month since last Friday, meaning it’s a consolidation structure.

- Utilize 3236 overnight low and yesterday’s closing print of 3245 as must-hold daily trending supports for the next few sessions.

- Zooming into the one- and four-hour charts, utilize 3270/3265/3250 trending supports to find ‘cheap’ deals to BTFD (buy the dip) if intraday/short-term setups allow.

- Shorting against the range high 3297-3300 is also a legitimate strategy, but just know that the odds are now roughly 70/30 for an eventual breakout later this week above 3300, so bi-directional trade setups need to be met with strict risk/reward approach. Today is like yesterday given the bulls have found their footing on a rounding bottom and bears lost/losing their fight miserably barring any big surprises today, such as a massive daily wick reversal candle by end-of-day.

- We have imposed new 4hr white/red line price projections onto our projections chart. White is primary for now and red line is alternative (see chart below).

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.