Coffee, cocoa and sugar all are amid moves greater than 10% one month into the year, reports Phillip Streible.

The S&P 500 reached an all-time high yesterday, however, was unable to hold onto those gains for the second half of the session. The markets were looking for Fed Chairman Jerome Powell to provide reassurance that they would step in and support the market given the effects of the Coronavirus on the global economy. WTI crude oil also found some support but this seems to be short lived and could fall back down to contract lows if we see any signs of a build on the EIA energy stocks release at 10:30 a.m. EST.

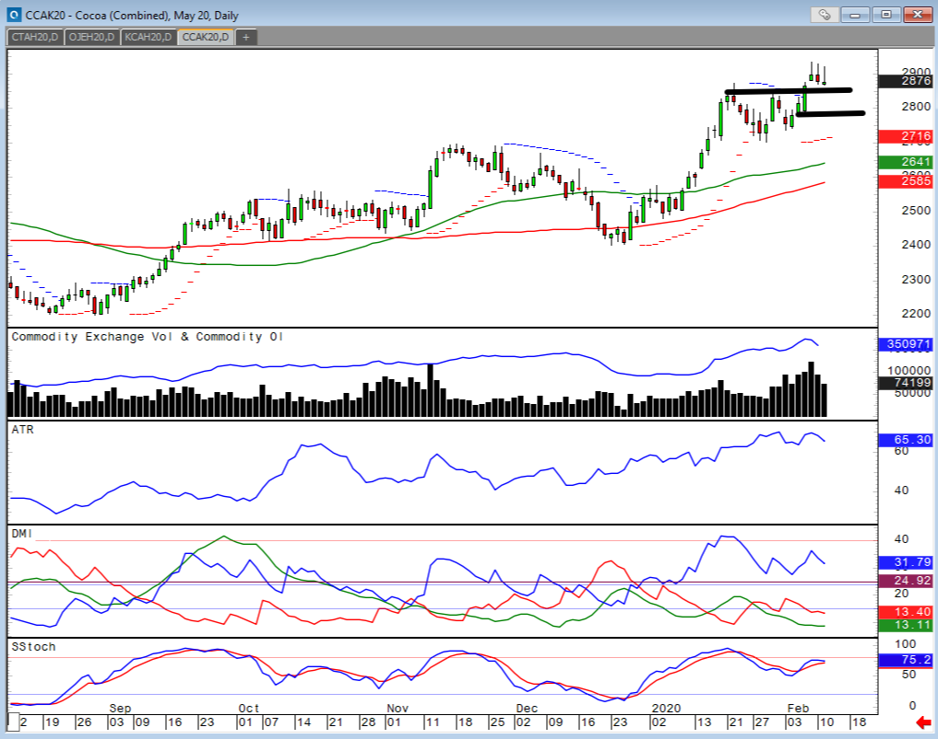

Cocoa: Up 13.7% year-to-date

Backing and filling in a small gap with the second day lower. I’ve seen this chart pattern many times and generally if we break the close in level of support on the charts, we trade down to the second before forming a consolidation. Nothing else stands out other than the usual hot dry weather impacting production levels.

From a trading perspective the breakout on the charts has position traders adding to their long positions since Jan. 10 at 2588. The first level of support is at 2868.

Give me a call if you are interested in softs trading or want trade ideas: 312-858-7303

Sugar: Up 14.3% year-to-date

A nice clean breakout on the charts, as a smaller production in Thailand has traders concerned about the global supply issues. We are already seeing a smaller crop out of India, which should give us a big global deficit. Shorts have to feel like they are getting squeezed so the next couple sessions are going to be interesting as we head into expiration.

Sugar trend traders are holding longs from Jan. 6 at 13.73 and first level of support is 14.84. Trend traders will most likely add to their longs on any pull back or gap open on the night session.

Coffee; Down 20.5% year-to-date

The coffee market had passed a small test by holding onto most of Monday’s gains. The Brazilian real continues to slide lower giving some level of concern; however, the small speculators are starting to come into this market back to the long side.

This market has been the worst performing commodity since the start of the year and finally maybe turning a corner with the short selling drying up. Looking at last week's Commitment of Traders (COT) report, we finally saw a reduction in the net short position indicating that a turnaround might be approaching.

From a trading standpoint, there's two ways to approach counter trend trading and I’ll put them in order of risk. The most risk averse strategy would be to buy a call spread, such as the May 102.50-107.50. The second would be to use a buy stop to initiate a trade over the first resistance and once filled use a sell stop below critical support near the contract low. This would be something like a buy stop at 104.60 and once filled a sell stop at 99.50 to protect yourself.

Orange Juice: Down 0.35% year-to-date

The shorts were knocked out of this market with today’s extension upward. Fundamentally this market is lacking the headlines and still is in the long term downtrend but one could consider the two day strength as a sign that a change is coming.

Bill Baruch provides technical levels on all markets throughout the week at BlueLineFutures.com. Please sign up for at Blue Line Futures to have our entire technical outlook, actionable bias and proprietary levels emailed to you each morning. Get our Trade Alerts, up 4.6% in January and up 15% since inception last year!