Numerous central banks, including the Fed, are ramping up their reaction to the fallout of Coronavirus, reports Adam Button.

The 1000-point rally in Dow Jones Index futures earlier in Asia was cut in half as markets await central banks to deliver on their statements to act appropriately in light of the global market and macro damage of the Coronavirus.

Fed Chair Powell's statement on Friday (see below) was followed by similar remarks from the Band of England and the Band of Japan, but not the ECB (that's partly why euro is the best performer since Sunday night). CFTC positioning data showed just how vulnerable euro positioning is to an unwind. Surprised by Goldman's Fed call below?

Fed Statement: The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.

A death and evident outbreak in the United States pushed Coronavirus onto front pages in America on the weekend as fears ramp up. The west coast of the United States appears to be dealing with several outbreaks but it's the same story globally with cases continue to rise at a rapid pace in Italy and South Korea.

Goldman Sachs now expects the Fed to cut rates by a total of 100 bps by end of June (not by end of year).

The dramatic measures taken by Chinese authorities appear to have some positive effect on the spread with the number of new cases falling quickly. The types of mass, mandatory quarantines they have put in place will be tough to mimic elsewhere but the economic effects of the drastic moves came into focus on the weekend with the official manufacturing PMI falling to 35.7 from 50.0. That's an all-time low that's far below the financial crisis bottom and much worse than 45.0 expected.

The non-manufacturing survey was even worse at 29.6 compared to 51.0 expected and 54.1 previously. The question is no longer whether Q1 GDP in China will be positive or negative, it's how deep of a contraction will it be.

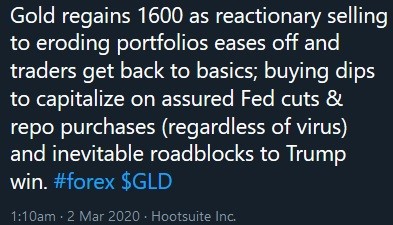

That first piece of soft economic data may be enough to give cover to central banks to move fast. The Bank of Canada is scheduled for Wednesday and there is chatter of a global coordinated move then, or sooner. The market is already pricing in a March 18 Fed cut as a sure thing with a 70% chance of a 50 basis point move.

Expect some kind of relief rally on central bank expectations or moves but how long it lasts depends on the next round of virus headlines. The central bank toolkit is much more powerful in a financial crisis than a biological one.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -114K vs -92K prior GBP +30K vs +29K prior JPY -56K vs -27K prior CHF +1K vs +2 prior CAD +15K vs +8K prior AUD -44K vs -38K prior NZD -15K vs -12K prior

The theme in markets late last week was to head to the sidelines and that is likely to continue. That helps to explain the strength in the euro and yen.

Adam Button is co-owner and managing director of ForexLive.com and a contributor at AshrafLaidi.com. You can see Ashraf’s daily analysis at www.AshrafLaidi.com and sign up for the Premium Insights. Ashraf's Tweet on indices here.