This week’s economic calendar and technical outlook from Joe Perry.

OPEC++ agreed to a cut in oil production of 10 million barrels per day (bpd) in principal, however, Mexico isn’t resolved and may throw the deal into chaos.

European finance ministers agreed on a rescue package worth roughly €540 billion ($590 million). Will this be enough to support the fragile EU? Stock markets are acting like the worst of the Coronavirus is behind us, but why then is the Federal Reserve throwing $2.3 trillion at small businesses and increased stimulus? This week will be all about watching if promises are held among OPEC++ countries. In addition, traders will be watching for signs to determine if the worst of the Coronavirus is behind us.

OPEC and Russia seem to have settled their differences between each other and brought the rest of oil producing countries together to discuss oil production cutbacks. The result was an agreement by the world to cutback oil production by 10 million barrels per day. However, as of Friday afternoon, Mexico wasn’t fully on board with the plan, although the United States is offering assistance to help Mexico meet their cutback quota.

The pace of increase in the number of Coronavirus cases worldwide seems to be decreasing. Many are looking at this as an opportunity to buy stocks as “things can only get better”. The S&P 500 was up nearly 12% last week, retracing more than 50% of its move from Feb. 20 to the low on March 23. The Dow Jones was up 12.7% and Nasdaq up 9.37%. The UK FTSE was up 8.66%, while the Germany DAX was up 11.95%. The U.S. Dollar Index was down 1.19%, with the AUD/USD leading the way, up 5.94%. Gold and silver also had nice weeks, with gold up 4.86% while silver was 6.64%. Which brings us to crude oil. Two weeks ago, WTI Crude Oil was up 32% with expectations of a positive outcome from the OPEC++ meeting. However, as meetings concluded this week, price was down 19.15%, a classic case of “buy the rumor sell the fact”.

Stock markets are either in a new bull market or bear market rally. Regardless, as previously mentioned, equity indexes are up 50% from their lows in late March. Does this mean that the worst of the Coronavirus is behind us? Although some countries feel they may have peaked or are at their peak, many countries are still seeing signs of increasing cases and increasing deaths. So why has the stock market retraced so much of its losses? Most likely it is because of efforts of central banks around the world creating stimulus to avoid a worldwide depression.

“Don’t fight the Fed” is an expression that has been said so often since 2008. In that context, traders try and get ahead of the U.S. Federal Reserve before they backstop the economy and markets. Just yesterday, the Fed threw another $2.3 trillion at the markets while the Bank of England said it would allow Britain’s government to run an unlimited overdraft to pay wages to millions of people laid off, cut taxes for businesses, and expand the welfare system. U.S. Fed Chairman Jerome Powell even said yesterday that U.S. banks don’t need to suspend dividend payouts. Questions will continue this week as traders digest daily data from the number of Coronavirus cases each day from around the world and whether central banks have done enough.

In the U.S. primary elections, Democratic candidate Bernie Sanders suspended his campaign. This leaves only Joe Biden to face Donald Trump in November.

Earnings season for Q1 kicks off next week with many of the Wall Street banks reporting. These include JPMorgan (JPM) and Wells Fargo (WFC) on April 14 and Citibank (C), Bank of America (BAC) and Goldman Sachs (GS) on April 15. Estimates are poor for most companies and some are even withdrawing future outlooks for the rest of the year given the uncertainty surrounding the Coronavirus.

There is some economic data this week, though the most watched will be from China. For most other countries, the data is second tier for the most part. The Bank of Canada meets this week; however, it is likely to be a non-event given how much stimulus the BOC has provided thus far. Below is a list of the more important data releases:

Tuesday

- Australia: NAB Business Confidence (MAR)

- China: Trade Balance (MAR)

- China: Vehicle Sales (MAR)

- China: FTI -YTD (MAR)

Wednesday

- Australia: Westpac Consumer Confidence (APR)

- China: New Yuan Loans (MAR)

- US: Retail Sales (MAR)

- US: Beige Book

- Canada: BoC Interest Rate Decision

Thursday

- Australia: Employment Change (MAR)

- Germany: Trade Balance (MAR)

- US: Initial Claims (week ending April 11th)

- US: Housing Stats (MAR)

- US: Building Permits (MAR)

- US: Philadelphia Fed Manufacturing Index (APR)

Friday

- China: GDP(Q1)

- China: Industrial Production (MAR)

- China: Retail Sales (MAR)

- China: Fixed Asset Investment – YTD (MAR)

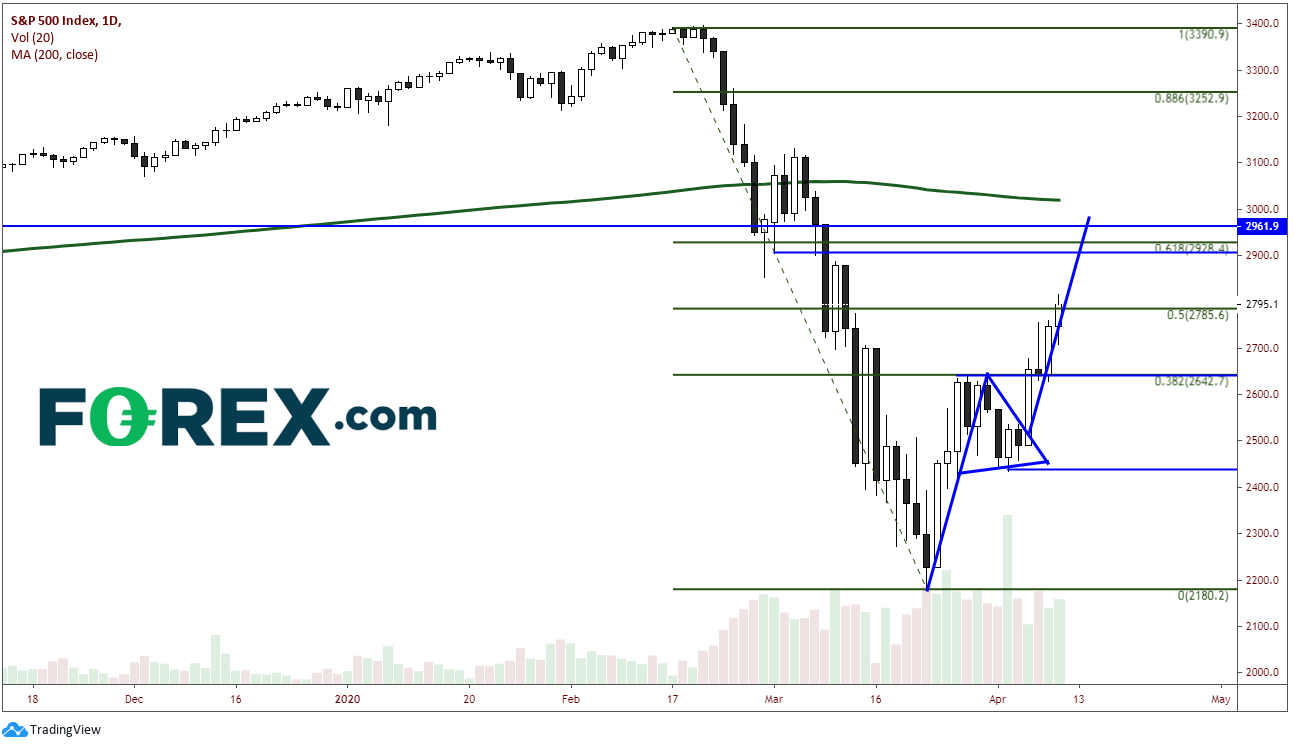

Chart of the Week: S&P 500 Daily

Source: Tradingview, FOREX.com

Price action has retraced 50% from the move from the high on Feb. 20 to the low on March 23. If price gets a daily close above 2800, there is no reason price can’t run to 2900. However, from here the market has work to do. Between 2900 and 3000 there are two levels of horizontal resistance, the 61.8% Fibonacci retracement level from the previously mentioned time frame, and the 200-day moving average. One can even argue that the S&P 500 has broken out of a pennant formation and targets 2980.

If price can’t push higher, support is lower at previous resistance near 2640. Below that support is at the bottom of the pennant near 2435. This will be a very important chart to watch as the direction of equities contributes to the direction of so many assets, such as bonds, commodities and the U.S. Dollar Index.

Everyone, please stay safe and remember to always watch your hands!

Joe Perry holds the Chartered Market Technician (CMT) designation and has 20 years of experience in the FX and commodities arenas. Perry uses a combination of technical, macro, and fundamental analysis to provide market insights. He traded spot market FX and commodity futures for 17 years at SAC Capital Advisors and Point 72 Asset Management. Don’t forget that you can now follow Forex.com’s research team on Twitter: FOREXcom and you can find more of FOREX.com’s research.