We are in a period of a New “new normal,” so it is best to follow the trend while keeping are timeframe short, notes Joe Duarte.

I am trading this rally on the long side for two reasons: it is folly to fight the Fed and it is equally foolish to fight the market’s momentum until proven otherwise.

Moreover, and I say with some trepidation, we may be reaching a point where the balance between the components of markets-economy and life (MEL), the complex adaptive system comprised of those three elements are nearing a point of emergence to a new level of operation. Because of the way algorithmic trading strategies are programmed, the Fed’s actions are paramount.

In other words, as long as the Fed is easing (in whatever new form that takes), the odds favor higher stock prices. So, until proven otherwise, be prepared for the emerging new reality of the Post New Normal World.

Trading is Still Dangerous but Difficult to Avoid

Trading stocks remains dangerous. Still as traders, the only viable strategy is to trade with the trend. Certainly, things could change quickly; as I’ve been saying for weeks as early as the Sunday night futures open, especially after a session where the action may have easily been influenced by options expiring such as what we saw on April 17.

Still, boosted by easy money from central banks the stock market continues to defy the grim fundamentals of the global economy supporting the notion that for now liquidity is winning the battle and that perhaps, as I discuss below we are witnessing a major change in MEL.

Accordingly, there are some interesting developments worth noting:

- Trading patterns in many individual stocks, are starting to return to some semblance of normalcy

- Trading patterns in the major indexes remain volatile and continue to feature wild point swings

- As earnings season develops the focus is likely to be on the fortunes of individual companies

- Trading success will now hinge more on stock picking and risk management instead of just buying oversold stocks

MEL is on the Move

There are important positives and negatives unfolding in complex adaptive system of MEL. While stocks have rebounded, we have rising joblessness, stalling commerce, an increasingly dangerous geopolitical tone and a new set of rules for human interaction: social distancing, video conferencing, and the possibility that face masks will become a long term fashion accessory around the world.

Yet, even as protests appear in U.S. state capitals we also see evidence of complexity, the process through which orderly change occurs in the universe slowly curtailing the activity of chaos. Note that key agents in the system, people, governments and companies are also adapting to the new reality of living in a world of unknown infection risk by working at home, adapting their businesses to the new rules and by looking for ways to survive and someday again thrive. Moreover, just as some people and some businesses are doing better than others this process of adaptation is visible in the stock market where some stocks are also acting better than others.

Moving toward the Edge of Chaos

What we are witnessing is a classic display of a complex adaptive system moving toward a point of emergence, where the optimal level of operation known as the Edge of Chaos - the transition point between chaos and complexity exerts its maximum influence. Emergence is crucial to the existence of the system as it is followed by co-evolution, the process through which different systems simultaneously adapt to the new reality. What this means, if the current trends remain in motion is that soon we may all have to recalibrate how we look at the world, how we trade, and how we live.

Moreover, where in life chaos is about finding solutions to the Coronavirus problem, in a stock, it is marked by the price action along key support and resistance areas. Of these three key dividers, the 200-day moving average is the most important as it is a long term dividing line between bear markets (chaos) and bull markets (complexity), whereas the 20- and 50-day moving averages are important dividing lines between short and intermediate-term trends.

Markets May Replace Economy as Leading Edge in MEL

Markets are on the verge of becoming the leading component of MEL. Therefore if the rally does not fall apart, and it is followed by a credible improvement in the economy, it could mean that MEL has emerged to a new operating level where the action in the stock market will be the crucial factor influencing economic activity.

Heady theories aside, the Coronavirus is a purely chaotic entity. That means that its actions are predictably unpredictable. Therefore, any type of action plan for a return to normal may still face significant setbacks at any time as chaos tries to reassert itself as the dominant macro influence in the world. What that means is that investors should have a balanced approach to trading at this point.

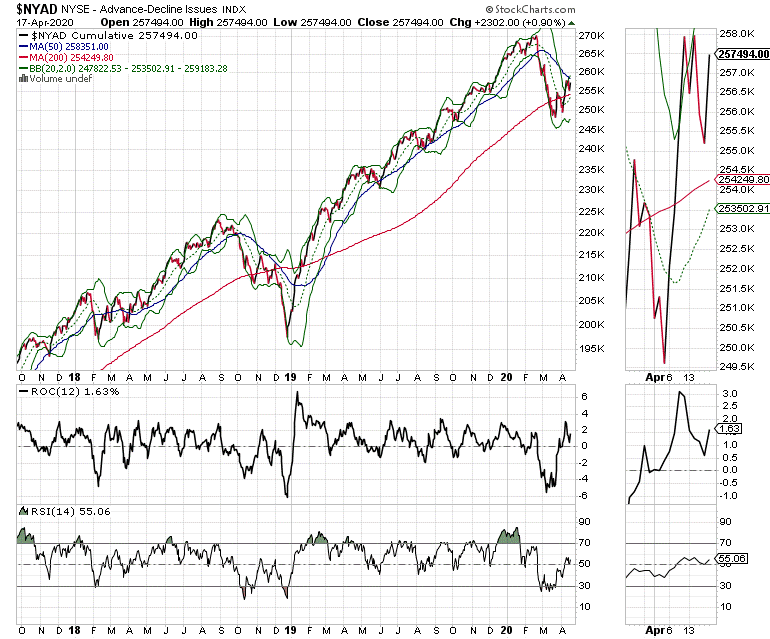

NYAD Holds above 200 Day Moving Average

The good news is that the New York Stock Exchange Advance Decline line (NYAD) remained above its 200-day moving average for two consecutive Fridays. The neutral news is that it did not cross above its 50-day line, which means that we are still operating under a partial all clear (see chart).

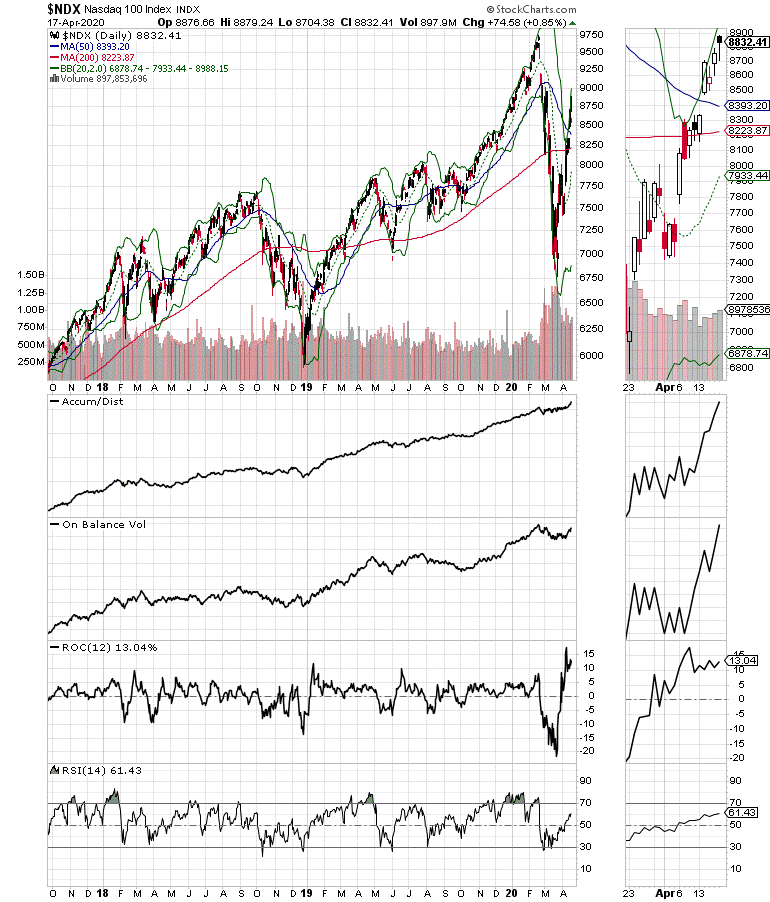

That said, the Nasdaq 100 index (NDX) is trading well above its 50- and 200-day moving averages with positive On Balance Volume (OBV) and Accumulation Distribution (ADI) confirming a return to a positive trend. NDX does have some overhead resistance near the 9000 area which is likely to lead to a pause in the uptrend at some point soon.

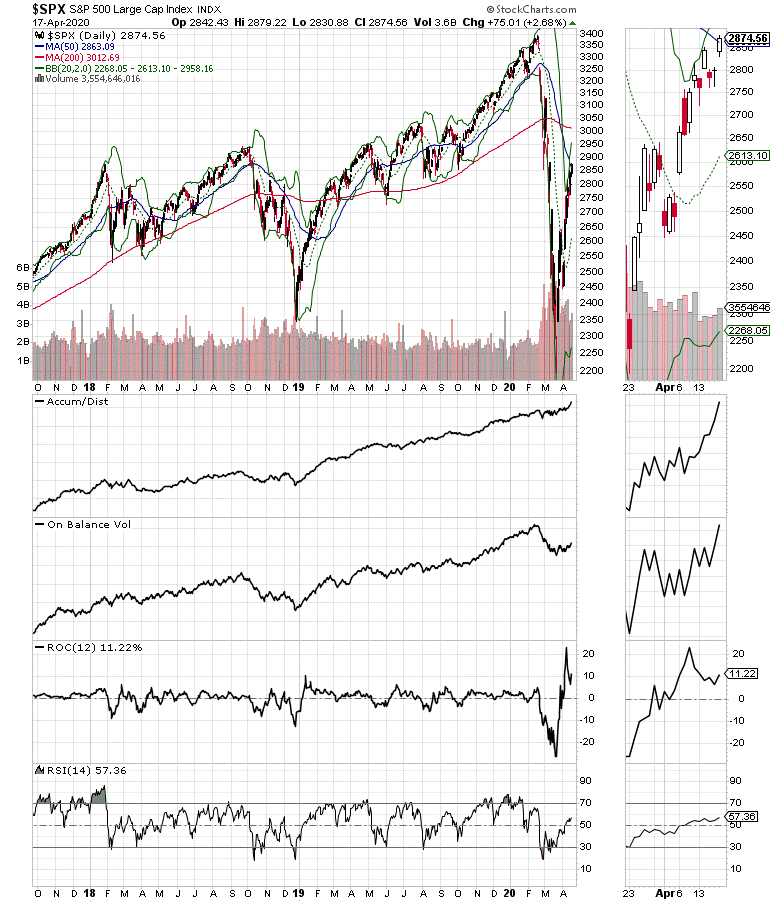

The S& P 500 (SPX) is slightly behind but also closed above its 50 but not above its 200 day moving average. Still, and this is an important point, the RSI indicator for NYAD, SPX and NDX is still hugging the 50 area, which means the market is not yet overbought, and could still move higher.

The bottom line is that some parts of the stock market are doing better than others but that we are seeing a well spread out recovery with technology leading the way higher.

Trade Individual Stocks, not Market

We are caught in a war between chaos and complexity as we near the point of emergence and a potential post New Normal world. And while we can’t control the forces of the universe, we can certainly control our trading.

What that means is that we trade small lots and we keep short term timeframes. If a trade is not working, you’re your losses. If we have profits we should consider paring down the position by fading big rallies.

Finally, keep higher levels of cash than usual in order to survive any unforeseen attacks from Chaos.

For more details on SBUX and other stocks you can sign up for a free 30-day trial. If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.