Here is a potential winner in the new normal from Joe Duarte.

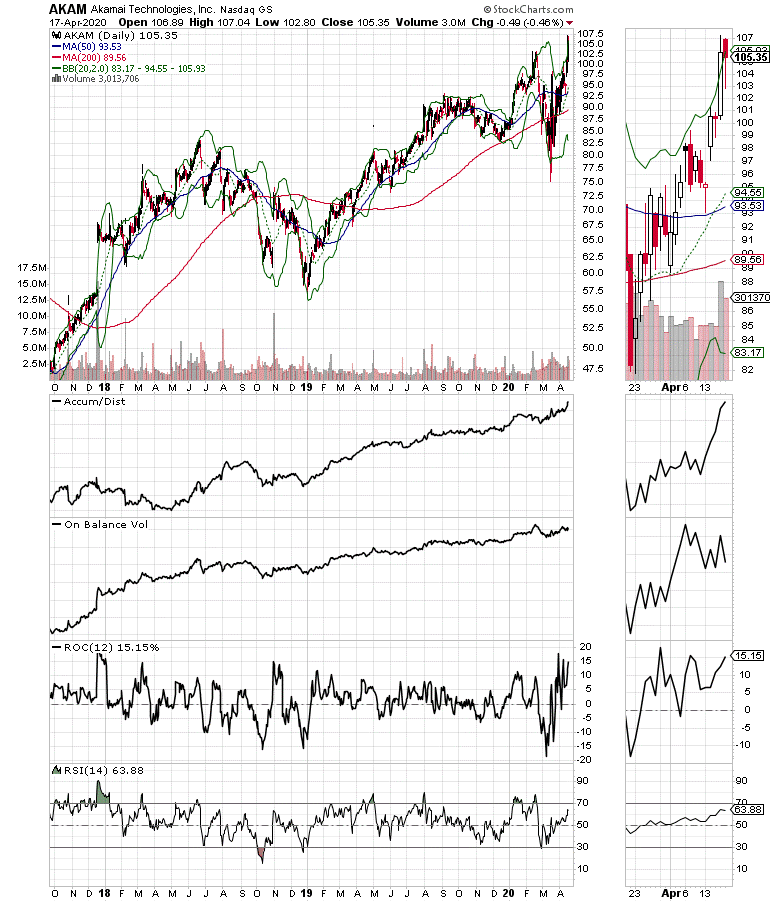

Shares of Akamai Technologies (AKAM), a leading provider of cloud infrastructure and services delivered a credible price breakout last week as the Coronavirus situation continues to increase demand for its business (see chart below). Perhaps the most interesting aspect of this stock, which I recommended to premium subscribers, before the breakout, is that it is not a very well-known company.

But even so, its compelling story, and the stock has the potential to climb higher over the next few months barring an all-out return of the bear market. There are still major cities such as New York, London and Los Angeles which are still on lockdown with significant questions remaining about the reopening of the global economy.

Moreover, it is now plausible to consider that the explosive growth of telemedicine and teleconferencing are here to stay for the foreseeable future. What that means is that companies like Akamai who provide the server space, software, and security framework for telework and content streaming may just be getting started in what could be a multi-quarter and perhaps longer earnings growth cycle.

Certainly, Akamai’s breakout and recent brokerage upgrades suggest that there is interest in the shares. Moreover, the stock is still far from being a household name, which means that what was once an obscure, certainly well run cloud company is about to be thrust into the limelight, and that could mean an even larger following. Right now, the shares look attractive as long as they hold above the $98 support area. Earnings are due at the end of April, so it will be interesting to see what happens between now and then, and of course, how the market responds to the company’s earnings report.

I own shares in AKAM as of this writing.

For more details about Akamai and other stocks, check out a FREE trial to Joe Duarte in the Money Options.com.

If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.