Joe Duarte breaks down one stock likely to be a winner in the age of Coronavirus.

Under normal circumstances, Leidos Holdings (LDOS) is a well-run software company with a plethora of government contracts and thus a fairly secure earnings stream. But now, when government bureaucracies are in Supernova mode due to the coronavirus stimulus packages, Leidos may just surprise even those with the most optimistic of expectations as it continues to mine the never ending income stream (see chart).

In the month of April alone, LDOS resumed work on a five-year $450 million U.S. Air Force IT contract, while adding a $69 million IRS customer e-services software management contract. And this is on top of a banner fiscal 2019, where the company delivered more than 10% year over year growth rates in key measures, including revenue, EBITDA, bookings and profit margins.

For example, in Q4 2019, the company inked a potential $7.7 billion contract with the U.S. Navy as part of a total of $18 billion in three separate contracts, two of which are still being negotiated.

eanwhile, the company booked a total of $14.5 billion in revenues for the full fiscal year 2019 and has a backlog of $24 billion in potential revenues on the books. Furthermore, the company continues to grow both organically and by acquisition in defense as well as most recently in healthcare where the COVID-19 situation is likely to increase the need for IT services due to telemedicine as well as electronic medical records.

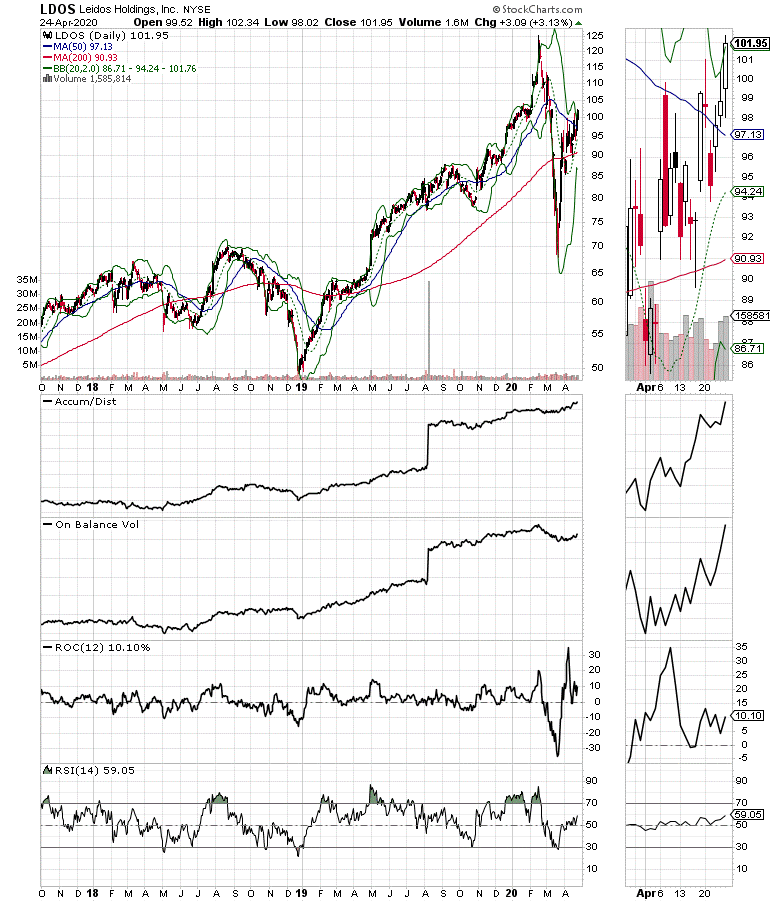

The stock recovered nicely from its bear market drop and is now in the complexity zone, where systems operate optimally, above its 50- and 200-day moving average after breaking out above the $100 level on April 24. Moreover, the breakout came on rising volume and with confirmation from Accumulation/Distribution (ADI) and On Balance Volume (OBV).

Barring a major market debacle, LDOS could well make its way back to its all-time highs near $125 over the next few months.

I own shares in LDOS.

For more on LDOS and stocks that are doing well in the current market consider a FREE Trial to Joe Duarte in the Money Options.com. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.