The bulls have won most of the recent technical battles in the E-mini, reports Ricky Wen.

Tuesday’s session played out as a “gap up and go” structure that faded in the final few minutes of regular trading hours. If you recall, the market opened at 2863.25 after Monday’s closing print of 2827.5 on the E-mini S&P 500 (ES), so it was a +1.2% gap up. Then price action continued to follow that trend for most of the day, forming higher lows and higher highs as the northbound train goes towards the immediate targets.

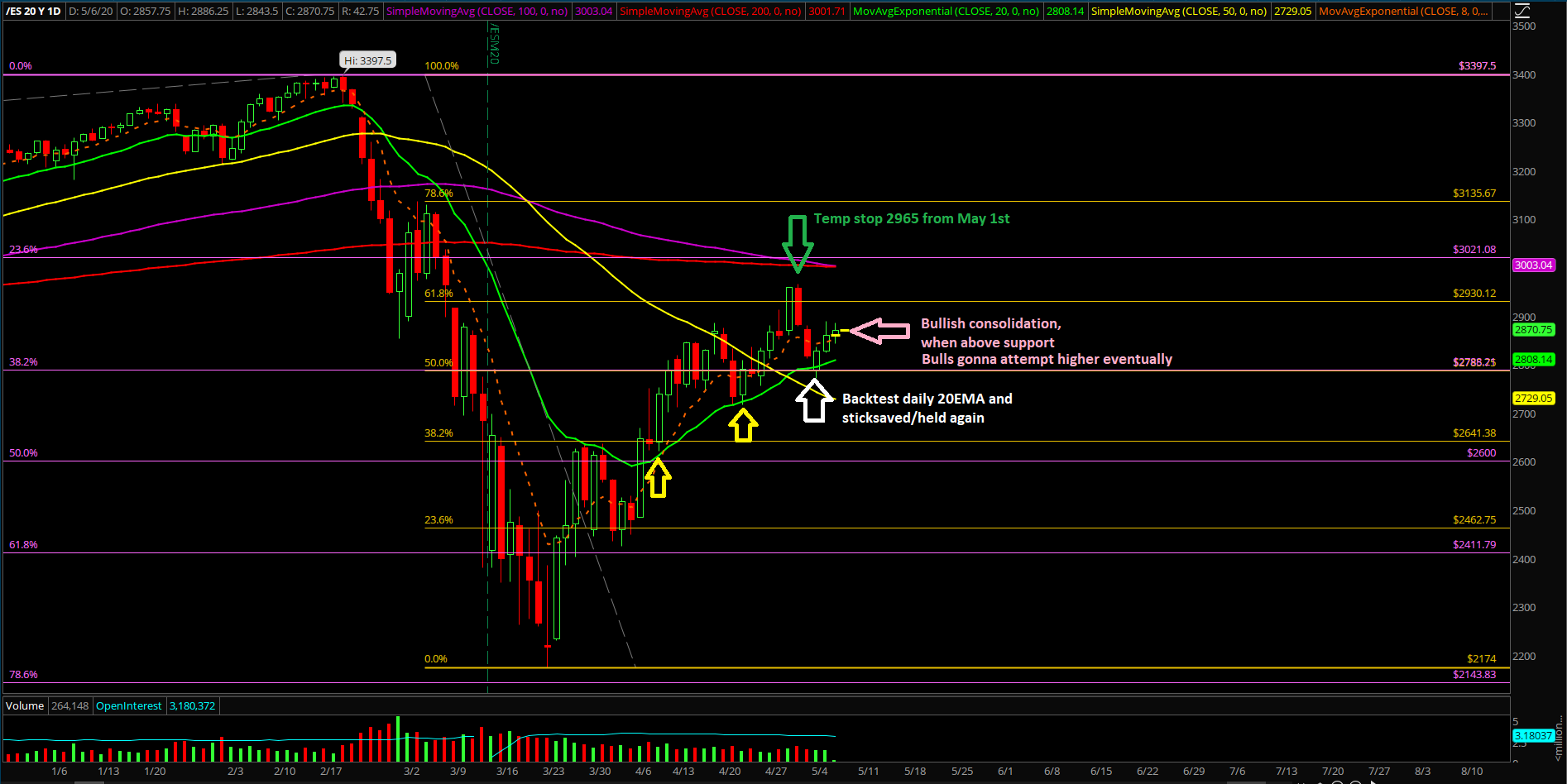

However, the bears made a counterattack around the 2889.75 high, which was right near the 61.8% Fibonacci retracement of the 2965-2771 range, and swiftly broke to test key support at 2850 by the end of the day.

The main takeaway is that the bulls had a textbook gap up and go structure, but failed at the last few minutes when the countertrend bears mounted a successful attack in order to disallow the bulls from closing at the highs of Tuesday’s session. This meant that bears are not truly dead yet as it’s still an ongoing battle within this consolidation zone.

Please be aware, the longer the E-mini consolidates forming bull flags, the greater the chance for the ongoing bull trend to continue given the momentum of the past few weeks. Bears are the ones running out of time right now, nervously looking for immediate reversal to the downside every single day and have been failing.

What’s next?

The ES closed Tuesday at 2859.75. Price action is trending above the eight-/20-day exponential moving average spread as bulls held key support on Monday and has bounced 100 points since then see chart).

Summing up our game plan:

- We’re bullish and if the ES remains above 2850, target 2900, 2916 and 2930 as continuation targets.

- If the ES drops below 2850, we target support at 2830 and 2800.

- There is an ongoing feedback loop squeeze setup from 2771 Sunday night low and yesterday’s regular trading hour low of 2788.50. Remember our rule, do not fight a feedback loop squeeze until the momentum turns. Otherwise, you will likely get killed 80% of the time dependent on timeframes.

- Sunday’s low of 2771 could be the low of the week already, see how it develops.

- We are on hold for our intermediate bearish bias until there’s a decisive break below 2752, followed by 2717 indicating immediate momentum aligns with micro- and intermediate timeframes. Know your timeframes!

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription service.