Bonds may be slowly heading towards a decades-long bear market, writes Al Brooks.

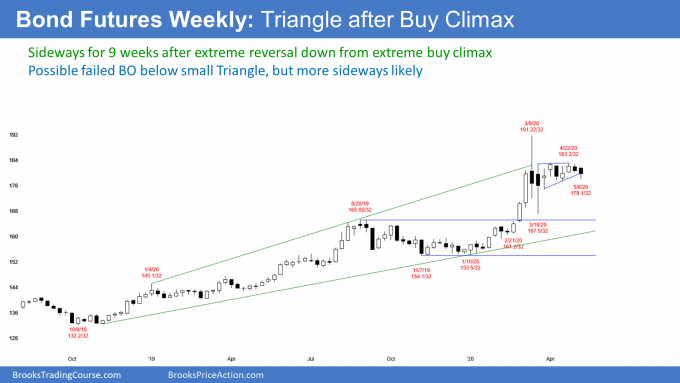

The U.S. 30-yeawr Treasury bond futures have been in a tight trading range for nine weeks. There is no sign that this is about to change. It is more likely to test the January low than the March high over the next few months.

The long bond has been trading sideways for since early March on the weekly chart (see below). The March 9 buy climax was the most extreme in history. It is a good candidate for the end of the 35-year + bull trend.

However, when a bull trend ends, especially an extremely strong one, what follows is typically a trading range. And it can last for several years.

At some point, the bond market will begin a bear trend for a decade. That is more likely than the bull trend resuming much above the March high.

Last week turned down from a micro double top with the April 3 high. This is a double top lower high major trend reversal. It could be the start of a 10-year bear trend. With the prominent tail below this week’s candlestick, it is more likely that the tight trading range will continue for at least another week.

If the next several weeks are big bear bars closing on their lows, there would be a 60% chance that this lower high will hold for many years. But if there is weak follow-through selling, traders will assume that the nine-week trading range will continue. If it does, there will probably be at least a brief breakout above this double top at some point.

Where are the boundaries of a trading range?

Trading ranges usually contain smaller trading ranges. The past nine weeks have been in a tight range. This week might be the start of a breakout below that range. If so, this will probably lead to a bigger trading range.

For example, the selloff might test the March 18 low. The bond futures reversed up violently from that low. Traders expect that there will be buyers around that price again. Therefore, there might be a double bottom there. That would then be the bottom of a bigger trading range. The March high should remain as the top of that bigger range.

2019 Final Bull Flag

The bottom of the range would be around the March low. I was intentionally vague. It is more likely that the bond futures will fall below that price. Why? Because when markets are in trading ranges and they are near support or resistance, they tend to exceed it before reversing.

The March low was a test of the Aug. 28 high. That was the breakout point for the January to March buy climax. Legs in trading ranges usually pull back beyond breakout points, which are also support. Consequently, the bottom of the range will probably be below that high.

Final Bull Flag in late 2019

In late 2019, I said that the August-December trading range was tight and late in a bull trend. I wrote that it was a good candidate for the Final Bull Flag.

At the time, I said that traders should expect a bull breakout, but that the breakout would likely be a final buy climax. I talked about how a Final Bull Flag is a magnet and that traders should expect the buy climax to start a reversal down to the bottom of the flag. That is the November low.

It could take a long time to get there. However, there is a 70% chance that the bonds will trade back to that Final Bull Flag within a year or two.

No negative interest rates

President Trump has said several times that he wants negative interest rates. If that were to happen, the bond market would probably go above the March high.

However, the American public expects to receive interest on their savings accounts. They do not want to pay a bank interest on their savings accounts. That is an obvious negative side effect of negative interest rates.

Furthermore, seniors want inflation. Many depend on interest on savings accounts and money market accounts. If we had negative interest rates, tens of millions of seniors and their families would be outraged. It therefore will not happen. That makes it unlikely that the bond market will get much above the March high. In fact, the odds are that March will be the high for at least a decade.

What about this week?

Although last week was a bear bar, it did not break strongly below the nine-week range. In addition, it had a prominent tail. It is therefore still only a leg in that range. Also, the bar on the weekly chart was not particularly big. That reduces the chance that it will be the start of a bear trend.

Nothing is clear in trading ranges. Remember, a trading range exists because the bulls and bears are balanced. That makes it difficult for one side to dominate for very long. Traders therefore expect bad follow-through after strong bars. Reversals are more likely than trends.

However, there are magnets below. After nine sideways weeks, traders expect the bond market to get to the 20-week exponential moving average within a few weeks. It can get there by going sideways or down.

In addition, April had a tiny range. May is within the April range. This selloff should fall below the April low. Since April was a bull doji candlestick on the monthly chart (not shown), it is a weak sell signal bar. That means that there will probably be buyers not far below the April low.

Bonds are probably working lower

Over the next few weeks, the 30-year bond futures market will probably be sideways to down. At some point over the next year it should continue down to the bottom of the most recent buy climax. That is the January low. Then, within one to three years, it should get down to the August-December 2019 Final Bull Flag.

Now what about Trump’s negative interest rates? The chart says that the institutions do not believe they will happen.

Buffet says no default

As a side note, Warren Buffet last week said something interesting that I have said a few times over the past many years. When the United States sells bonds, people and other governments pay dollars to buy them. When our government buys them back, the government pays in dollars.

Because the Treasury decides how many dollars they want to print, we can never default on our debt, not matter how big it gets. We can simply print infinite money and pay off any debt.

But there is a side effect to everything. Countries who bought our bonds would effectively see that as effectively a default, even though it is not an actual default. It is a default in the sense that we did not live up to our promise of doing everything possible to keep their money safe.

If there are so many dollars that they are now worthless, any country who bought our bonds would be holding worthless bonds. Our dollars would not be able to buy anything from anyone. TVs, phones, French wine, German cars, shirts, shoes, etc. Our quality of life would deteriorate horribly. We would be a poor country.

But that is our unspoken back-up plan to guarantee that we will never default.

Full faith and credit

People who buy our bonds rely on our full faith and credit. They know we will pay them when the bonds mature. They understand that we will cheat if we have to and print infinite money, but there is less chance with our bonds than with those from any other country. Because the world trusts us, we get to sell bond in dollars and at low interest rates.

It is important to note that this is different from many other countries. For example, if Argentina, Venezuela or Iran have inflation rates of 1,000 to 1,000,000% and it wants to sell bonds, no one would buy their bonds if those bonds were issued in their own currencies. Those countries would have to sell them in dollars and pay high interest rates because of the significant risk of default.

It is critically important that we remain trustworthy. This will allow us to always sell bonds in dollars and therefore never have to worry about defaulting.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed E-mini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a two-day free trial.