The post new normal COVID-19 environment is creating new winners and losers, reports Joe Duarte.

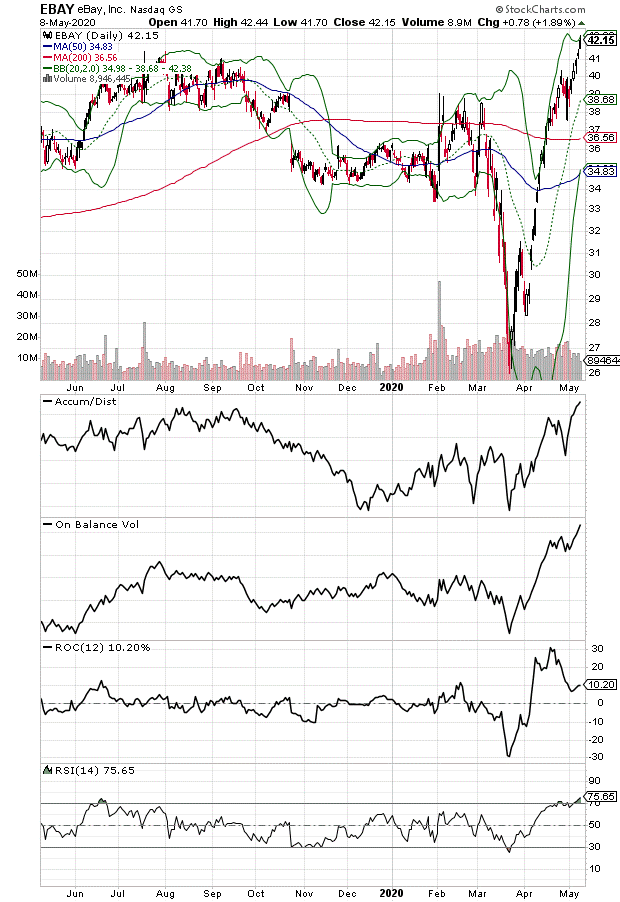

The longer Covid-19 remains a factor, the more likely eBay Inc. (EBAY) stock will prosper. Indeed shares of the long maligned and underperforming online auction and sellers’ marketplace have been moving steadily higher since the market bottomed, highlighting the adaptive nature of complex systems such as markets, economy and lives (MEL), where the markets, the economy, and people’s lives and financial decisions coalesce into a single entity. Moreover, the shares have powered higher with little fanfare as they have become a great place for stay at home transactions between individuals and businesses, especially in the re-sales category as pocketbooks are strained (see chart).

But the quiet period may be over as more investors discover the dynamic behind the stock’s rise, and its recent breakout, which is that eBay is becoming an alternative to Amazon (AMZN) for a specific set of buyers and sellers. From a price standpoint, it’s clear that eBay is more attractive than Amazon. But more than price, from a value standpoint, it’s clear that eBay’s price earnings (P/E) ratio of 7 is more attractive than Amazon’s trailing P/E of 110.

Certainly, this is a bit of an apples and oranges comparison from a business standpoint as eBay is strictly a marketplace while Amazon is a retailer that also offers a marketplace option. Nevertheless, over time, the current price pattern in the stock suggests that eBay has an excellent niche in the post new normal world and that it can easily grow that niche without too much worrying about its gigantic competitor.

The company delivered an upbeat earnings report and positive guidance in late April as it continues to become an alternative place to buy and sell goods, even for brick and mortar shops in the post new normal Covid-19 economy. Perhaps the brightest spot in the report was the 25% growth rate in advertising, which suggests that there is a social media component to the business that is starting to blossom. This coupled with aggressive enhancements to the underlying technology used to list and advertise products suggests that as the post new normal dynamic evolves, eBay should be able to continue its growth pattern.

Technically, the stock continues to move higher, delivering a new high on May 7 while remaining under steady accumulation with On Balance Volume (OBV) and Accumulation Distribution (ADI) continuing to highlight positive money flows.

I own DHI and EBAY.

If you’re not a subscriber yet take a 30-day Free Trial HERE. Joe Duarte is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here. I’ll have more for subscribers in this week’s Portfolio Summary. For a 30-day Free trial subscription go here. For more direction on managing the GILD trade, go here.