Alan Ellman describes how to select a stock for covered call writing.

Setting up a portfolio of NASDAQ and S&P 500 stocks in a user-friendly and time-efficient manner is an important process for covered call writing.

Many covered call writers and put-sellers favor a portfolio mix of blue-chip and tech companies and turn to the S&P 500 and the Nasdaq 100 indexes for locating the best underlying securities. Since this benchmark and exchange total nearly 4000 stocks, locating an elite portfolio can be an overwhelming task. This article will present an approach that is both user-friendly and time-efficient for retail investors.

What is the Invesco QQQ Trust (QQQ)?

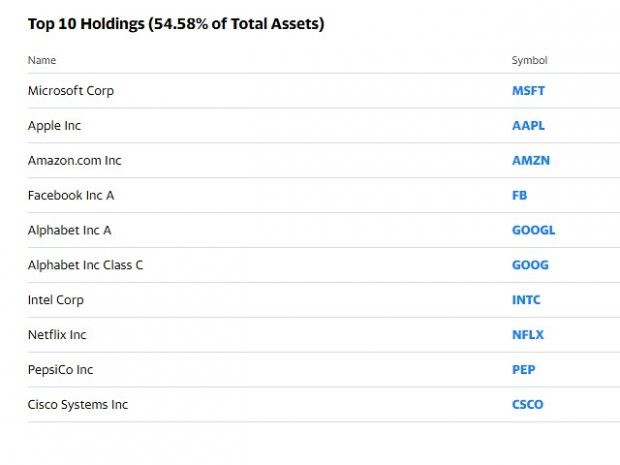

This is an exchange-traded fund (ETF) that trades on the Nasdaq exchange. It offers broad exposure to the tech sector by tracking the Nasdaq 100 index, which consists of 100 of the largest non-financial stocks on the Nasdaq. It is also known as the triple Q. Here is a chart of the top-holdings of QQQ as of June 1, 2020:

QQQ: Top Holdings as of 6/1/2020

What are the SelectSector SPDRs?

Select Sector SPDRs are unique ETFs that divide the S&P 500 into 11 sector index funds. They have the diversity of a mutual fund, the focus of a sector fund, and the tradability of a stock. Together, the 11 Select Sector SPDRs represent the S&P 500 as a whole. However, each Select Sector SPDR can also be bought individually, providing us with exposure to a particular sector or industry group. Traders can double up on one sector they are bullish on or hedge out the exposure of one sector they are bearish on.

These securities all have options and can be used with a covered call or put-selling strategy.

The 11 Select Sector funds and their ticker symbols are:

- Consumer Discretionary (XLY)

- Consumer Staples (XLP)

- Energy (XLE)

- Financials (XLF)

- Health Care (XLV)

- Industrials (XLI)

- Materials (XLB)

- Real Estate (XLRE)

- Technology (XLK)

- Utilities (XLU)

- Communications (XLC)

By choosing the top three performing SelectSector SPDRs, we will own the top-performing 27% of the S&P 500. This gives us an immediate advantage over those who own the index as a whole.

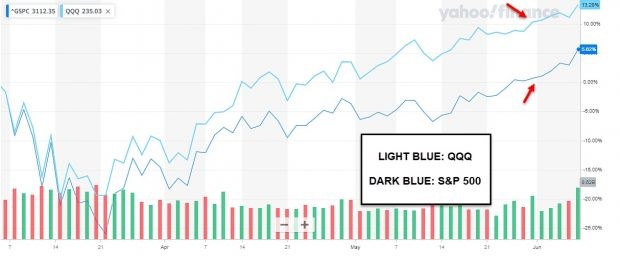

Tech: Make sure QQQ is trading at or above the S&P 500 benchmark over the past 3-months using a comparison chart

QQQ/S&P 500 Comparison Chart as of 6/5/2020

Blue-chip: Use the SelectSector SPDR Tracker to determine the top-3 performers

SelectSector SPDR Tracker on 6/1/2020

XLV, XLK and XLU are the top-three performers

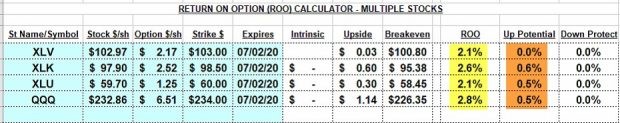

Using the Ellman Calculator to ensure our initial time-value return goal range of 1% -2% is satisfied

ETF Calculations on 6/1/2020

The yellow field shows initial time-value returns and the brown field shows modest upside potential.

Discussion

A practical way of selecting blue-chip S&P 500 stocks is by locating the top-three performing SelectSector SPDRs. Similarly, a time-efficient way of incorporating tech companies into our option-selling portfolios is by using the Qs. An initial time-value return goal range between 1% to 2 % (up to 3% when market volatility is high) is reasonable and achievable by using slightly out-of-the-money strikes.

Use the multiple tab of the Ellman Calculator to calculate initial option returns (ROO), upside potential (for out-of-the-money strikes) and downside protection (for in-the-money strikes). The breakeven price point is also calculated. For more information on the PCP strategy and put-selling trade management click here and here.