Hormel has continued to disappoint, but fundamentals are indicating it could be a strong play, reports Joe Duarte

The stock market may be missing something here.

Shares of meat processor Hormel (HRL) have been disappointing over the past couple of years.

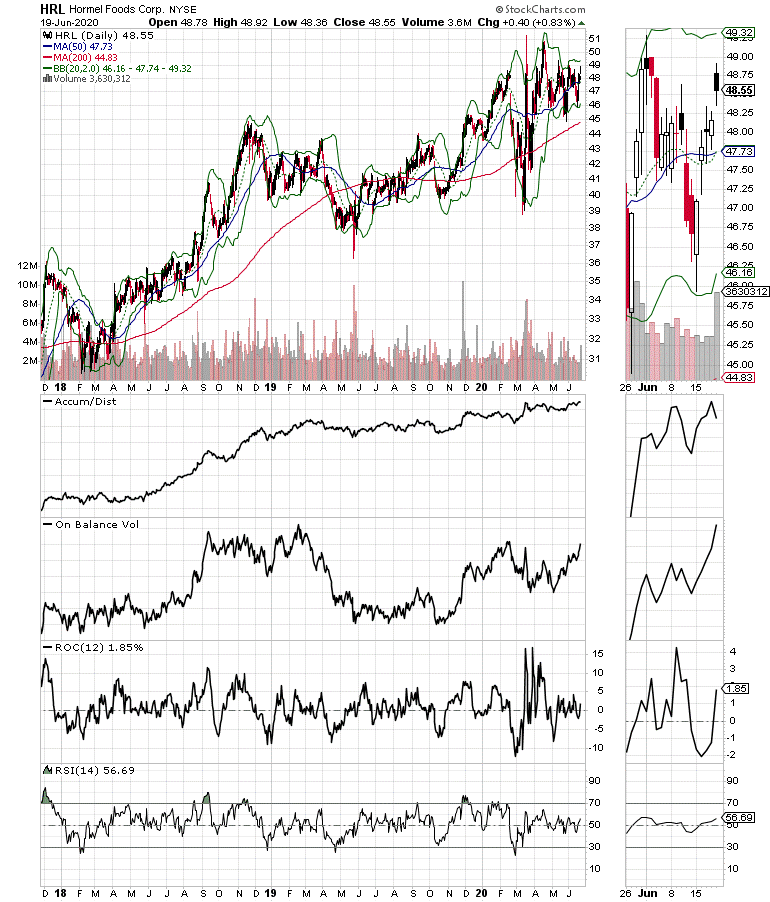

Let’s get it out in the open. Hormel is the proverbial disappointment wall flower stock. In fact, every time the stock approaches a chart breakout point something comes out of blue and takes the share price down. So, as the stock approaches yet another breakout opportunity, it makes sense to see if this will be the time that it actually delivers (see chart below).

Hormel is best known for SPAM, a canned meat standard. But it’s actually got a broad variety of other pork and beef related products, especially its Hormel canned Chili and its organic, gluten free, non-GMO Mary’s Chili Verde, which make for an interesting product mix.

I must admit, I am partial to Mary’s Chili Verde, and recommend it, especially for those nights when you don’t want to cook.

The big question is, why isn’t Hormel trading well above $50 when the China trade pact, political warts and all, should have increased its exports, especially of pork? Moreover, in the wake of reports of beef shortages expected for the summer in response to Covid-19 infected meat processing farms, the stock should have popped. The latter point is even more poignant given Hormel’s increasing market share in the turkey market, given that turkey would be an adequate replacement for beef, especially during the summer months.

Specifically, in its May earnings report, Hormel reported a 16% increase in its retail sales growth, along with decent organic growth and overall product volume. Its only segment decreases were in frozen foods, and international which were flat. Its turkey sales grew by 12%, which suggests that consumers were making a change in their dietary habits due to prices for beef.

The market may be underestimating Hormel’s positive potential here, and that the company may actually deliver even better results in its next quarter if it can keep the momentum going, especially if beef prices remain high as the summer grilling season heats up.

The bottom line is that if HRL can take out $49, it could rally to mid-50s in a hurry. And with China suddenly announcing it may start to play catch up on its U.S. trade commitments, this stock could deliver more of a Hot Chili, Hot Turkey set of results than many expect.

For more details on the summer trading season catch my most recent Your Daily Five installment here. To subscribe for a FREE trial to Joe Duarte in the Money Options.com, click here. I have compiled a small list of companies whose stocks are showing relative strength and may be worth owning. The list can be accessed via a FREE trial to Joe Duarte in the Money Options.com To subscribe to my service, click here