Impressive jobs data pushes stocks higher, reports Fawad Razaqzada.

Following the publication of another impressive U.S. jobs report, risk assets have extended their gains with European and U.S. stock indices rising sharply.

In case you haven’t seen the headlines, 4.8 million jobs (nonfarm payrolls) were added in June with the unemployment rate falling to 11.1% from 13.3%. What’s more, the prior month saw an upward revision to 2.7 million from an already impressive 2.51 million. That’s despite Coronavirus infections spiking in several States last month and keeps the V-shaped recovery narrative intact.

While stocks could obviously turn lower on profit-taking or concerns over valuation etc., the short term path of least resistance remains to the upside for now.

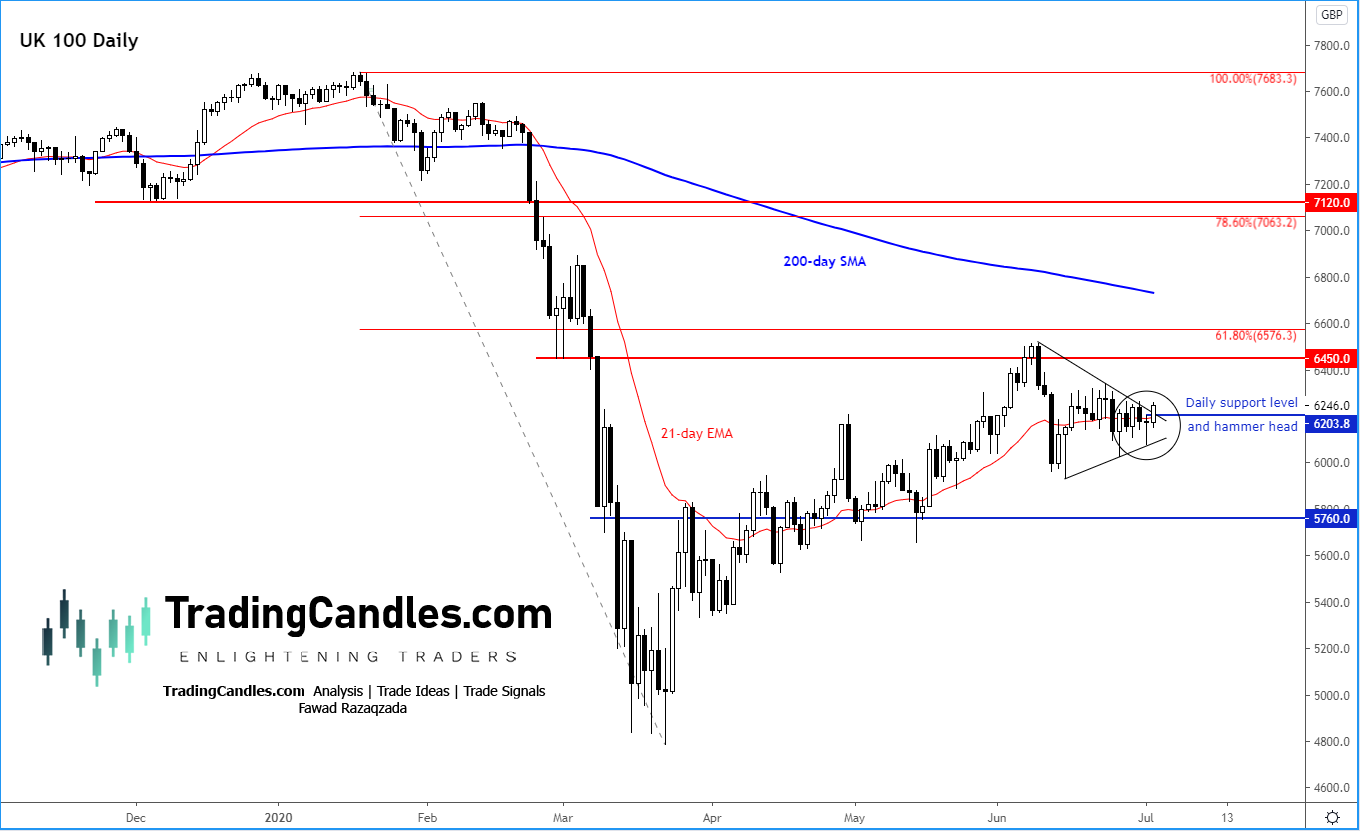

Among the indices, the FTSE is the one catching my attention because it is slowly trying to break higher, and potentially catch up with the other global indices, which have surged higher (see chart below).

Source: TradingView.com and TradingCandles.com

FTSE’s daily chart, above, shows a breakout above the triangle pattern. So, the idea is to go long on the dips back to support until this strategy fails to work.

The key support that needs to hold is the hammer head that was created the day prior at around 6200/5. For as long as this holds, I think the bulls would be aiming for a return to recent highs.

Fawad Razaqzada, Senior Market Analyst at TradingCandles.com, is an experienced forex market analyst and economist. He posts market analysis on all sectors from both a technical and fundamental. Previously he served as a market analyst with FOREX.com and City Index.