European and Asian Markets are higher on positive economic news and reopening economies, reports Fiona Cincotta.

Global economic recovery optimism is in full swing as the new week kicks off, driving Asian and European markets firmly higher, overshadowing concerns of rising Covid-19 numbers, especially in the United States.

According to the World Health Organization (WHO), a record 212,000 new daily Coronavirus cases were reported, with the United States, Brazil and India reporting the largest number of increases. However, the United States reported 53,000, which is a slight improvement on the 57,000, cases reported on Friday, but still well-above the April peak. With Fourth of July celebrations dominating across the weekend, there is a good chance that this number will rise again in the coming weeks. What is clear is that the United States never got the outbreak under control before reopening the economy, putting the world’s largest economy in the firing line for a second wave (or extended first wave).

China blue chips at 5-year high

Even as the Coronavirus statistics show concerning increases, the mood in the market remains bullish as investors place firm belief in the view that a revival in Chinese activity will help sustain global economic growth.

Chinese blue chips rose 5%, adding to the 7% jump last week, taking the stocks to a five-year high. Increased volumes suggest that investors are tactically opting for a stronger and speedier recovery in Asia over the United States.

This week is relatively quiet on the economic data front. Today German factory orders showed that the largest economy in the Eurozone was rebounding with orders increasing 10% short of the 15% forecast, but still a vast improvement on May’s 28% decline. Looking ahead Eurozone investors sentiment and retail sales will be in focus.

GBP slumps on negative rates talk

The British pound (GBP) is a notable decliner vs. the euro in early trade after a report surfaced that Bank of England Governor Andrew Bailey and the British central bank are still seriously considering negative interest rates in the UK to boost the economic recovery. Negative rates would pressurize already squeezed lending margins at the banks. The banks could lag other sectors on the open.

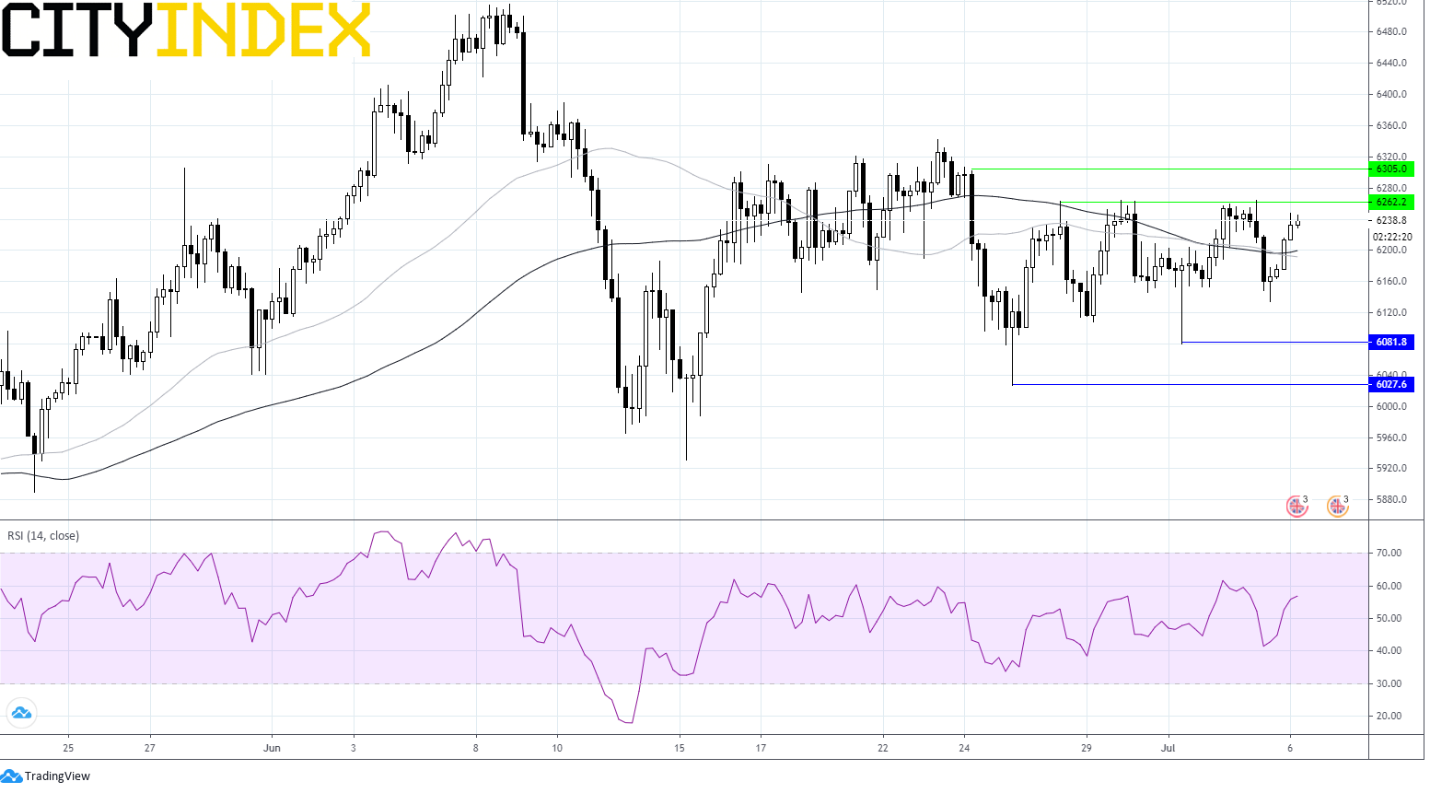

This weekend saw the UK hospitality sector reopen with pubs, restaurants and hairdressers among businesses reopening. With more and more of the economy reopening the economic rebound should start to gather pace in the UK after a very slow few month (see FTSE 100 chart below).

UK construction Purchasing Manager Index (PMI) is due to show that the contraction in the sector slowed, increasing from 28.9 to 47.

The final U.S. service sector PMI is also due late today. Expectations are also for the contraction to have slowed. Meanwhile the closely watched Institute of Supply Management non-manufacturing PMI is expected to reach 50, the level which separates expansion from contraction.

Fiona Cincotta is a Market Analyst for Currency Live