Following Monday’s noticeable reversal in the bullish trend for U.S. stock indices, risk-sensitive currencies, particularly the commodity currencies—the Australian dollar (AUD), New Zealand dollar (NZD) and the Canadian dollar (CAD) — will be in focus now.

If the stock market selling resumes this week, then I would expect to see the likes of the Aussie/U.S. dollar pair (AUD/USD) and NZD/USD break lower and USD/CAD to push higher. While stocks regained roughly half the ground it lost Monday, by Tuesday’s close, let’s see what happens Wednesday.

This is how the Nasdaq 100 chart looks:

Source: TradingView.com and TradingCandles.com

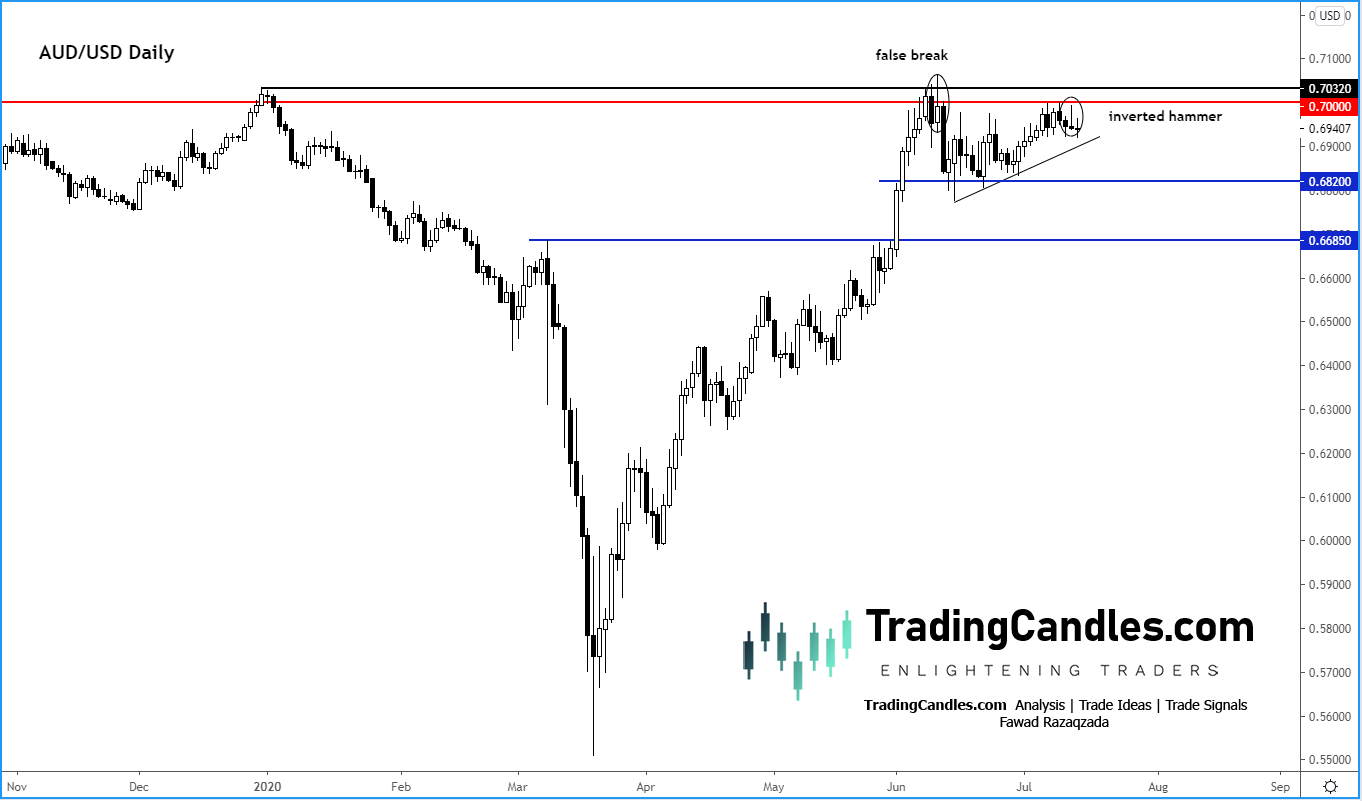

If the above is a genuine reversal signal, then the AUD/USD looks juicy for the bears (see chart below).

Source: TradingView.com and TradingCandles.com

The AUD/USD created an inverted hammer on daily on Monday, tracking the reversal for major U.S. stock indices. A few weeks ago, it had created a false break above its old high at 0.7032 and price has since struggled to go back above the 0.70 handle.

Given the above developments I think a correction looks likely. I would be wrong if we close above 0.70 on daily.

Fawad Razaqzada, Senior Market Analyst at TradingCandles.com, is an experienced forex market analyst and economist. He posts market analysis on all sectors from both a technical and fundamental. Previously he served as a market analyst with FOREX.com and City Index.