Safe havens & smart money assets surge, reports Mike Larson.

Are you watching the action in precious metals? Gold just exploded another $45 an ounce in three days. At $1,850 on Wednesday, it was trading at its highest level since September 2011, closing in on its all-time high. Meanwhile, silver surged more than $3 to $22-and-change. That puts it at an almost seven-year high.

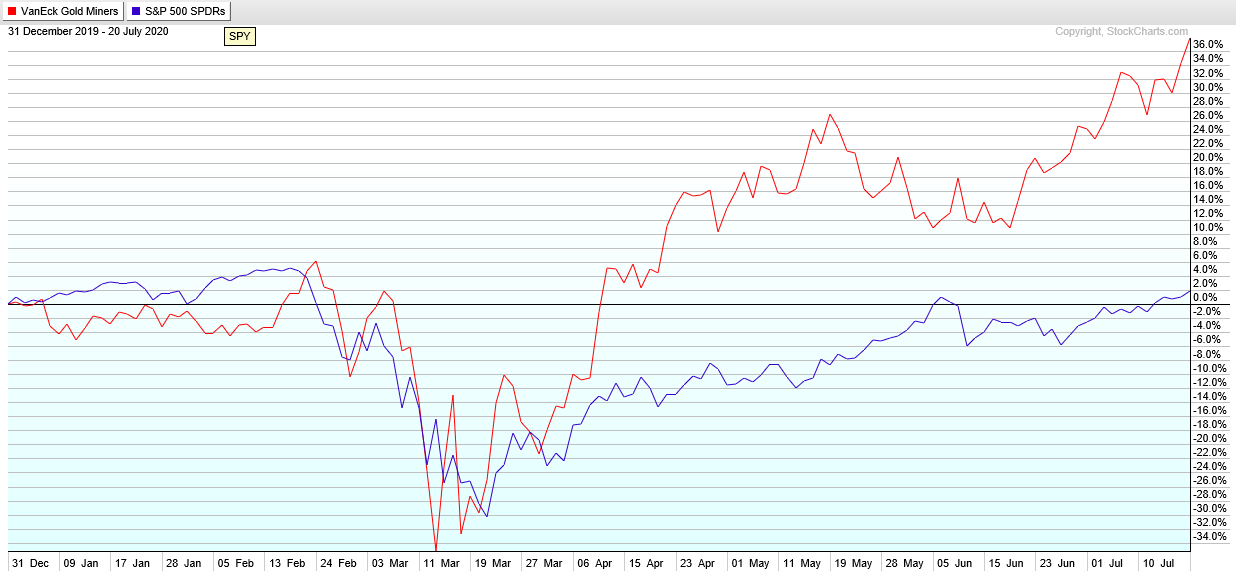

Mining shares are also going ballistic. The VanEck Vectors Gold Miners ETF (GDX) has now surged more than 37% year-to-date. That’s more than 20X the return of the SPDR S&P 500 ETF (SPY)!

Income focused stocks with solid Weiss Ratings are also on fire.

Clorox (CLX), which I’ve had in the Safe Money Report model portfolio for some time, is up 47% since the beginning of the year.

What’s the common thread? Central banks are flooding the markets with liquidity and cheap money. This is an epically ineffective policy for the real economy. We’ve had years and years of LIRP/ZIRP/NIRP (Low, Zero, Negative Interest Rate Policy). We’ve had years and years of Quantitative easing (QE).

And in many economies, we’ve had years and years of other rate-focused policies like yield curve control. That’s where the central bank fixes different interest rates at different levels rather than just targeting very short-term ones. This appears to be the Federal Reserve’s next preferred step to take, possibly as soon as the fall.

What has that accomplished?

Neither the Fed nor its overseas counterparts has been able to hit and maintain their oft-stated 2% inflation targets. They haven’t demonstrated an ability to consistently juice GDP growth. So again, it’s impact on the real-world economy is marginal at best.

For asset markets, all this funny money is like manna from on high.

With little yield available in investments like Treasury bonds, investors are forced to seek it elsewhere. They’ve been aggressively buying dividend-paying stocks, which is driving their prices higher.

With little competition from interest rates— and in some countries, sub-ZERO interest rates— they’re willing to buy other assets with 0% yields. That includes gold and silver. This, in turn, drives up the price of those metals and shares of the companies that mine them.

Throw in the need for “chaos insurance” in a volatile market, or rampant uncertainty about both the short-term and long-term impacts of the Covid-19 outbreak, and you can see why these trends are so powerful. They’re the kinds of mega-moves you simply can’t ignore and have to make every effort to profit from.+

How long can these runs continue and how powerful will they be?

Well, Opening Day 2020 is today. With baseball in mind, I’d say we’re only in the fourth inning or so. And with many investors only recently warming to moves in under owned sectors like miners, versus over followed sectors like tech, there are still a ton of opportunities out there.

If you want to profit from specific recommendations like my Safe Money subscribers already are, you can join them by clicking here. Or if you’re not quite ready to take that step, you can use our Weiss Ratings website to screen for ETFs and mutual funds that focus on precious metals and income stocks.